US Market Open: US equity futures are mixed and DXY firmer; Geopolitical tension heightens raising crude

Update: 2025-11-17

Description

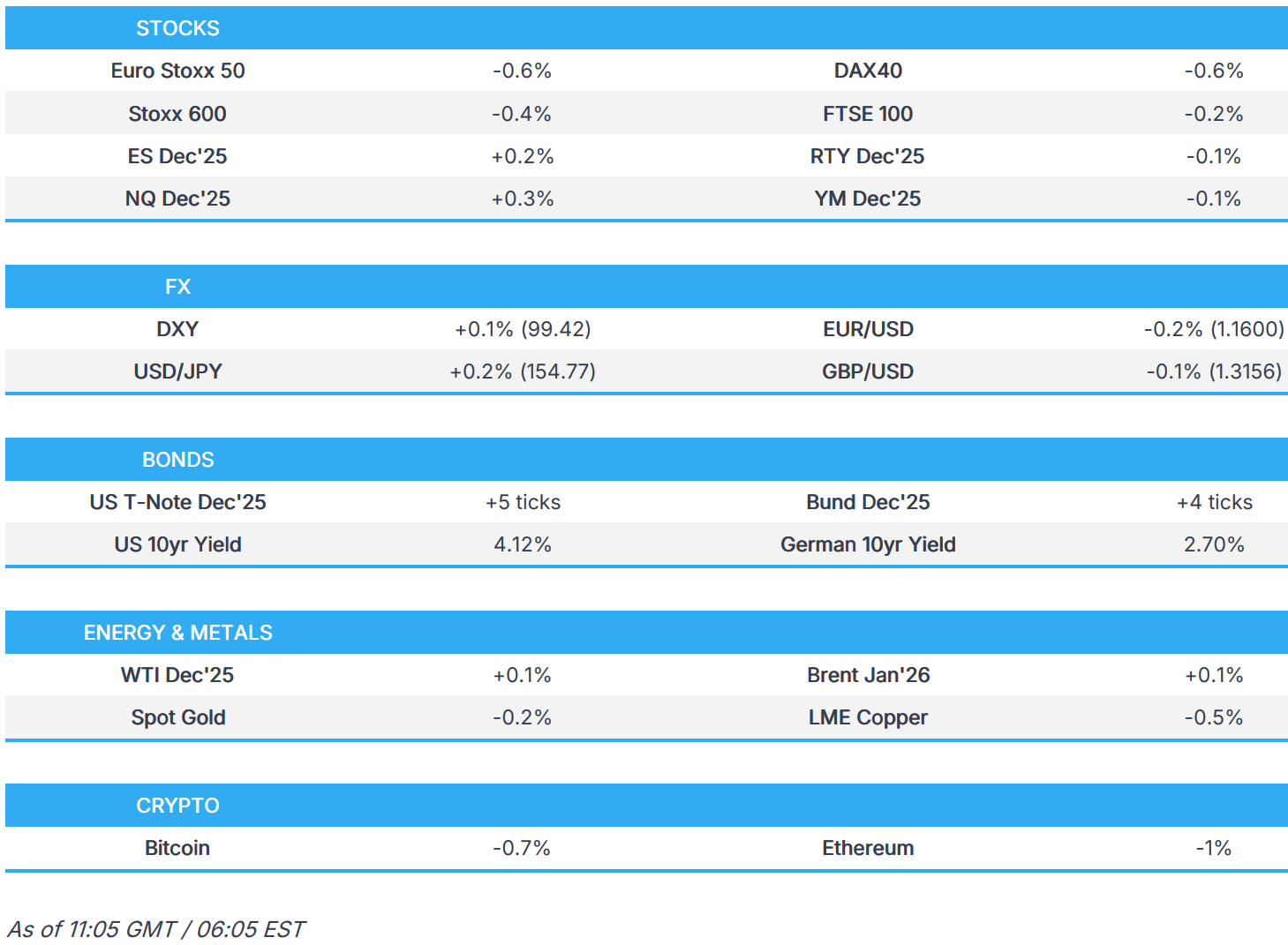

- European bourses initially opened flat, but have since slipped into the red; US equity futures are mixed.

- DXY is slightly firmer, whilst Antipodeans slip as the risk tone deteriorates a touch.

- Bonds are firmer amid the softer European tone but largely awaiting a packed speakers docket, and data later this week.

- Crude complex started the session in the red, but has since reversed on geopolitical updates; XAU marginally subdued.

- Looking ahead, highlights include US NY Fed Manufacturing, Construction Spending, Canadian CPI. Speakers include Fed’s Williams, Jefferson, Kashkari, Waller; ECB’s Cipollone; BoE’s Mann; BoC’s Kozicki.

</figure>

</figure>TRADE / TARIFFS

- US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be done by Thanksgiving, according to Fox News. Treasury Secretary Bessent said he is confident China will honour the agreement after the upcoming meeting between Presidents Trump and Xi, and emphasised that Washington has “many levers” if Beijing does not comply.

- US President Trump said he does not think more tariff rollbacks will be necessary; he said top US officials spoke with their Chinese counterparts on Friday and that he is speaking to China about soybeans, according to Reuters.

- US Treasury Secretary Bessent said US President Trump’s proposal to send USD 2,000 “dividend” payments from tariffs to US citizens would require congressional approval, according to Reuters.

- Tesla (TSLA) is now reportedly requiring its suppliers to exclude China-made components in the manufacturing of its cars in the US, a fresh example of the fallout from Washington–Beijing tensions, according to the WSJ.

- Brazil’s Vice President Alckmin said Brazil will continue working to reduce US tariffs further; he noted that progress has been made but there is still a long way to go, expressed optimism about further progress, and said the US government has taken a step in the right direction to reduce costs for its consumers, according to Reuters.

- USTR Greer has warned the EU that trade remains a “flashpoint” with Washington, according to the FT.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.4%) began the morning around the unchanged mark, with trade tentative, though recently sentiment has soured a touch with most European bourses slipping into the red. Nothing really behind the latest bout of pressure, but does continue the subdued mood seen overnight.

- European sectors also opened with a positive bias, but now holds a negative bias. Utilities and Real Estate marginally top the pile whilst Retail lags. Dassault Aviation (+6.2%) bucks the broadly lower mood in Europe, after Ukrainian President Zelensky said Ukraine had ordered 100 Rafale fighter jets.

- US equity futures (ES +0.2% NQ +0.2% RTY -0.1%) are mixed and have been moving lower in recent trade alongside the pressure seen in Europe. Macro newsflow light this morning, so traders will ultimately be mindful of the "delayed" US data releases dotted throughout the week, and NVIDIA earnings on Wednesday.

- Apple (AAPL) has intensified succession planning for CEO Tim Cook and is preparing for him to step down as soon as next year, with John Ternus, Apple’s Senior Vice President of Hardware Engineering, widely seen as his most likely successor, according to the FT.

- In its 2026 outlook, Morgan Stanley (MS) lifts its S&P 500 target to 7,800 for 2026, driven by strong EPS growth, positive operating leverage, AI-enabled efficiencies and an early-cycle “rolling recovery”.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat/modestly firmer and trades in a busy 99.29 to 99.47 range, given the lack of pertinent newsflow this morning but ahead of a packed weekly docket, which includes; the release of the delayed September NFP report, FOMC Minutes and a number of Fed speakers. Today’s docket is a bit more on the quiet side with only really the NY Fed Manufacturing report and comments via Fed’s Williams, Jefferson, Kashkari and Waller.

- EUR is a little lower today and trades just around the 1.1600 mark, within a 1.1596 to 1.1624 range. Newsflow for the region is relatively quiet ahead of the European Commission Autumn forecasts; there were some comments via ECB’s de Guindos who suggested that he is slightly more optimistic regarding growth, and expects inflation to converge towards target. Back to the Commission it raised its 2025 growth forecast for the bloc but cuts its view for 2026 to 1.2% (prev. 1.4%), while the inflation forecast was maintained for the year but increased in 2026. No significant EUR move seen, as such the single currency remains around the 1.16 mark.

- JPY is modestly lower vs the USD, and as is the case with peers, trade has been contained within a narrow 154.41 to 154.83 range. Overnight, price action was also lacklustre, and was ultimately little moved by a less-than-feared contraction in headline GDP – largely due to weak exports and lower tourism. Analysts at OxEco write that the dip in GDP will likely prove to be temporary, suggesting that consumption should modestly improve. On the fiscal side of things, Japan's Key Government Panel member Kataoka said that the Government must compile a stimulus package of up to JPY 23tln, funded with JPY 10tln in net bond issuance and JPY 13tln with tax and non-tax revenues.

- GBP is flat/slightly lower and trades towards the midpoint of a 1.3136 to 1.3180 range. Traders remain solely focused on the Budget developments, albeit updates over the weekend have been lacking on that front. This morning, The Times reported that Reeves is considering a nightly levy for British holidaymakers and foreign tourists on hotel stays and Airbnb-style rentals.

- Antipodeans are pressured, with the Aussie the marginal laggard across G10 pairs. Nothing really driving things for the currencies this morning, but follows on from subdued price action overnight, following the APAC risk tone.

- PBoC set USD/CNY mid-point at 7.0816 vs exp. 7.0956 (Prev. 7.082)

- Click for a detailed summary

FIXED INCOME

- A contained overnight session for USTs. Meandered within a narrow 112-15 to 19 range early doors with specifics light and participants preparing for a week of delayed data to finally start hitting and a substantial amount of Fed speak; into this, the odds of a cut in December have slipped to c. 40% vs the ~50% seen last week. Thereafter, the early European morning saw a modest deterioration in the region's risk tone (though, US futures remained strong), which provided some modest support to benchmarks generally. Lifting USTs further into the green and to a 112-22+ peak. If the move continues, we look to 112-23 from Friday before 112-31 and 113-00 from the two sessions prior. Today’s docket is dominated by Fed speak, where Williams (voter), Jefferson (voter), Kashkari (2026) and Waller (voter) are all due. From those, we expect Jefferson and Waller to provide texts, Jefferson and Kashkari to partake in Q&A’s while Williams is not expected to provide either.

- Bund overnight action was contained and similar to that outlined in USTs. Until the arrival of European participants, where a bout of upside occurred as the European risk tone deteriorated. Newsflow is relatively light and the move isn’t a particularly pronounced one, with Bunds firmer by just over 10 ticks at most at a 128.79 peak. If this continues, we look to 128.97 from Friday after which there is a gap until the figure and then levels between 129.19-40 from last week.

- Gilts are firmer, just about outperforming peers but the magnitude of action is also modest thus far. Gapped higher by 20 ticks to above the 92.05 mark before briefly losing the figure and then conformed to peers and lifted to a 92.29 peak, with gains of 14 ticks at most. Newsflow remains firmly focussed on the budget, and while there have been several scoops and reports around what Chancellor Reeves may do, there has not been anything of the magnitude seen last Friday. This week, the main focus point is Wednesday’s CPI, a series that provides early insight into the December deliberations, where Bailey may have to play the tie-breaking role once again.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks were muted to start the European session

Comments

In Channel