With Tariffs Still Unsettled, Deregulation Should Be Trump’s Next Target

Description

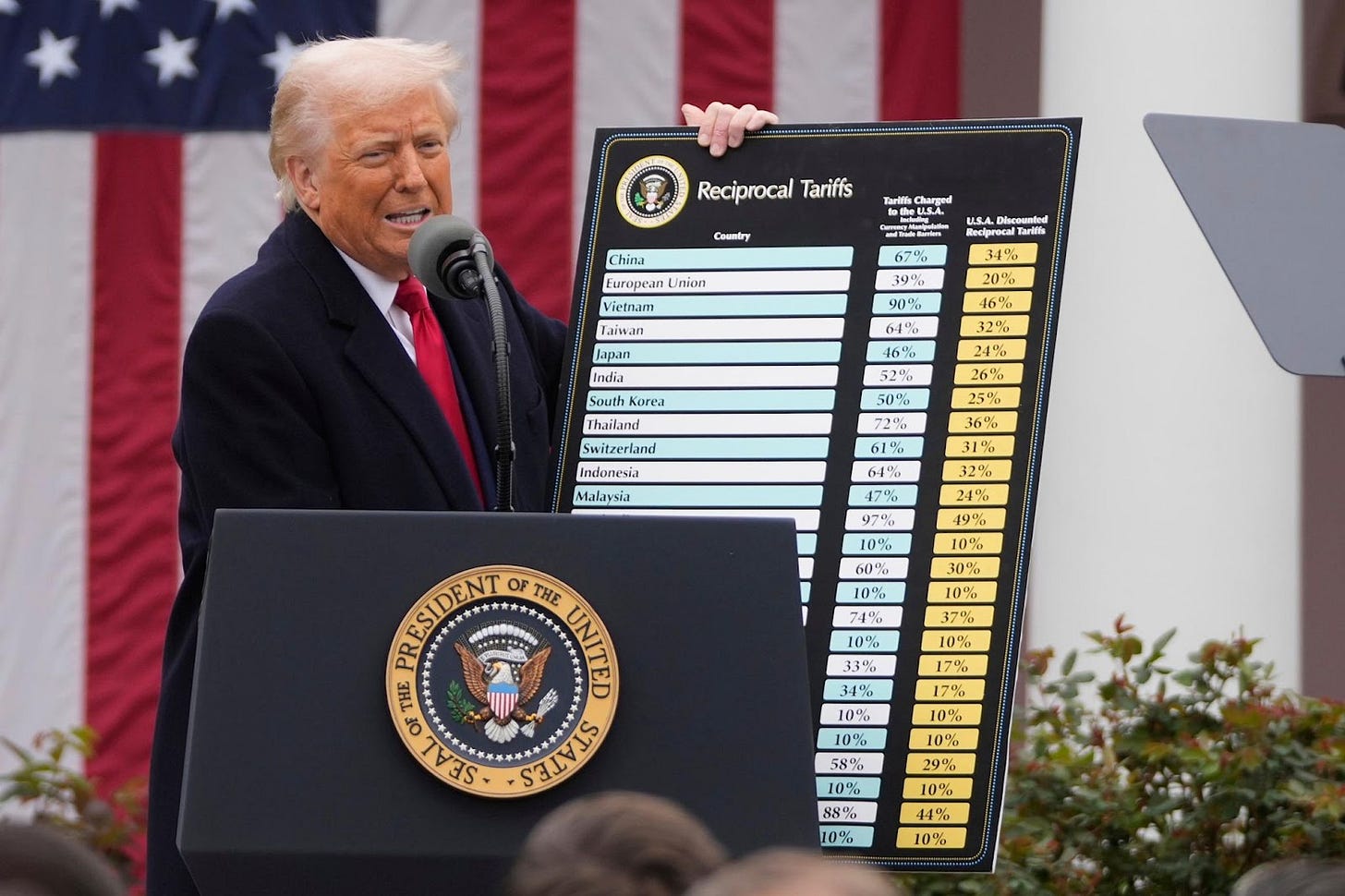

The markets were dealt a bit of a surprise this week when the U.S. Court of International Trade blocked President Trump from imposing his sweeping reciprocal tariffs under the 1977 International Emergency Economic Powers Act only for an appeals court to reverse the ruling 24 hours later.

What that means for tariffs is up in the air, but we know that the current stay is only temporary and the Trump administration has until June 9th to file the necessary paperwork in order to proceed with next steps.

The Lead-Lag Report is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Leaving the politics of the situation out of it, if the Trump tariffs were to be blocked indefinitely, it would mark a sharp reversal in his economic policy plans. Going back to his first term, he’s long favored using tariffs as a means of leverage for getting what he wants. It gets framed as a way of generating money for the United States. This is technically true since the tariffs collected go to the U.S. Treasury, although those tariffs are paid by U.S. importers. If his tariffs do remain blocked indefinitely, it could reframe the economic outlook moving forward.

There were some interesting market reactions and insinuations that could be taken away from this:

U.S. Stocks Barely Moved

In isolation, you’d think that a sudden halt in the Trump tariffs, the one thing that has consistently moved the market for the past two months and longer, would be warmly welcomed by the market. U.S. stock prices moved higher right out of the gate, but then pulled back to relatively unchanged. Even following news of the stay that would put tariffs temporarily back on, the S&P 500 and Nasdaq 100 finished the day with only minor gains. Even the VIX barely moved, which suggests that the market largely took the developments in stride.

This suggests that easing trade tensions and an unlikelihood that the more punitive tariffs would stick were already largely priced into the market. But the reversal also didn’t generate much of a reaction. Maybe the market is tired of this. Maybe it thinks there’s no point in reacting because things are probably going to change again soon anyway. Either way, it’s a significant departure from the earlier market reactions to trade war developments, which saw U.S. stocks typically move several percent in either direction.

An indefinite pause on tariffs, however, could reframe the U.S. economic outlook a little differently. If reciprocal tariffs end up getting pulled off the table and the markets remain flat, it means there’s probably little upside left from reduced trade tensions. On the other hand, if Trump finds another way or form to re-introduce tariffs or gets the order thrown out permanently, the markets could move sharply lower. On a purely trade war point of view, risk/reward is tilted to the downside.

Treasury Yields Rose & Then Retreated

The initial reaction of the 10-year Treasury yield rising posed an interesting thought experiment. Reduced tariffs should be disinflationary, so why were long bond yields still rising?

</picture>

</picture>