US Market Open: US equity futures are weaker across the board in pre-market trade as Tech continues to lag on valuation concerns

Update: 2025-11-14

Description

- European equities opened broadly lower, with all major indices in the red as sentiment soured following weakness in APAC trade; FTSE 100 lags.

- US equity futures are weaker across the board in pre-market trade as Tech continues to lag on valuation concerns.

- GBP/USD is in focus this session following reports that Chancellor Reeves has scrapped plans for an income tax rate hike, a move seen as increasing fiscal risks ahead of the November 26th budget.

- Gilts experienced a volatile session, with the benchmark plunging from 93.37 to 92.07, but has since rebounded modestly on reports around UK forecasts.

- UKMTO notes of incident off the coast of UAE's Khor Fakkan [near the Strait of Hormuz], believed to be state activity; Vessel is transiting towards Iranian territorial waters.

- Looking ahead, speakers include ECBʼs Cipollone & Lane, Fedʼs Bostic, Schmid & Logan.

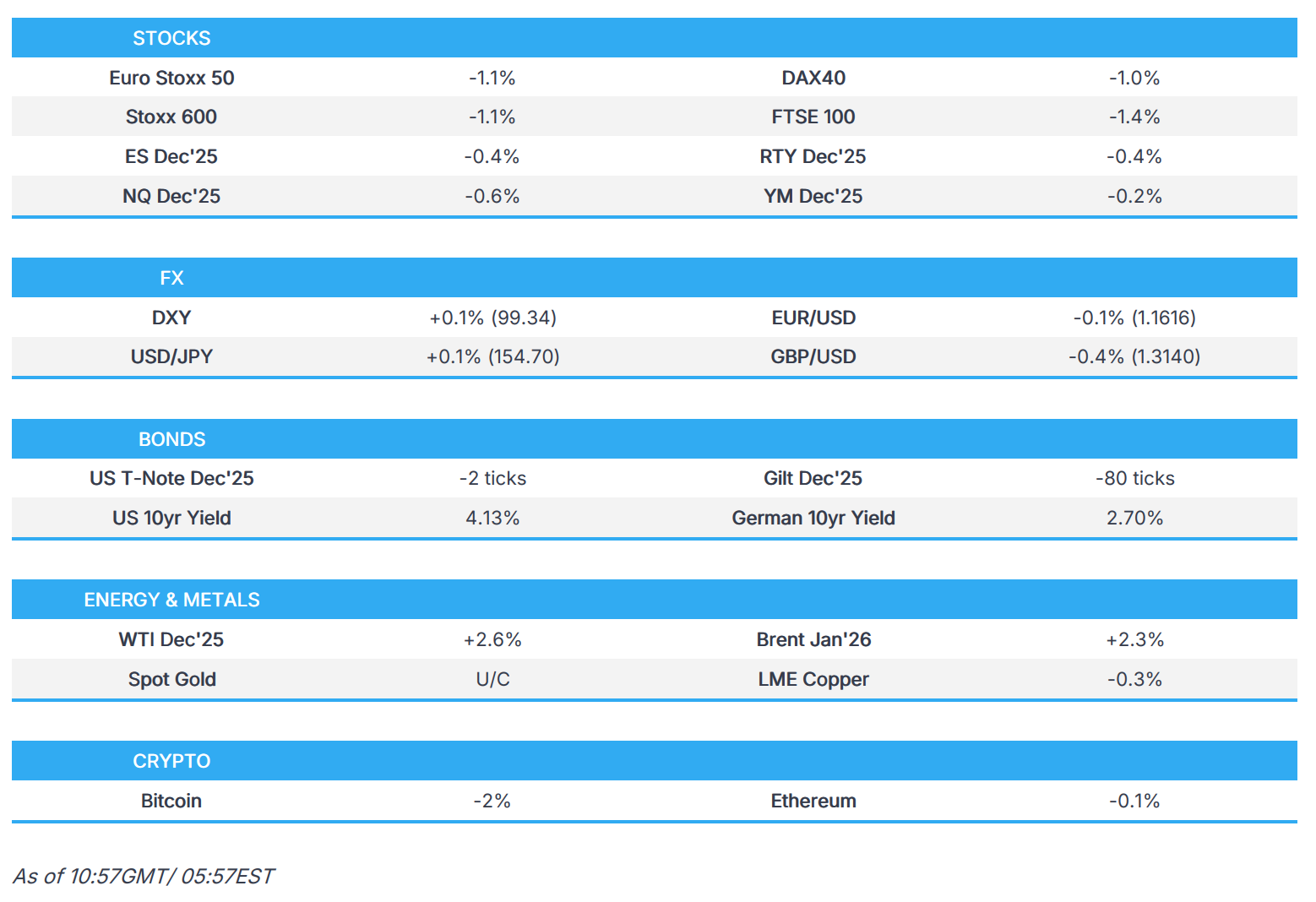

SNAPSHOT

<figure class="image"> </figure>

</figure>TARIFFS/TRADE

- US President Trump's administration is preparing tariff exemptions in a bid to lower food prices, according to NYT

- US Secretary of State Rubio met with Brazil's Foreign Minister and discussed a reciprocal framework for the US-Brazil trade relationship, according to the State Department

- US senior official said agreements with Argentina, Ecuador, El Salvador and Guatemala open markets to US agricultural and industrial products, expects full agreements with most of these countries to be finalised within the next two weeks, in which the four countries agreed not to impose digital service taxes. Furthermore, the tariff rates will remain for these countries, but framework agreements will provide relief in certain areas, including bananas.

- US senior official said talks with Switzerland on Thursday were very positive, and if the deal is accepted by US President Trump, we would see a reduction of tariffs on Swiss imports. The official also commented that they have made a lot of advances with Taiwan.

- South Korea announced the factsheet with the US was finalised and President Lee said that US President Trump made a rational decision for the factsheet, while Lee added they agreed that investment in the US will be limited to commercially viable projects and that South Korea and the US will build a new partnership for shipbuilding, AI and the nuclear industry. Lee stated that the sides agreed on South Korea building a nuclear-powered submarine, and South Korea will strengthen ties with companies like NVIDIA.

- South Korean Presidential Adviser said the US will give South Korea chip tariff terms that are no less favourable than Taiwan’s, while it was agreed with the US that forex market stability needs to be ensured and that the amount and timing of fund supply to the US can be adjusted if needed for forex stability.

- White House said the US and South Korea deal includes USD 150bln of Korean investment in the shipbuilding sector approved by the US and USD 200bln of additional Korean investment committed pursuant to an MOU on strategic investments, while the US has given approval for South Korea to build nuclear-powered attack submarines. US said it will reduce its Section 232 sectoral tariffs on automobiles, auto parts, timber, lumber and wood derivatives of South Korea to 15%, and for any Section 232 tariffs imposed on pharmaceuticals, the US intends to apply a tariff rate no greater than 15% to originating goods of South Korea. Furthermore, South Korea is committed to spending USD 25bln on US military equipment purchases by 2030 and shared its plan to provide comprehensive support for US Forces Korea amounting to USD 33bln in accordance with South Korean legal requirements, while the US agreed that South Korea will pay USD 20bln annual phased instalments as part of the trade deal.

EUROPEAN TRADE

EQUITIES

- European Equities – Opened broadly lower, with all major indices in the red as sentiment soured following weakness in APAC trade, where tech underperformed on valuation and China AI concerns. Recent hawkish Fed rhetoric and mixed Chinese data also weighed. UK headlines dominated the morning, with reports that PM Starmer and Chancellor Reeves will scrap plans to raise income tax, further pressuring the FTSE 100 (-1.2%). EZ GDP and employment data were largely shrugged off, while attention now turns to ECB’s Buch, Elderson, and Lane.

- European sectors - Opened mostly lower, with only Energy (+1.0%) and Consumer Products & Services (+0.7%) in positive territory. The latter was lifted by Richemont (+8.0%) after stronger-than-expected H1 revenue and profit, while Energy gained on elevated crude prices following a Ukrainian drone strike on Russia’s Novorossiysk oil depot and upbeat results from Siemens Energy (+9.9%), which raised 2026 guidance. Laggards include Technology (-2.7%), Banks (-2.0%), and Basic Resources (-2.0%). Tech mirrored US weakness amid renewed US–China AI race concerns, while softer Chinese industrial output weighed on resources. Banks underperformed on UK political turbulence, with HSBC (-2.8%), Lloyds (-3.4%), and Barclays (-2.8%) all lower.

- US Equity Futures - Weaker across the board in pre-market trade as Tech continues to lag on valuation concerns. Overnight, US officials described talks with Switzerland as “very positive,” noting that if approved by President Trump, the deal would see reduced tariffs on Swiss imports. The White House also announced a South Korea investment deal, including USD 150bln in approved shipbuilding investment and USD 200bln in additional strategic commitments under an MOU. Today’s US calendar is light, with Fed speakers Schmid (’25, hawkish), Logan (’26), and Bostic (’27) on deck.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD - DXY is little changed after a subdued overnight session, following yesterday’s weakness when USD-denominated assets came under pressure amid a broader risk-off tone. With the government now reopened, focus shifts to the release of delayed economic data, though no official schedule has been confirmed — one could, however, be announced as early as today. In early European trade, DXY continues to hold within a narrow 99.109–99.336 range, well within Thursday's 98.991-99.591 range.

- EUR - EUR/USD is trading slightly softer in early European hours after holding onto the prior day’s gains during APAC trade, remaining above the 1.1600 handle amid ongoing dollar pressure. Newsflow for the Eurozone is light, with the pair contained within a 1.1618–1.1648 intraday range and well within yesterday’s 1.1579–1.1656 parameters. The 50DMA and 100DMA sit just above at 1.1660 and 1.1662, respectively.

- GBP - GBP/USD is in focus this session following reports that Chancellor Reeves has scrapped plans for an income tax rate hike, a move seen as increasing fiscal risks ahead of the November 26th budget. Gilts slipped at the open, with the pound underperforming into European trade. Price action later reversed modestly after Bloomberg sources suggested that improved UK forecasts had prompted Reeves to drop the planned tax rise (see Fixed Income section for details). GBP/USD spiked from 1.3121 to 1.3200 on the Bloomberg headlines before easing back toward 1.3150, with trade contained within a 1.3109–1.3200 intraday range and inside yesterday’s broader 1.3100–1.3215 parameters.

- JPY - USD/JPY is struggling for clear direction after recent choppy trade and amid a lack of fresh domestic catalysts, while Japanese press highlights growing scepticism among market participants over the government’s ability to support the yen through direct intervention. The JPY is showing limited reaction to the broader risk-averse tone, with sentiment further dampened by sharp remarks from China’s Defence Ministry, which warned that Japan “will only suffer a crushing defeat” should it “dare to take a risk.” The comments followed Japanese PM Takaichi’s statement that a conflict over Taiwan could constitute a “survival-threatening situation” for Tokyo. USD/JPY trades within a 154.32–154.74 intraday range, contained inside yesterday’s 154.13–155.02 parameters.

- Antipodeans - The Antipodeans are mixed with NZD leading gains despite limited fresh catalysts, after the RBNZ confirmed it will proceed with easing mortgage loan-to-value ratio restrictions as previously announced last month. AUD/USD briefly moved above its 100DMA (0.6540) before pulling back, while NZD/USD recovered strongly from yesterday’s losses. The AUD/NZD cross meanwhile slipped from a 1.1558 high to a 1.1487 low.

- PBoC set USD/CNY mid-point at 7.0825 vs exp. 7.0964 (Prev. 7.0865).</

Comments

In Channel