Europe Market Open: European equity futures mostly lower; UK PM Starmer and Chancellor Reeves to ditch income tax increase plans

Update: 2025-11-14

Description

- APAC stocks were pressured following the sell-off stateside, where tech was hit on valuation and China AI race concerns, while sentiment was also not helped by recent hawkish-leaning Fed rhetoric and mixed Chinese activity data.

- Chinese activity data was mixed, in which Industrial Production disappointed and Retail Sales marginally topped estimates, but both showed a slowdown from the previous, while Chinese House Prices continued to contract.

- US BLS said it is working on a plan to release the delayed data and stated, "We appreciate your patience while we work to get this information out ASAP, as it may take time to fully assess the situation and finalise revised release dates", according to WSJ.

- UK PM Starmer and Chancellor Reeves reportedly ditched budget plans to increase income tax rates, according to FT.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.3% after the cash market closed with losses of 0.8% on Thursday.

- Looking ahead, highlights include German Wholesale Price Index (Oct), French/Spanish CPI Final (Oct), EU Trade Balance (Sep), EU GDP Flash Estimate (Q3), Speakers including ECB’s Cipollone, Elderson & Lane, Fed’s Bostic, Schmid & Logan, Earnings from Swiss Re, Allianz & Siemens Energy.

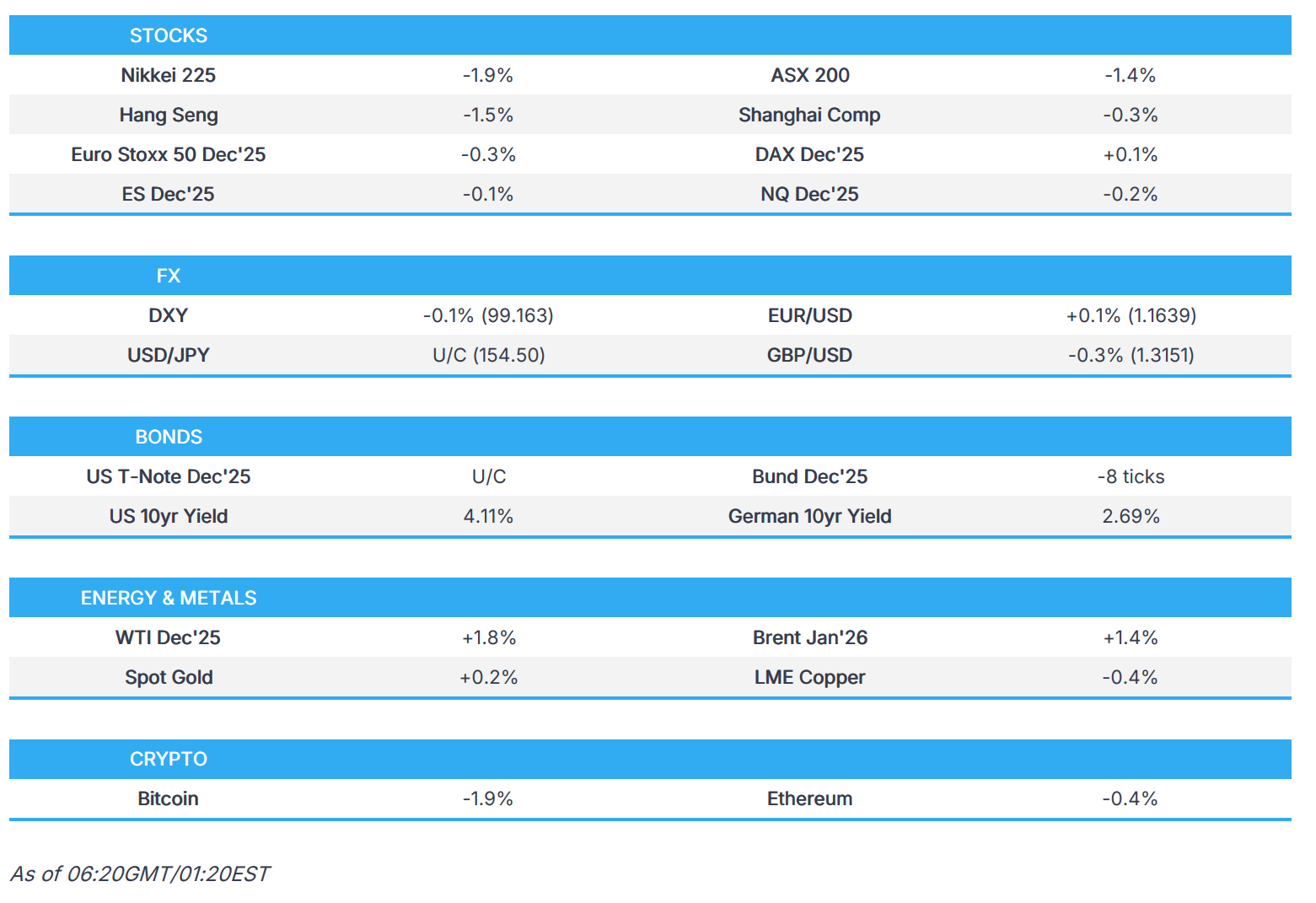

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks declined with the Nasdaq and big tech names leading the losses, seemingly driven by concerns over the US position in the AI race against China after a slew of positive updates from Chinese tech companies overnight. The SPX sold off by over 100 points at the close, while RUT and NDX clearly underperformed.

- Sectors were predominantly lower, with the homes of the heavy weights, Consumer Discretionary, Tech and Communications the laggards, while Energy, Consumer Staples and Healthcare outperformed, in which energy stocks tracked crude prices higher as Russia appeared frustrated with Ukraine's lack of negotiations although crude settled well off today's highs amid the downbeat risk tone and after inventory data saw a chunky build.

- SPX -1.64% at 6,739, NDX -2.05% at 24,993, DJI -1.65% at 47,457, RUT -2.78% at 2,383.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump's administration is preparing tariff exemptions in a bid to lower food prices, according to NYT

- US Secretary of State Rubio met with Brazil's Foreign Minister and discussed a reciprocal framework for the US-Brazil trade relationship, according to the State Department

- US senior official said agreements with Argentina, Ecuador, El Salvador and Guatemala open markets to US agricultural and industrial products, expects full agreements with most of these countries to be finalised within the next two weeks, in which the four countries agreed not to impose digital service taxes. Furthermore, the tariff rates will remain for these countries, but framework agreements will provide relief in certain areas, including bananas.

- US senior official said talks with Switzerland on Thursday were very positive, and if the deal is accepted by US President Trump, we would see a reduction of tariffs on Swiss imports. The official also commented that they have made a lot of advances with Taiwan.

- European Commission President von der Leyen said ministers agreed to hike duties on small parcels.

- South Korea announced the factsheet with the US was finalised and President Lee said that US President Trump made a rational decision for the factsheet, while Lee added they agreed that investment in the US will be limited to commercially viable projects and that South Korea and the US will build a new partnership for shipbuilding, AI and the nuclear industry. Lee stated that the sides agreed on South Korea building a nuclear-powered submarine, and South Korea will strengthen ties with companies like NVIDIA.

- South Korean Presidential Adviser said the US will give South Korea chip tariff terms that are no less favourable than Taiwan’s, while it was agreed with the US that forex market stability needs to be ensured and that the amount and timing of fund supply to the US can be adjusted if needed for forex stability.

- White House said the US and South Korea deal includes USD 150bln of Korean investment in the shipbuilding sector approved by the US and USD 200bln of additional Korean investment committed pursuant to an MOU on strategic investments, while the US has given approval for South Korea to build nuclear-powered attack submarines. US said it will reduce its Section 232 sectoral tariffs on automobiles, auto parts, timber, lumber and wood derivatives of South Korea to 15%, and for any Section 232 tariffs imposed on pharmaceuticals, the US intends to apply a tariff rate no greater than 15% to originating goods of South Korea. Furthermore, South Korea is committed to spending USD 25bln on US military equipment purchases by 2030 and shared its plan to provide comprehensive support for US Forces Korea amounting to USD 33bln in accordance with South Korean legal requirements, while the US agreed that South Korea will pay USD 20bln annual phased instalments as part of the trade deal.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said outside of data centres, business investment has been tepid and that businesses are learning how to run their firms in an uncertain environment. Musalem said he supported rate cuts so far to protect the labour market and they need to proceed with caution now. Furthermore, he sees limited room to ease without becoming overly accommodative and said policy is closer to neutral than modestly restrictive, while he added they need to continue to lean against inflation.

- Fed's Hammack (2026 voter) said the US economy has been remarkably resilient and that she hears from contacts that inflation is too high and moving in the wrong direction. Hammack stated the employment side of the mandate is challenged amid job market softening, and inflation may be tariff-driven, but service inflation is a real concern, while she added that Fed policy needs to remain somewhat restrictive to push inflation pressures down.

- Fed's Kashkari (2026 voter) said it seems like there are real pockets of weakness in the labour market and corporations are very optimistic about 2026, while he has no strong inclination yet on a December rate cut, but noted data suggests more of the same since the October meeting and that the resilient economy called for a rate pause in October.

- NEC Director Hassett said he expects to see 60k job losses due to the government shutdown, while he responded that the numbers they have are consistent with more rate cuts, when asked about inflation.

- BLS said it is working on a plan to release the delayed data and stated, "We appreciate your patience while we work to get this information out ASAP, as it may take time to fully assess the situation and finalise revised release dates", according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks were pressured following the sell-off stateside, where tech was hit on valuation and China AI race concerns, while sentiment was also not helped by recent hawkish-leaning Fed rhetoric and mixed Chinese activity data.

- ASX 200 was dragged lower by weakness in tech and with nearly all sectors in the red aside from energy.

- Nikkei 225 dipped beneath the 51,000 level and was among the worst performers amid earnings results and tech woes.

- Hang Seng and Shanghai Comp declined with participants digested the recent data releases, including mixed activity data in which Industrial Production disappointed and Retail Sales marginally topped estimates, but both showed a slowdown from the previous, while Chinese House Prices continued to contract. Nonetheless, the downside in the mainland was somewhat cushioned with China pledging to expand domestic demand and stabilise trade.

- US equity futures languished near the prior day's lows following the tech-related selling.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.3% after the cash market closed with losses of 0.8% on Thursday.

FX

- DXY traded little changed overnight after weakening yesterday as USD-denominated assets were hit alongside the risk-off mood. Following the government reopening, markets now await the delayed data, although there has been no schedule announced yet, and White House Economic Adviser Hassett said the jobs part will be released for one month, but not the unemployment rate, due to the shutdown. Furthermore, there were several recent Fed comments, including from Kashkari who said he has n

Comments

In Channel