US Market Open: US equity futures are gaining ahead of Nvidia; Trump could announce the next Fed Chair before Christmas

Update: 2025-11-19

Description

- The Trump administration has been secretly working in consultation with Russia to draft a new plan to end the war in Ukraine, according to Axios sources; Politico reported that US officials are close to unveiling a major new peace agreement with Russia to end the Ukraine conflict.

- The White House confirmed that US President Trump is set to speak at the US-Saudi investment forum on Wednesday at 12:00 EST (17:00 GMT) in Washington.

- US Treasury Secretary Bessent said US President Trump may announce the next Fed Chair before Christmas, via Fox News.

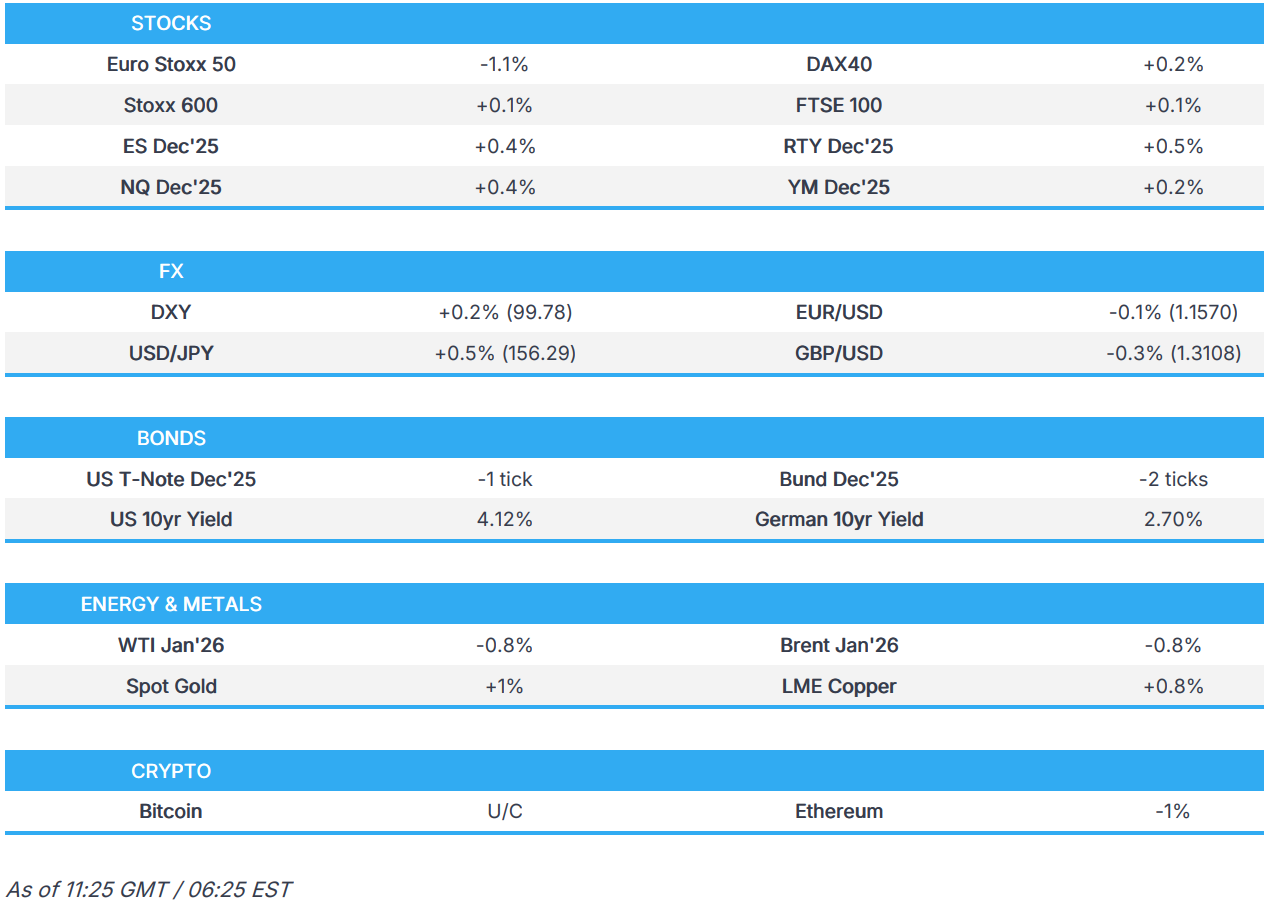

- European bourses are trading on either side of the unchanged mark, whilst US equity futures gain ahead of NVIDIA.

- USD is modestly firmer into FOMC Minutes, USD/JPY rises above 156.00 after Finance Minister Katayama said there were no specific discussions on FX with BoJ Governor Ueda.

- Bonds initially bid by a subdued risk tone, but now hold a downward bias sentiment improves; Gilts briefly boosted by CPI, but then come under marked pressured.

- Crude complex is modestly lower with Zelensky’s delegation in Turkey, XAU returns above USD 4100/oz.

- Looking ahead, US International Trade (Aug), FOMC Minutes, Fed’s Williams, Logan, Barkin, Miran; BoE’s Dhingra, supply from the US. Earnings from NVIDIA.

</figure>

</figure>TRADE

- The White House stated that the US and Saudi Arabia have agreed to increase engagement on trade issues in the coming weeks, with an agreement secured for Saudi Arabia to purchase nearly 300 American tanks. President Trump approved a major defence sale package, including future F-35 deliveries. Key Saudi-US achievements include a civil nuclear cooperation agreement, advancements in critical minerals cooperation, and a landmark AI memorandum of understanding (MOU).

- The White House confirmed that US President Trump is set to speak at the US-Saudi investment forum on Wednesday at 12:00 EST (17:00 GMT) in Washington.

- Dutch government says it has suspended intervention at Nexperia as a show of goodwill, via Reuters citing sources. We are positive about the measures taken by China to ensure supply of chips. Will continue to engage in constructive talks with China.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.1%) are modestly mixed and trade on either side of the unchanged mark, as sentiment attempts to stabilise following recent losses - but ultimately traders remain tentative ahead of FOMC Minutes and NVIDIA earnings.

- European sectors are mixed. At the top of sectors is Media (+1.5%), Energy (+1.0%) and Food and Beverage (+0.5%). At the bottom of sectors is Utilities (-0.9%), Banks (-0.6%), and Insurance (-0.4%), once again newsflow has been light to explain the downtick in those sectors.

- US equity futures (ES +0.3% NQ +0.4% RTY +0.5% ) are modestly higher across the board, attempting to pare back some of the hefty losses seen in the prior session.

- NVIDIA’s earnings are due after the market close, as investors grow wary of soaring AI spending. Investors expect clarity on where billions allocated to AI are flowing, with analysts suggesting that the results could steer wider market sentiment. Analyst forecast Q3 earnings of USD 1.24 per share, and revenue of USD 54.41bln revenue, mostly from Data Centre operations. Orders for Blackwell and Rubin chips are expected to exceed USD 500bln, Susquehanna says. Despite optimism, Michael Burry recently announced he has 1mln puts, while SoftBank (SFTBY) has exited its stake.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

- Click for Market Analysis on the Tech sector

FX

- DXY is a little firmer and trades within a narrow, but fairly busy, 99.49 to 99.79 range. Sentiment continues to remain tentative ahead of the key risk events today (NVIDIA/FOMC Minutes) and into September’s NFP report on Thursday. G10s are currently broadly flat/lower vs the USD, with clear underperformance in the Antipodeans. On the Fed, US Treasury Secretary Bessent said US President Trump may announce the next Fed Chair before Christmas, via Fox News.

- EUR is flat/mildly lower vs USD and trades within a narrow 1.1566 to 1.1597 range, stopping just shy of the round 1.1600 mark; a low for the day which marks a fresh WTD trough, but towards the midpoint of last week’s confines. EZ HICP Final Metrics were left unrevised – no move on the report.

- Overnight, USD/JPY traded choppily within a tight range, with the yen showing modest strength as risk sentiment in Japan and South Korea deteriorated. Into the morning, the JPY scaled back that strength to trade modestly lower vs the USD, ahead of a meeting between BoJ Governor Ueda and Japanese Finance Minister Katayama. To put this meeting in some context, Japan’s bond yields hit multiyear highs overnight on fears a roughly JPY 17tln stimulus package under PM Takaichi will strain already weak public finances. She provided some post-meeting remarks, where she highlighted that the meeting focused on maintaining a close BoJ-Government coordination, with the largest bout of pressure for the JPY seen following remarks that there was “no specific discussion on FX”. This broke the Yen out of its overnight range to make a fresh session high above the 156.00 mark - a changing target right now, but high for today 156.29 at time of writing.

- GBP is lower today, in the aftermath of the region’s UK inflation report. Delving into the data, headline CPI Y/Y and M/M printed in-line with expectations, and cooled a touch from the prior whilst Services was cooler-than-expected. Governor Bailey, who cast the tie-breaking vote last time around, made clear in the statement & press conference that, in terms of the next cut, the BoE generally but Bailey in particular, is highly inflation contingent. As such, the as-expected moderation will push Bailey towards a December cut; however, it is too soon to say for sure, given the uptick in food inflation and the stickiness of various components. Additionally, we await next week's budget and then the November inflation print just before the December announcement for further insight.

- Antipodeans trade lower overnight, amidst the subdued risk tone – price action which has continued to play out into the European session. The Kiwi sits at the foot of the G10 pile, closely joined by the Aussie; NZD/USD is currently at the bottom end of a 0.5622 to 0.5661 range.

- PBoC set USD/CNY mid-point at 7.0872 vs exp. 7.1121 (Prev. 7.0856)

- Click for a detailed summary

FIXED INCOME

- Gilts opened firmer by a handful of ticks before lifting to a 92.46 peak with gains of 13 at most. Upside spurred given the modest bullish bias in peers early doors and, more pertinently, after the morning's CPI release confirmed that UK inflation peaked across the late Summer. A release that factors in favour of the dovish contingent of the BoE.

- However, the stickiness of several components and uncertainty into the Budget and November inflation report mean that a definitive call for a December cut cannot be made just yet. Explaining the minimal magnitude of the Gilt move, its subsequent paring and why market pricing didn't deviate significantly/lastingly from a c. 80% chance of a cut. Downside was exacerbated after supply, where another sub-3x b/c spurred modest pressure to losses of c. 15 ticks, before slipping further to within reach of 50 of downside ticks at most. Supply aside, no clear fresh driver behind the move, aside from the uptick in the general risk tone (European equities moving a little higher).

- Bunds began on the front foot, and got to gains of eight ticks at most at a 128.79 peak. Thereafter, the complex saw a modest pullback and fell into the red with downside of just over five ticks at most. Specifics for the space light thus far and the docket ahead is devoid of Tier 1 events. As such, we look to US drivers for direction.

- USTs were contained ahead of several key US events, but slipped to troughs alongside a pickup in sentiment and underperformance in Gilts; supply, minutes, speakers and potentially most pertinently NVIDIA earnings all due. For the minutes, we look for insight into how the FOMC aligns itself to the hawkish tone taken by Powell in the press conference; ahead of that, markets ascribe a c. 40% chance of a December cut. Into this, USTs hover around the unchan

Comments

In Channel