Europe Market Open: Tentative trade as markets await the FOMC Minutes and Nvidia earnings

Update: 2025-11-19

Description

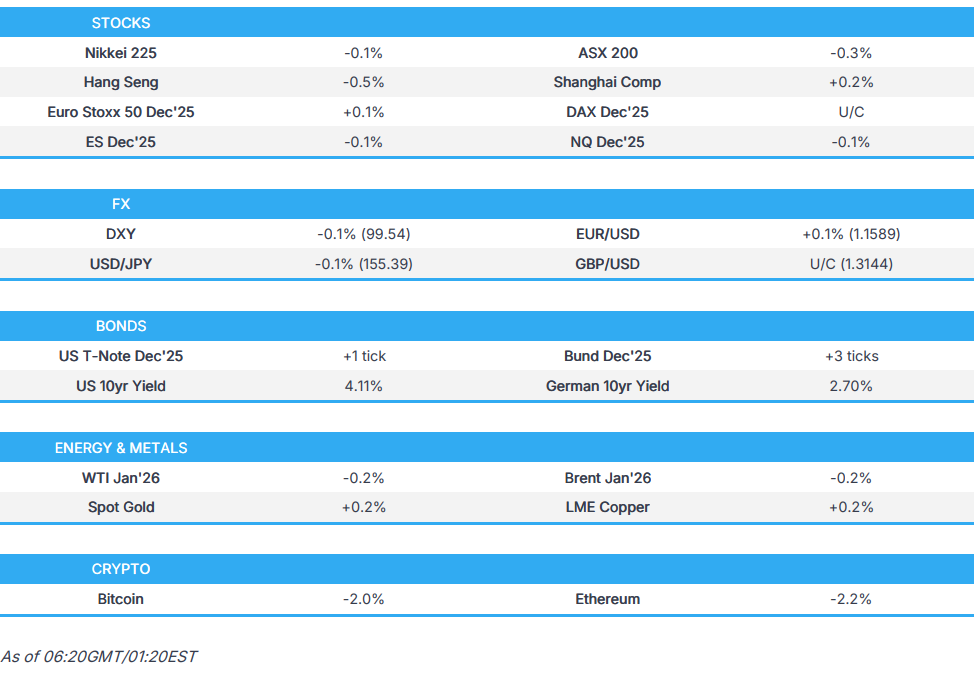

- APAC stocks were choppy, cautious, and eventually traded subdued, as the region held a tentative stance ahead of the FOMC minutes and NVIDIA earnings.

- The Trump administration has been secretly working in consultation with Russia to draft a new plan to end the war in Ukraine, according to Axios sources; Russia said Ukraine attempted to strike targets deep inside Russian territory.

- BoJ Governor Ueda, Japanese Finance Minister Katayama, and Japanese Economy Minister Kiuchi are set to meet at 09:10 GMT (04:10 EST), according to JiJi; Japanese Finance Minister Katayama is expected to speak to media at 09:30 GMT (04:30 EST).

- The White House confirmed that US President Trump is set to speak at the US-Saudi investment forum on Wednesday at 12:00 EST (17:00 GMT) in Washington.

- US Treasury Secretary Bessent said US President Trump may announce the next Fed Chair before Christmas, via Fox News.

- Looking ahead, highlights include UK CPI, EZ HICP (Final), US International Trade (Aug), FOMC Minutes, Fed’s Williams, Logan, Barkin, Miran; BoE’s Dhingra, supply from the UK & US. Earnings from NVIDIA, Target & Lowe’s.

- Click for the Newsquawk Week Ahead.

</figure>

</figure>US TRADE

EQUITIES

- US stocks were lower, albeit settling well off troughs, as mega-cap sectors Consumer Discretionary and Technology underperformed amid continued concerns regarding AI overvaluation. These worries were heightened on Tuesday, as Rothschild downgraded both Amazon and Microsoft, saying it’s time to take a more cautious stance on AI hyperscalers. Health and Energy sat at the top of the sectorial breakdown, with the latter buoyed by strength in the crude complex, albeit not on any specific headline driver.

- SPX -0.83% at 6,617, NDX -1.20% at 24,503, DJI -1.05% at 46,103, RUT +0.21% at 2,346.

- Click here for a detailed summary.

NOTABLE US HEADLINES

- US President Trump said he has begun interviews for Fed Chair and would love to remove Powell immediately, adding he thinks he already knows his choice; he said there are some surprising names under consideration but he may go the standard route, and noted that people are holding him back from firing Powell, according to Reuters.

- US Treasury Secretary Bessent said US President Trump may announce the next Fed Chair before Christmas, via Fox News.

US DELAYED DATA UPDATES

- The US Department of Labor said weekly jobless-claims data will be released on Thursday and that a technical issue caused an early posting of some of the claims data, according to Reuters.

- The BLS said the PPI for September will be released on November 25th, while the Import and Export Price Indices for September will be released on December 3rd, 2025, according to Reuters.

NOTABLE US EQUITY HEADLINES

- Meta (META) won its FTC antitrust trial over the Instagram and WhatsApp acquisitions, with the judge ruling the deals did not create an illegal monopoly, according to Bloomberg.

- NVIDIA (NVDA) and Microsoft (MSFT) are committing to invest in Anthropic’s next fundraising round, according to Reuters citing sources.

- US President Trump posted "Investment in AI is helping to make the U.S. Economy the “HOTTEST” in the World — But overregulation by the States is threatening to undermine this Growth Engine...We MUST have one Federal Standard instead", via Truth Social.

- Tesla (TSLA) CEO Musk and NVIDIA (NVDA) CEO Huang are set to participate in a panel at the US-Saudi investment forum on November 19th, according to Reuters.

- Elon Musk's xAI is said to be in advanced talks to raise USD 15bln in new equity at a USD 230bln valuation, according to WSJ sources.

TRADE/TARIFFS

- US President Trump said China is on schedule in buying US farm products but wants China to speed up soybean purchases, adding that he wants Treasury Secretary Bessent to tell China to accelerate those purchases, according to Reuters.

- The White House stated that the US and Saudi Arabia have agreed to increase engagement on trade issues in the coming weeks, with an agreement secured for Saudi Arabia to purchase nearly 300 American tanks. President Trump approved a major defence sale package, including future F-35 deliveries. Key Saudi-US achievements include a civil nuclear cooperation agreement, advancements in critical minerals cooperation, and a landmark AI memorandum of understanding (MOU).

- The White House confirmed that US President Trump is set to speak at the US-Saudi investment forum on Wednesday at 12:00 EST (17:00 GMT) in Washington.

APAC TRADE

EQUITIES

- APAC stocks were choppy, cautious, and eventually traded subdued, as the region held a tentative stance ahead of the FOMC minutes and NVIDIA earnings.

- ASX 200 printed on either side of the unchanged mark with limited news flow in the region. Wage Price Index data came in as expected, producing little market reaction. The index found support from gains in gold miners after the metal bounced from support around USD 4,000/oz.

- Nikkei 225 experienced choppy trade, swinging between gains and losses. Following modest opening gains, the index quickly turned negative within the first 30 minutes as JGB yields continued to rise, while Japan navigated ongoing tensions with China and PM Takaichi's fiscal package. Nikkei thereafter moved to session highs above 49,000 before trimming those gains once again.

- KOSPI saw a sharp acceleration in losses shortly after the open (-2.2% at one point), driven by declines in its heavily-exposed tech sector, with Samsung Electronics falling some 3% at one point. KOSPI thereafter trimmed a bulk of its losses but remained negative.

- Hang Seng and Shanghai Comp opened with modest, cautious gains, in contrast to the more negative tone in Japan and South Korea, although the former later conformed to the global tech losses, whilst the latter gave up initial modest gains.

- US equity futures initially traded flat but soon adopted a negative bias as sentiment soured in Japan and South Korea shortly after the open. Some positivity was seen around the China open, although futures later waned once again ahead of FOMC minutes and NVIDIA earnings.

- European equity futures Indicative of an uneventful open with the Euro Stoxx 50 future U/C after cash closed -1.9% on Tuesday.

FX

- DXY was choppy in a narrow 99.524–99.669 range, remaining within Tuesday's parameters for most of the session before it eclipsed yesterday's peak (99.661) before trimming modest gains. Market focus shifted towards the FOMC minutes, with attention also on NVIDIA earnings.

- EUR/USD saw little movement as the pair consolidated following yesterday's losses, which saw it fall below the 1.16 mark. Traders are now looking ahead to the EZ Final CPI data, though this is unlikely to have a significant impact on EUR assets.

- GBP/USD continued to tread water ahead of the upcoming UK CPI, with current BoE pricing suggesting a 79% chance of a 25bps rate cut at the December 18th announcement.

- USD/JPY traded choppily within a tight range, with the yen showing modest strength as risk sentiment in Japan and South Korea deteriorated. The pair fluctuated around 155.50, staying within the 154.81–155.73 range seen yesterday. Some JPY weakness was seen on reports that the Chinese government issued a renewed ban on Japanese seafood imports.

- Antipodeans eventually traded lower as sentiment tilted lower. AUD saw little reaction to the Australian Wage Price Index, which printed in line with expectations and prior readings.

- PBoC set USD/CNY mid-point at 7.0872 vs exp. 7.1121 (Prev. 7.0856)

FIXED INCOME

- 10yr UST futures held a mild upward bias following the previous day’s steepening, supported by the cautious risk profile across APAC.

- Bund futures were underpinned amid the cautious risk tone, with little material data on the EZ docket, as traders focused on the upcoming FOMC minutes and NVIDIA earnings.

- 10yr JGB futures bucked the trend, with yields rising across the Japanese curve. The market remained under pressure, with downticks after Japan’s 20-year JGB auction, where weak demand raised concerns about the fiscal stimulus plan, although the 10yr JGB future edged higher after the initial reaction to the auction. Meanwhile, the 40-year JGB yield reached a record high of 3.685%.

- Japan sold JPY 600bln vs exp. JPY 800bln 20-year JGB; b/c 3.28x (prev. 3.56x), average yield 2.809% (prev. 2.674%)

- Australia sold AUD 1bln 2.75% 2035 AGB; b/c

Comments

In Channel