US Market Open: US equity futures are stronger as senators take first steps to ending the US government shutdown whilst USTs and USD are softer

Update: 2025-11-10

Description

- US Senate voted 60 vs 40 to advance the government funding bill through the procedural hurdle, moving it closer towards passage, after 8 Democrats supported the measure in a rare Sunday session.

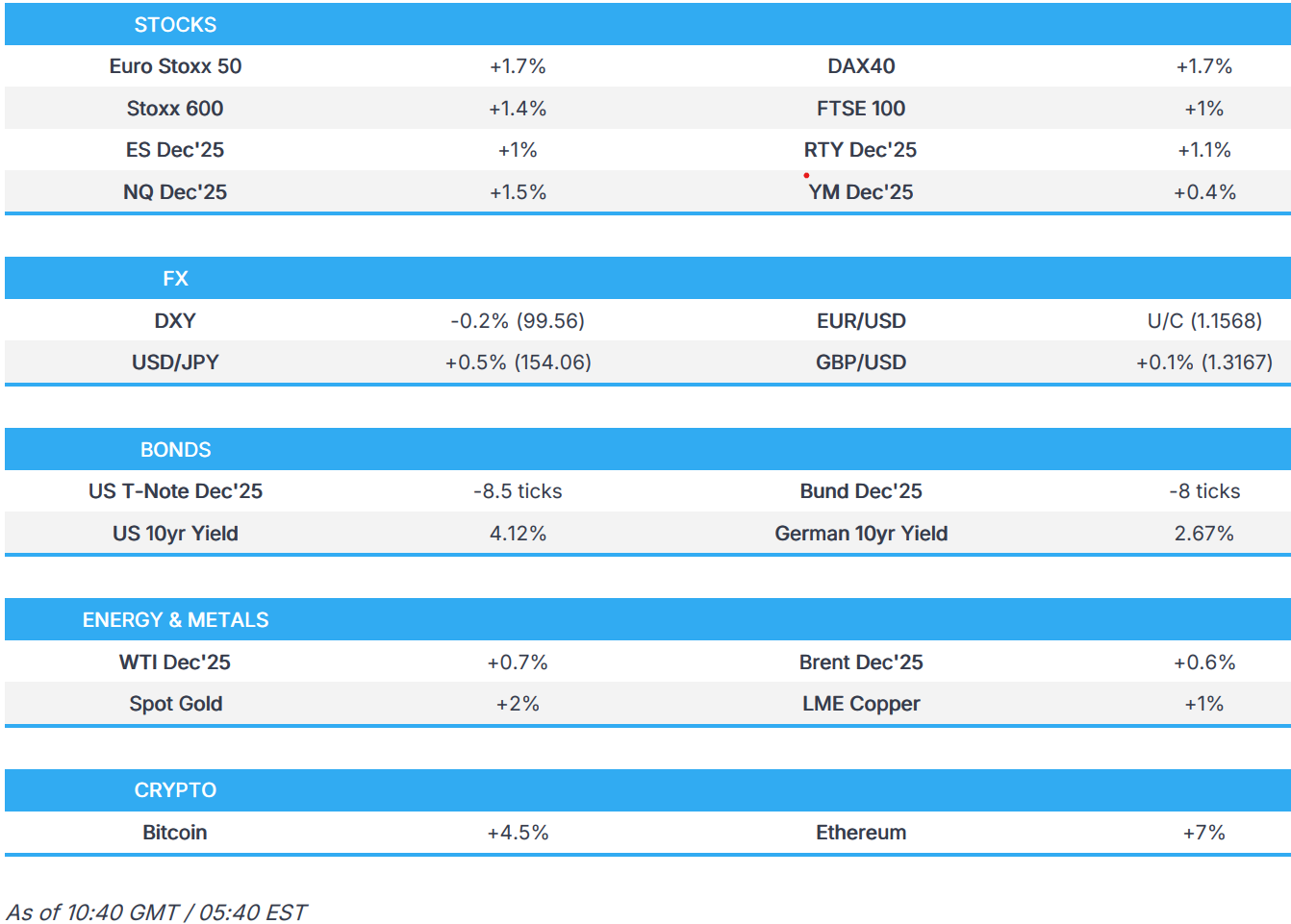

- European and US equity futures are stronger across the board as senators take first steps to ending the US government shutdown; NQ +1.5%.

- USD softer against high-beta FX but higher against havens amid the risk-on mood.

- USTs slip on US Government shutdown related progress, Gilts digest reports of a dividend tax hike.

- Commodities follow the positive sentiment stateside and constructive Chinese inflation figures.

- Looking ahead, highlights include Chinese M2 & New Yuan Loans (Oct), Speech from Fed's Daly, Musalem, Supply from the UK.

</figure>

</figure>TARIFFS/TRADE

- USTR announced the suspension of action in the Section 301 investigation of China's targeting of maritime logistics and shipbuilding sectors for dominance, with the action to be suspended for one year as of 00:01 EST on November 10th, while the USTR said the US will negotiate with China pursuant to Section 301 regarding the issues raised in the investigation.

- FBI Director Patel visited China last week to talk about fentanyl and law enforcement, according to sources cited by Reuters.

- China’s Commerce Ministry said it suspended the 2024 ban on approving exports to the US of dual-use items related to gallium, germanium, antimony, and superhard materials until 27th November 2026.

- China halted special port fees for US vessels for one year and removed sanctions on US-linked units of Hanwha Ocean (042660 KS) for a year.

- China’s Commerce Ministry said China has taken measures to exempt the export of Nexperia chips compliant with civilian use from export controls, and it welcomes the European side to continue to urge the Dutch side to correct ‘wrongful’ practices. Mofcom also said that China hopes the Netherlands will promote the early resolution of the Nexperia semiconductor issue, and that China agreed to a request from the Dutch Economics Ministry to send officials to China for talks.

- EU Trade Commissioner Sefcovic said they welcome confirmation given by China’s MOFCOM on further simplification of export procedures for Nexperia chips to EU and global clients.

- India and Australia held further talks on boosting trade and economic ties, while they reaffirmed a desire for an “early conclusion” of a Comprehensive Economic Cooperation Agreement, according to Bloomberg citing a statement by the Indian government after India’s Commerce Minister Goyal met Australian Trade Minister Farrell.

- China Commerce Ministry said it makes adjustments to management catalogues of drug-related precursor chemicals; will require license for export of certain chemicals to the US, China, Canada and Mexico.

EUROPEAN TRADE

EQUITIES

- European bourses (+1.3%) are stronger across the board, with sentiment boosted amidst progress related to the US Government shutdown. Price action saw indices open on a strong footing and continue to rise as the morning progressed.

- European sectors are almost entirely in the green, with a clear cyclical bias. Tech and Basic Resources leads whilst Optimised Personal Care lags. For Basic Resources specifically, the sector has been lifted by upside across underlying metals prices - upside facilitated by the risk sentiment and better-than-expected Chinese inflation figures over the weekend.

- US equity futures (ES +1%, NQ +1.4%, RTY +1.2%) are entirely in the green, with clear outperformance in the tech-heavy NQ. Overall, sentiment boosted by the shutdown-related progress; on that, eight democrats voted with Republicans to advance a deal which would reopen the government and keep it funded until the end of January. Separately, NVIDIA (+3.5%) benefits from the risk tone and after CEO Huang said that the Co. has very strong demand for Blackwell chips and asked TSMC (2330 TT) for more wafers to meet strong AI demand.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The DXY trades choppily after a rangebound APAC session, showing a mixed tone against major peers as participants digest upbeat US–China trade headlines and optimism over a potential resolution to the US government shutdown. The latter followed reports that eight Democrats backed the Republican spending bill to advance past a key procedural vote. Looking ahead, the data docket is void of any pertinent releases, so focus will be on speeches from Fed's Daly and Musalem. The DXY currently holds within a tight 99.46–99.74 band, comfortably inside Friday’s broader 99.40–99.87 range.

- EUR/USD trades without clear direction around the 1.1550 mark amid a lack of fresh drivers from the Eurozone, while ECB’s Sleijpen warned against rushing into the issuance of joint European bonds, arguing such a move would ultimately burden the bloc with higher debt levels. Regional newsflow was light through the morning, leaving the pair largely at the mercy of broader dollar dynamics. Despite the softer USD backdrop, the euro failed to meaningfully capitalise, with upside momentum likely constrained by sizeable option expiries clustered below and around the 1.1500 handle. EUR/USD currently trades within a 1.1542–1.1583 band.

- USD/JPY climbed at the open as improved sentiment surrounding US–China trade ties and renewed hopes for a US government reopening drove outflows from haven currencies. The JPY stands as the clear laggard among the majors, with moves largely reflecting an unwind of prior risk premia rather than fresh domestic developments. Comments from Japanese PM Takaichi ahead of the European open failed to elicit any notable market reaction. The pair gapped higher from Friday’s 153.41 close, opening at 153.77 before reclaiming the 154 handle. USD/JPY now trades within a 153.40–154.23 range.

- GBP/USD eased slightly overnight from last week’s highs but remained confined to a narrow range around the 1.3150 mark amid a quiet news backdrop. The high-beta currency finds modest support from a softer dollar and improved risk sentiment, though gains are capped as traders exercise caution ahead of the November 26th Budget. The Telegraph reported overnight that UK Chancellor Reeves is preparing to raise the dividend tax rate as part of fiscal tightening efforts. GBP/USD currently trades within a 1.3136–1.3184 range.

- The Antipodeans are the standout gainers amid a broadly constructive risk tone and ongoing USD softness, benefiting from the easing in US–China trade tensions and firmer Chinese inflation data over the weekend. Chinese CPI and PPI figures surprised modestly to the upside, reinforcing optimism around domestic demand stabilisation. AUD outpaced its Kiwi counterpart, aided by strength in gold and copper prices, while NZD’s gains were more measured as AUD/NZD extended its advance beyond the 1.1550 mark.

- China will raise its retail prices of gasoline and diesel from Tuesday, based on recent changes in international oil prices, according to Xinhua.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are underperforming today and currently reside at session lows within a 112-15 to 112-23 range. Downside comes after a week of safe haven-related inflows after a string of poor private labour market figures, downbeat UoM sentiment metrics, AI-bubble related fears and ongoing US government shutdown; the latter has recently shown signs of progress, which has boosted risk sentiment today. In terms of details, the US Government shutdown is showing some early signs of progress after eight democrats voted with Republicans to advance a deal which would reopen the government and keep it funded until the end of January. Price action today has only really been one direction, and that’s downwards; overnight saw the USTs open at 112-23 (highest today) and continue to trundle lower to make a fresh trough of 112-15 in early European hours.

- Bunds are weaker today, albeit to a lesser extent than global peers; currently trading off by around 10 ticks in a 128.80 to 128.96. Gapped below 129.00 at the open, and continued to drip lower overnight and into the European open. However, the German paper then caught a slight bid just after the cash open, which took Bu

Comments

In Channel