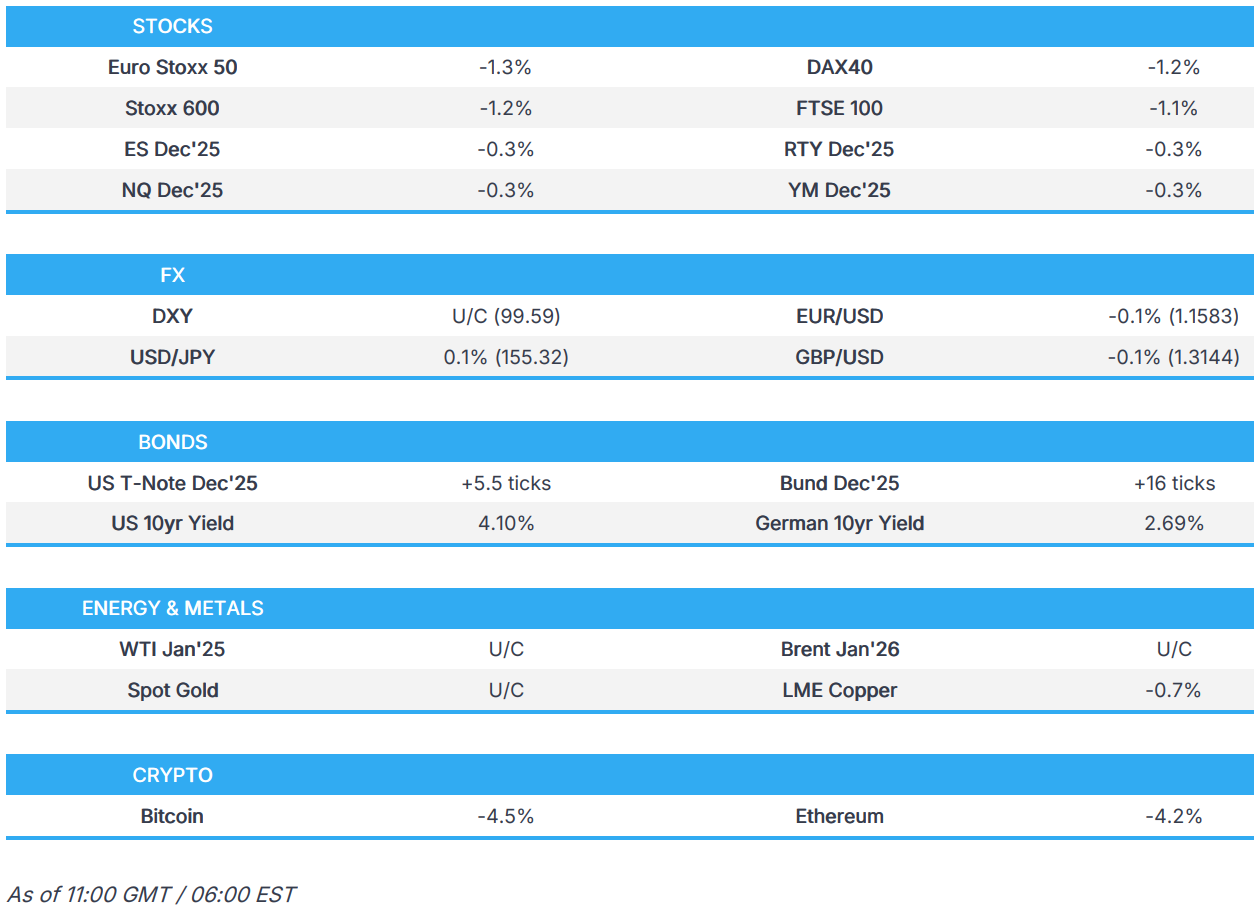

US Market Open: US jobless claims at 232k (w/e 18th Oct); US equity futures lower whilst USD is choppy

Update: 2025-11-18

Description

- US jobless claims at 232k in the October 18th week, via DOL; continuing claims 1.957mln.

- European bourses are entirely in the red, US equity futures are modestly lower.

- USD is choppy amidst early release of weekly jobless claims, JPY digests more verbal intervention.

- Bonds are benefiting from the risk tone, with some modest price action seen on a surprise jobless claims release.

- Crude and Copper continue to be dragged by equity selloff as XAU bounces at USD 4k/oz.

- Looking ahead, US ADP Weekly Estimate, US Factory Orders (Aug), US Durable Goods (Aug), and Japanese Trade Balance. Speakers include BoE’s Pill, Dhingra; Fed’s Barr, Barkin.

</figure>

</figure>TRADE/TARIFFS

- EU Trade Commissioner Sefcovic says the EU plans to introduce restrictions on EU exports of aluminium scrap.

- German Finance Minister on rare earths says Germany must do its homework and diversify supply chains.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -1.3%) opened lower across the board, in a continuation of the downbeat mood seen in Wall St and in APAC trade overnight. Indices found a base in early morning trade, where they have resided throughout the morning so far.

- European sectors are entirely in the red, and hold a clear defensive bias. Healthcare tops the pile, buoyed by strength in Roche (+5.6%), after a positive trial update related to a breast cancer pill. To the downside, Autos, Tech and Basic Resources are all pressured.

- US equity futures (ES -0.2%, NQ -0.2%, RTY -0.2%) are modestly lower across the board, albeit not to the extent seen in Europe. Traders count down their clocks till NVIDIA earnings on Wednesday, but before that markets will have some US data (Durable Goods, Weekly ADP Average Estimate) and a couple of Fed speakers. Earlier, a surprise jobless claims release (w/e 18th Oct) had little impact on contracts.

- EU Commission launches market investigations on cloud computing services under the Digital Markets Act; will determine if Amazon (AMZN) and Microsoft (MSFT) should be designated as gatekeepers for their cloud computing services. Two market investigations will assess whether Amazon and Microsoft should be designated as gatekeepers for their cloud computing services, Amazon Web Services and Microsoft Azure, under the DMA. The third market investigation will assess if the DMA can effectively tackle practices that may limit competitiveness and fairness in the cloud computing sector in the EU.

- Elliott Management has built a large stake in Barrick Mining (B), via FT citing sources; stake makes them a top 10 shareholder.

- Home Depot Inc (HD) Q3 2025 (USD): 3.62 EPS (exp. 3.85), Revenue 41.35bln (exp. 40.98bln).

- Barclays forecasts 2026 year-end target for Stoxx 600 at 620 Sector. Weightings: Mining upgraded to Overweight. Diversified financials upgraded to Overweight. Transportation downgraded to Underweight. Electricals downgraded to Market Weight. Business services downgraded to Underweight. Chemicals downgraded to Market Weight.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is currently choppy and trades within a busy 99.39 to 99.60 range. Initial action saw the index buoyed by the downbeat risk tone, where the USD was pressured by typical haven currencies such as the JPY & CHF whilst the Antipodeans lagged. Thereafter, the risk tone improved a touch and the Dollar dipped to make a session low – a move which also came amidst a surprise US weekly claims release. Do note that the weekly claims release is a delayed report for the w/e Oct 18th; it printed at 232k, whilst continuing claims printed at 1.957mln. Looking ahead, ADP will release its weekly US jobs gauge; last week, it reported that its average weekly estimate was -11,250. US factory orders are expected to have risen by 1.4% M/M in August (prev. -1.3%); durable goods revisions for August are also due today. NAHB's housing market index is seen unchanged at 37 in November. Fed's Barr (voter) and Fed's Barkin (2027 voter) are set to speak, while Fed's Logan (2026 voter) will deliver remarks after the close.

- EUR is currently flat/mildly lower and largely moving at the whim of the Dollar given the lack of pertinent European newsflow. Initially flat vs the Dollar, then caught a bid to make a fresh session high above the 1.1600 mark – before once again reversing. Bid seemingly in the moments preceding the US jobless claims figures. Currently towards lows at 1.1583.

- JPY is also flat vs the USD, but began the European session a little firmer, having benefited from the subdued risk tone seen overnight. That downbeat sentiment has remained this morning, with equities continuing to reside firmly in the red – albeit have stabilised just off worst levels. For Japan specifically, a number of key sticking points; 1) a meeting between BoJ Governor Ueda and PM Takaichi, 2) China-Japan tensions, 3) ongoing verbal intervention.

- GBP is steady vs the USD, but as above, was subject to some two-way action surrounding the US jobless claims data. Currently trading in a 1.3146 to 1.3176 range. Focus for the day will be on commentary from BoE's Pill and Dhingra this afternoon, and then will shift to the UK's inflation report on Wednesday. A dataset which has heightened focused, given BoE Governor Bailey highlighted inflation developments at the most recent confab - he is likely to be the deciding vote ahead in December; markets currently assign a 79% chance of a 25bps reduction at that meeting. More pertinent for the GBP are budget-related updates. Most recently, The Telegraph reported that UK Chancellor Reeves is reportedly considering a last-minute raid on banking profits in the budget. This would be a politically favourable move, but perhaps overshadowed by the growth-related implications of such a move, and boost concerns re. the UK’s investment attractiveness.

- Antipodeans were initially the clear underperformers vs the USD overnight and into the European morning – though as the session progressed, that move has since stabilised. AUD is essentially flat and trades within a 0.6466 to 0.6499 range whilst the Kiwi is marginally firmer and trades within a 0.5639 to 0.5669 range.

- PBoC set USD/CNY mid-point at 7.0856 vs exp. 7.1096 (Prev. 7.0816)

- Click for a detailed summary

FIXED INCOME

- USTs started the day on a firmer footing, buoyed by the risk tone, and have continued to grind higher as the morning progressed. USTs at a 112-19 peak, posting gains of nine ticks at most. Eclipsing Monday’s 112-24+ best but stopping just shy of a cluster from last week between 113-01+ to 113-04+. Upside this morning was also spurred by a surprise release from the Department of Labour, jobless claims at 232k in the October 18th week and continuing at 1.957mln (prev. 1.947mln); no direct comparison to initial, the last release was 219k for the week of September 20th. Notably, the move in US fixed income assets to the release was fairly muted in nature. Potentially a function of participants awaiting more timely series and/or the hard data to begin to be released in the next few days and weeks before reassessing their position in December. Ahead, we get the latest ADP series (not the BLS reference period), a handful of other prints and remarks from Fed’s Barr (voter) and Barkin (2026) on supervision and the economic outlook respectively.

- Bunds are bid, in-fitting with the above. Lifted across the early European morning before seeing a bit of a pullback just after the cash equity open and in proximity to the time of the discussed US jobless claims series. A pullback that was possibly a function of cash equity benchmarks opening slightly better than futures had implied at their worst and/or participants being caught off guard by the DOL release. Since, Bunds have resumed their climb and are towards highs of 128.90 as the European tone remains subdued overall and the fixed income complex generally moves higher.

- Gilts are also moving alongside peers. Currently at the top-end of a 92.41 to 92.60 bound. Specifics for the UK light today, as we count down to Wednesday’s CPI release for confirmation that inflation has peaked and early insight into the December meeting. UK specifics remain focused on the budget, and while there have been a handful of pertinent updates, primarily relating to domestic banking names, nothing has emerged to significantly change the narrative for rates at this point in time.

- UK sells GBP 1.25bln 4.75% 2030 Gilt by tender: b/c 3.75x, average yield 3.89

Comments

In Channel