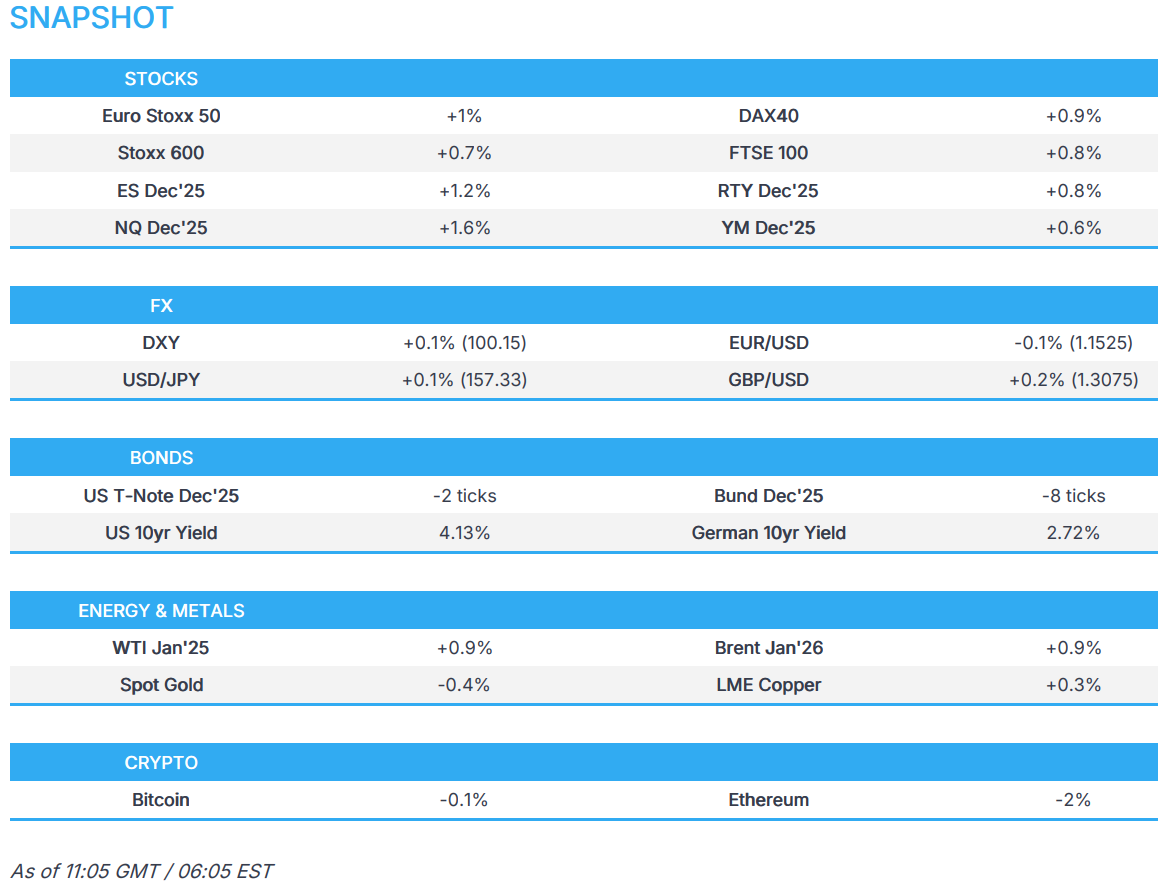

US Market Open: US equity futures stronger post NVIDIA earnings; Crude also higher after Kremlin said no peace talks with the US

Update: 2025-11-20

Description

- China is reportedly mulling new property stimulus measures, including mortgage subsidies, according to Bloomberg sources.

- European and US equity futures are stronger across the board, with sentiment boosted after strong NVIDIA results and as CEO Huang shrugged off “AI bubble” woes.

- DXY is firmer into the September NFP report, JPY unreactive to further jawboning.

- WTI and Brent edge higher, with some strength seen after Russia’s Kremlin said no peace talks with the US are taking place; XAU dips a touch.

- JGBs lag with stimulus in focus, USTs bearish as the data fog continues.

- Looking ahead, Highlights include, EZ Consumer Confidence Flash (Nov), US NFP (Sep), US Jobless Claims (w/e 15 Nov), New Zealand Trade Balance (Oct), Australian Flash PMIs (Nov), Japanese Nationwide CPI (Oct), SARB Policy Announcement, Fed’s Cook, Barr, Hammack, Paulson, Miran, Goolsbee; BoE’s Dhingra, Mann. Supply from the US. Earnings from Gap and Walmart.

</figure>

</figure>TRADE/TARIFFS

- US lawmakers are reportedly considering a new bill to codify China AI chip export curbs, according to Bloomberg sources; the White House has reportedly asked Congress to reject the bill curbing NVIDIA (NVDA) exports.

- US Commerce Department plans to approve export of 70,000 advanced AI chips to UAE and Saudi Arabia, according to WSJ sources; Export deal includes approval for NVIDIA's (NVDA) GB300 or equivalent chips.

- China’s October rare earth magnet exports to the US rose 56.1% from September, according to customs data.

- European Commission will, on Monday, present a list of sectors it wishes to be exempt from US tariffs to US Commerce Secretary Lutnick and USTR Greer, via Politico citing sources; includes medical devices, wines, spirits, beers & pasta

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.7%) opened entirely in the green, with sentiment boosted following strong earnings from NVIDIA (see below). Price action today has been fairly sideways at elevated levels as markets await US NFP later.

- European sectors hold a strong positive bias. It is no surprise that Tech is at the top of the pile, in tandem with pre-market gains in NVIDIA (+5%). The likes of ASML (+1.4%) and Infineon (+1.5%) both move higher.

- US equity futures (ES +1.2% NQ +1.5% RTY +0.7%) are stronger across the board, with very clear outperformance in the Tech-heavy NQ, following NVIDIA results. In brief, the Co. reported stronger-than-expected revenue and upbeat sales guidance eased investor worries about heavy AI spending. NVIDIA saw data centre sales rise 66% driven by Blackwell and GB300 demand; it noted that cloud GPUs are sold out, strong gaming, visualisation, robotics growth, though limited China sales.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

NVIDIA Commentary Highlights:

- CEO on AI bubble: CEO Huang says there has been a lot of talk about an AI bubble but "we see something different."

- CFO on China: Will continue to cooperate on China. Sizeable purchase orders for H20 AI chip never materialised in the quarter due to geopolitical issues and the increasingly competitive market in China. Not expecting data-centre-compute revenue from China in Q4.

- CEO Comments: NVIDIA has done a really good job in terms of planning and supply chains. NVIDIA will continue to do stock buybacks. More successful this year vs last year.

- CFO Comments: Still in early innings. Reiterates visibility into USD 500bn Blackwell and Rubin revenue. Cloud services are sold out. Demand continues to exceed expectations.

FX

- DXY is a little firmer today and currently trading towards the upper end of a 100.10 to 100.32 range. From a technical standpoint, the index topped its 200 DMA at 99.91 in the prior session and has continued to rise to a multi-month high – levels not seen since late-May’25. Upside today facilitated by a hawkish leaning FOMC Minutes, and the BLS announcing that the October and November NFP reports will be till December 16th - notably leaving the Fed with only today's (Sept) NFP report. As it stands money markets currently price in a near-25% chance of a cut at the December meeting.

- EUR is a little weaker vs the Dollar, and as has been the case in recent weeks, a real lack of European specific data to help guide the Single-Currency in any direction. As such, much of the price action has been dictated by the Dollar side of the pair, and will ultimately await the NFP report today. Worth highlighting German Producer Prices data which printed more-or-less in-line, and ultimately had limited impact on the pair.

- USD/JPY has continued its ascent beyond the 157.00 mark in overnight trade, to top the 157.50 mark and make a fresh session high of 157.77. Worth noting that the pair has been subject to moves on both sides, with USD gaining amidst a hawkish repricing into the December meeting, whilst JPY has had domestic factors to digest. Overnight, Katayama was back on the wires where she once again attempted some verbal intervention, but to no effect – the pair continued to edge higher. As the European morning progressed, the pair has cooled from best levels, to currently trade at 157.20, but still very much at the upper end of Wednesday’s confines.

- A quiet session for the GBP this morning, with little fresh newsflow from a Budget perspective. Cable currently resides in a 1.3039 to 1.3076 range. The GBP has been subject to some selling pressure over the course of the past month, with losses totalling roughly 3% - this comes amidst Budget related jitters as Chancellor Reeves chops and changes her thoughts on the best approach. Moreover, the recent political uncertainty within the Labour party has added to the risk premium. Scheduled speakers today include Dhingra and Mann.

- Antipodeans trade mixed, with the Kiwi benefiting from the risk-tone whilst the Aussie is flat and essentially conforms to the subdued risk tone in China overnight, hit by their status in the AI race post-NVIDIA; moreover, base metals are generally softer across the board. For China specifically, no major move was seen on reports that China is reportedly mulling new property stimulus. AUD/USD trades within a 0.6472 to 0.6491 range whilst NZD/USD trades in a 0.5596 to 0.5614 confine.

- PBoC set USD/CNY mid-point at 7.0905 vs exp. 7.1201 (Prev. 7.0872)

- Click for JPY Analysis

- Click for a detailed summary

FIXED INCOME

- JGBs are pressured overnight as Japanese yields continue to climb. JGBs themselves to a 134.56 trough, marking a new contract low. As such, the 10yr yield has risen to a 1.85% peak, taking us back to levels from early 2008. Action that has been driven by ongoing speculation and reporting around the upcoming stimulus. The latest reporting suggests an outlay of around JPY 17tln, far exceeding the JPY 13.9tln figure from the last package. Updates that have pressured JGBs given an expectation for it to necessitate greater issuance than the JPY 6.7tln figure outlined last time.

- USTs are under pressure, but only modestly so. Downside comes given the upbeat risk tone after NVIDIA numbers (see Equities). Additionally, the latest FOMC minutes showed a somewhat divided board but the undertones were hawkish. Potentially more pertinently, the BLS has confirmed the October payrolls release will not print in full (no unemployment rate) while the November series has been delayed until after the December meeting. Factors that are both hawkish/bearish. As the lack of data visibility gives the Fed theoretical scope to wait-and-see how the economy is faring before easing further; reminder, in October, Powell remarked, “when there is fog, you could slow down”. Given all this, USTs are in the red and down to a 112-18 base. Support comes into play at 112-17 from Tuesday before Monday’s 112-15+ WTD low.

- Bunds are softer, following the risk tone lower and posting downside of just under 20 ticks at most. Holding around a 128.48 low, if the move continues, we look to 128.25 from early October before the figure and then touted support at 127.88. Specifics for the bloc are somewhat light thus far. No move to ECB’s Makhlouf this morning, remarks that chimed with the market view that the ECB is at a terminal. Interestingly, Makhlouf said he does not think the new projections are likely to change; a remark in reference to the December forecast

Comments

In Channel