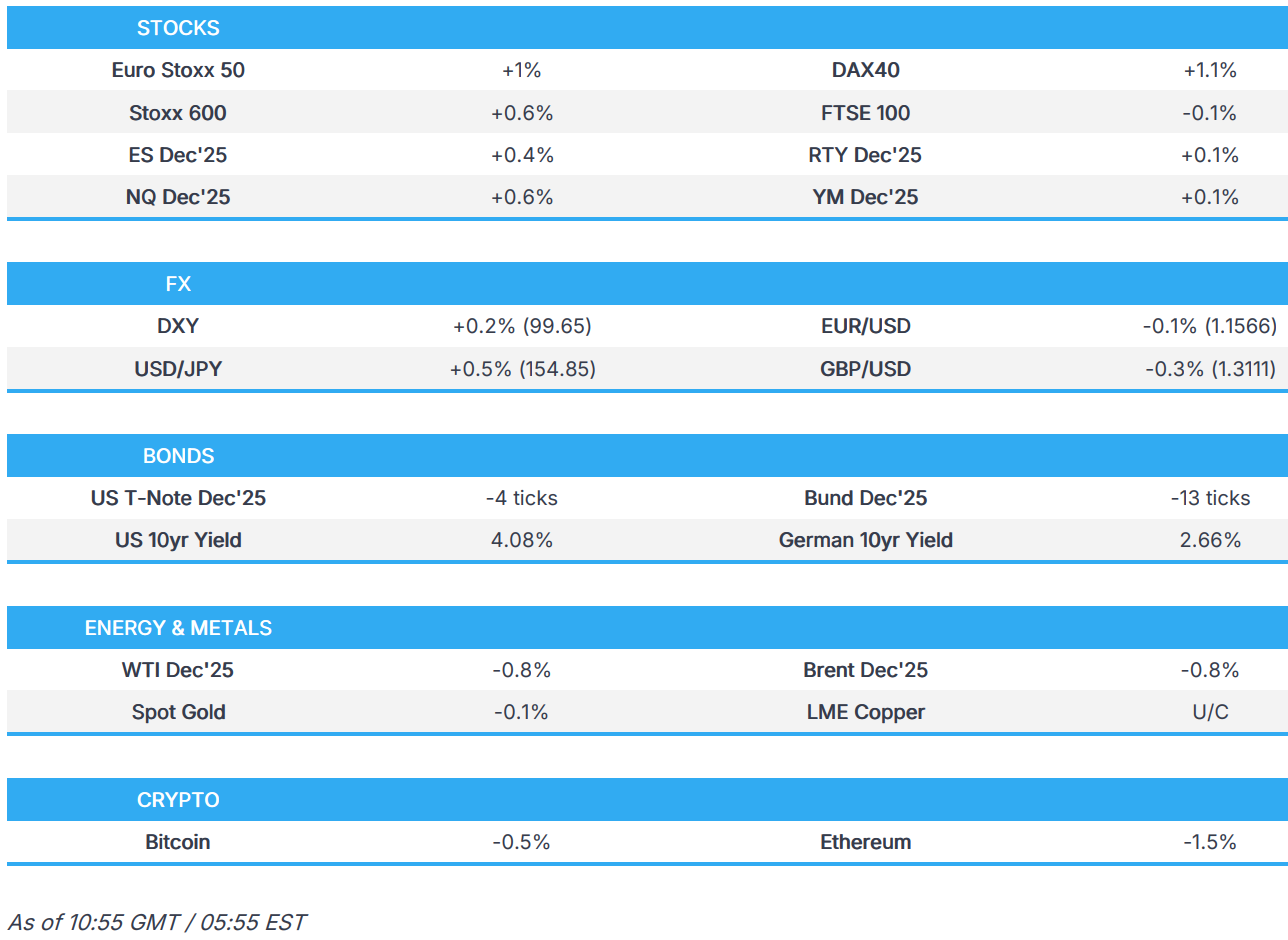

US Market Open: USD & US equity futures firmer ahead of a slew of Fed speakers; US House set to vote on ending shutdown

Update: 2025-11-12

Description

- US House to vote on a bill which could end the shutdown and keep the government funded through January 2026.

- European bourses are broadly firmer and continue to make highs, US equity futures also gain with the RTY (+1%) outperforming.

- USD is firmer ahead of a slew of Fed speakers, GBP pressured on political uncertainty; JPY lags.

- Global bonds are softer given the risk tone, Gilts lag with PM Starmer pressured into PMQs.

- Crude benchmarks pull back after Tuesday’s gains, XAU remains rangebound.

- Looking ahead, highlights include BoC Minutes (Oct), EIA STEO, OPEC MOMR, Speakers including ECB’s de Guindos, Fed’s Paulson, Bostic, Williams, Waller, Miran, Collins; US Treasury Secretary Bessent. Supply from the US.

</figure>

</figure>TARIFFS/TRADE

- US President Trump said that they are going to lower some tariffs on coffee, according to a Fox News interview.

- Dutch Economy Minister Karremans said he spoke to EU Trade Commissioner Sefcovic about Nexperia and said they are both determined to ensure that supply chains are restored as quickly as possible, while they are committed to securing supply in the semiconductor space and are working closely with European and International partners.

- US and Saudi officials have held intense negotiations in recent weeks to finalise a number of agreements, including a defence pact, ahead of Saudi Crown Prince MBS meeting US President Trump in the US next week, via Axios citing sources.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.6%) have opened largely firmer, once again carrying on the positive momentum displayed over the last two days. The FTSE 100 underperforms with sentiment in the region hit amidst fears that PM Starmer's leadership is "vulnerable".

- European sectors are also primarily in the green. The biggest winners thus far today are Utilities (+1.1%), Banks (+1.1%) and Automobiles & Parts (+1.3%). The latter has been boosted by a broker upgrade for Ferrari (+2%). For the Tech sector, Infineon (+6.6%) soars after reporting strong Q3 metrics and providing solid AI-related commentary.

- US equity futures (ES +0.3%, NQ +0.6%, RTY +0.1%) are trading on a firmer footing. The NQ is firmer today as Tech returns back to a firmer footing, with sentiment boosted by Infineon and Foxconn results; the latter said it was "very optimistic" about AI-driven demand.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat/modestly firmer and trades in a very busy 99.44 to 99.61 range, with newsflow exceptionally quiet today. Focus in the prior session was ultimately on the dire weekly ADP prelim estimate, which led to some pressure in the USD. Docket today thins out from a data perspective, but a slew of Fed speakers will take the spotlight; Fed’s Paulson, Bostic, Williams, Barr, Waller, Miran, Collins and Treasury Secretary Bessent are all on the docket. Markets remain focused on government shutdown developments. To recap briefly, the US passed a funding bill to end the longest-ever shutdown in the prior day – this was then voted 8-4 by the House Rules Committee to advance it to the House Floor for consideration. Expectations are for the bill to be passed (albeit subject to dissent); overall, this will keep the US government funded till at least January 30th.

- EUR is essentially flat vs the USD. Failed to breach 1.16 to the upside in overnight trade, making a peak at 1.1588, to then fall back towards session lows of 1.1571. It is worth highlighting that the EUR is mildly stronger vs the broadly weaker GBP (which is suffering from political related pressure). European-specific newsflow has been exceptionally light today. Featuring an unrevised German inflation report, whilst Italian Industrial Output topped the most optimistic of analyst expectations. Docket should pick up later in the day, in the form of ECB speak via Schnabel (Hawk) and de Guindos (Dove) – no text release is expected from either.

- JPY is the worst-performing G10 currency today, given the generally positive risk environment with other haven assets generally sold (ex-gold). ING opines that one reason to keep the USD/JPY higher, is Japan’s agreement to invest directly in the US. This pressure in the JPY has led to continued jawboning from the Japanese officials; overnight, Finance Minister Katayama said she has seen “one-sided and sharp foreign exchange moves” recently, adding that it is being watched with a “high sense of urgency”. Whilst in the past similar jawboning has helped strengthen the JPY, the comments overnight were unable to boost the currency today.

- GBP is pressured vs the USD today, with regional political uncertainty on the forefront of traders minds. On that, in the prior session, The Guardian reported that Downing Street was fearing that some of the PM’s closest viewed PM Starmer as “vulnerable” to leadership change in the wake of the Budget. More recently, Wes Streeting has come out to clarify his support for Starmer, adding that he has not had talks with anyone, regarding any attempts to oust his leader.

- Antipodeans are mixed today, with the Aussie sitting towards the top of the G10 pile whilst the Kiwi is essentially flat. Nothing really driving the modest outperformance in the Aussie today, but it is worth highlighting some massive option expiries in the Aussie; 0.6495-0.6505 (2.4bln), 0.6525-30 (1.2bln), 0.6550-60 (906mln).

- PBoC set USD/CNY mid-point at 7.0833 vs exp. 7.1141 (Prev. 7.0866).

- Click for NY OpEx Details

- Click for a detailed summary

FIXED INCOME

- USTs are pressured today, in-fitting with global bonds, as US paper scales back some of the ADP-related upside seen in the prior session and as risk sentiment today is boosted (equity futures firmer across the board). USTs currently trade at the bottom end of a 112-27 to 113-00+ range, and with price action relatively muted so far. Not really much on the data docket today, but a slew of Fed speakers will take the spotlight; Fed’s Paulson, Bostic, Williams, Barr, Waller, Miran, Collins and Treasury Secretary Bessent are all on the docket. Markets remain focused on government shutdown developments. To recap briefly, the US passed a funding bill to end the longest-ever shutdown in the prior day – this was then voted 8-4 by the House Rules Committee to advance it to the House Floor for consideration. Expectations are for the bill to be passed (albeit subject to dissent); overall, this will keep the US government funded till at least January 30th.

- Bunds lower at the start of the European day, opened at 129.19 with losses of a handful of ticks, briefly rebounded to a 129.24 peak with gains of a tick before getting dragged lower as the European risk tone continues to improve. Currently holding just off a 129.02 trough with downside of 21 ticks at most, if the move continues and the figure is breached then yesterday's 128.97 base comes into view. Bunds also potentially lower in sympathy with Gilts (see below) given the speculation around UK PM Starmer and associated price action as we get ever closer to the November Budget. For Germany, no move to Final CPI, which was unrevised, as expected. More recently, remarks from ECB's Kocher of note, as he said it would not be too surprising if the ECB holds rates steady in 2026, especially if inflation and growth projections play out as expected. A mixed Bund auction (2046 strong, but 2056 line garnered a 1.3x b/c), had little impact German paper at the time.

- This afternoon, the French National Assembly is to hold the first reading on the Social Security articles, with reference to the suspension of pension reform, set to occur around 14:00 GMT. Politico writes that the articles should be adopted. Into this, OATS trade better than peers with the mood-music relatively constructive for PM Lecornu at this particular stage. Narrowing the OAT-Bund 10yr yield spread down to 74bps, the lowest since August.

- Gilts are underperforming vs peers, scaling back some of jobs-related upside seen in the prior session, which saw odds of a December BoE rate cut boosted. Moreover, po

Comments

In Channel