Deploy! Unlocking America's Energy and Economic Potential with Jigar Shah

Description

Today's episode is a special recording of my live interview on September 6th in Austin with Jigar Shah, Director of the Department of Energy’s Loan Programs Office (LPO). Previous to LPO, Jigar founded SunEdison and served as president of Generate Capital. He also wrote a book called “Climate Wealth: Unlocking the Impact Economy,” and many of the book’s themes come up in this interview. Jigar also previously hosted the Energy Gang Podcast, which I learned a lot from, and recommend to folks to this day.

I loved this conversation with one of the leading thinkers and doers for the past several decades. We talked about the work of the LPO, the surge in manufacturing in the United States, the Inflation Reduction Act, load growth, virtual power plants, batteries, EVs, geothermal, nuclear, hydrogen, and even more. It was a packed hour.

This podcast was recorded live at the 2024 Texas Tribune Festival - Texas’ breakout politics and policy event held in downtown Austin. For recaps from this year's recently concluded event and to stay updated on next year's program, visit TribFest.org.

I hope you enjoy the episode. Timestamps, show notes, and the transcript are below. Please don’t forget to like, share, subscribe, and leave a five-star review wherever you get your podcasts.

Timestamps

1:49 About Jigar and Loan Programs Office (LPO)

5:27 - The Inflation Reduction Act as industrial policy; national security benefits of onshoring the energy industry

9:01 - Load growth

17:33 - Virtual Power Plants, batteries, and EVs

28:57 - State of nuclear energy

35:28 - State of geothermal energy

37:47 - Potential for LPO programs in Texas

45:16 - Exporting American energy technologies and the potential for further economic growth

46:43 - State of vehicle-to-grid and vehicle-to-home technologies

49:34 - State of hydrogen

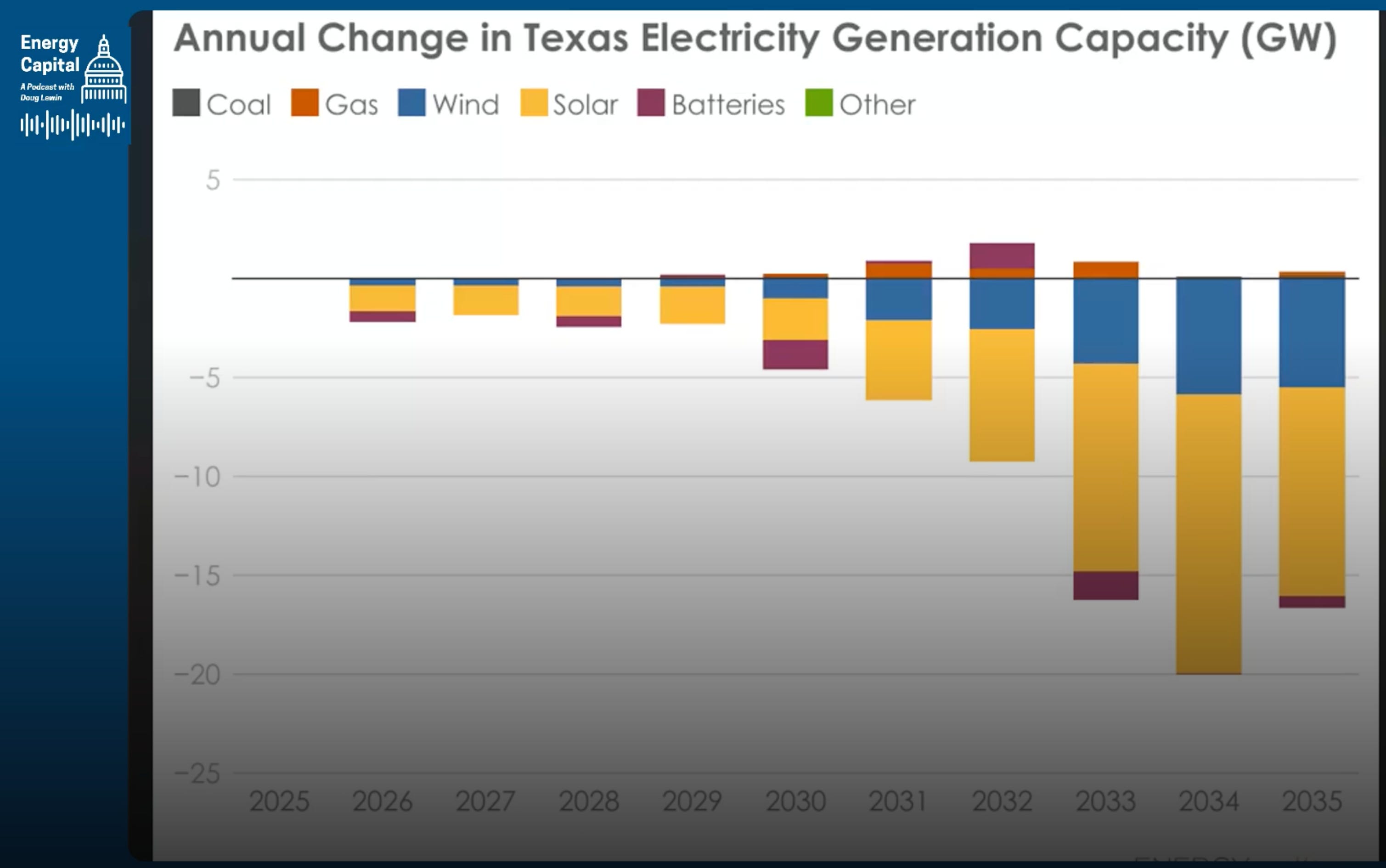

51:40 - ERCOT interconnection queue

55:33 - What will happen to DOE and EPA programs under a new presidential administration?

58:45 - Deploy24

Show Notes

Department of Energy Loan Programs Office

Pathways to Commercial Liftoff Reports

Creating Climate Wealth: Unlocking the Impact Economy by Jigar Shah

Transcript

Doug Lewin

Good to see you all. My name is Doug Lewin. I'm the host of the Energy Capital podcast. We are recording this for the Energy Capital podcast. The first time on the Energy Capital pod, we've done a live recording. So very excited for this and particularly thrilled that for the first time for a live recording, my guest is Jigar Shah.

I think probably everybody who's here knows who he is, but let me just give just a quick introduction as to who Jigar is. In case you don't know, he's the Director of the Loan Programs Office at the Department of Energy. He was the founder of SunEdison, president of Generate Capital. He also wrote a book called “Climate Wealth: Unlocking the Impact Economy”, and we'll talk a little bit about that theme. For years and years, Jigar hosted the Energy Gang, and I think those episodes actually hold up super well. I learned a lot, just listening to that podcast was kind of like an education for me, and I think many, many thousands of other people. So Jigar really is just a huge part of the clean energy economy, and in this role now, at the Loan Program Office (LPO), Jigar has a tremendous opportunity and has been using that opportunity over the last couple years to really accelerate the clean energy economy.

So Jigar, if you want to add anything to that by way of introduction, and then maybe let the folks both in the room and for the podcast know just briefly a little history of LPO, and I think most importantly why it matters.

Jigar Shah

Well, first of all, thank you for having me on, and thanks to the Texas Tribune for putting on this fantastic event. I always meet just fascinating people here, so thank you for that.

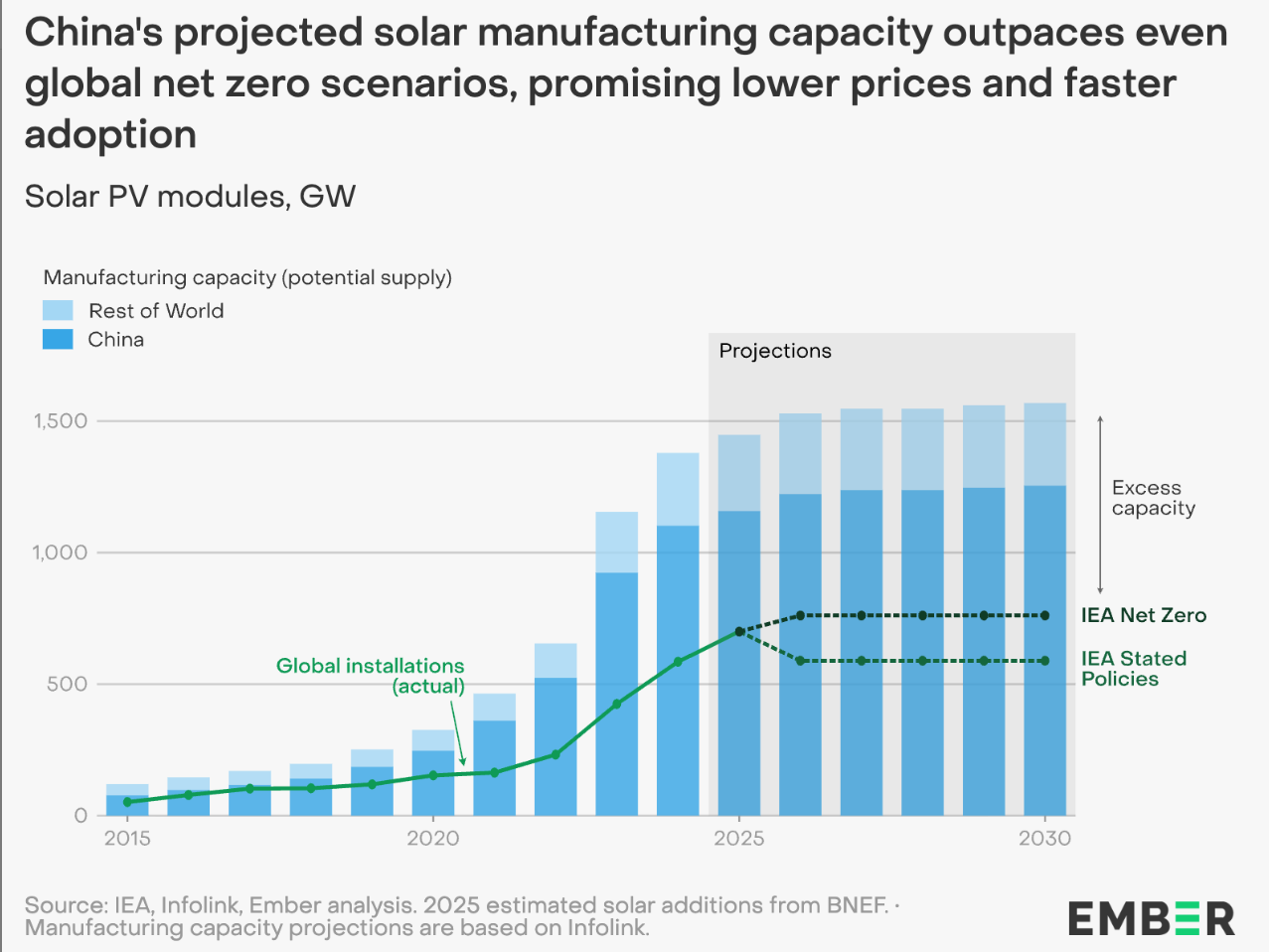

Look, I think that we in the United States have always been amazing at innovation, right? I mean, DOE is roughly 45 years old. We've got 10,000 engineers, scientists, and experts at work at the national laboratories around the country. And so whether it's solar panels or modern wind turbines or advanced nuclear designs, enhanced geothermal, hydraulic fracturing, all of that stuff really came out of the research mission of the US Department of Energy. And then it sort of happened that the capital markets of the United States just wasn't interested in commercializing much of that. And so a lot of those technologies went overseas to get commercialized, and now we're importing a lot of those technologies back into the country, having someone else make it.

So the Loan Programs Office was conceived of in 2005 in the 2005 Energy Act. And the goal of it initially was to help build nuclear plants in the United States. In 2007, we had an additional mandate around helping with fossil technologies and renewable energy technologies. And from 2009 to 2011, it was super busy and did about $35 billion worth of loans at that moment. I'd say it went dormant after that. And I think when the Secretary came into the Department of Energy, she and President Biden really wanted to bring back the Loan Programs Office. They asked me to join, and it was the right place at the right time. And today we've got almost $300 billion worth of loan applications into the Loan Programs Office. And it's roughly at 50% debt equity, so it's probably $600 billion worth of projects. And so people in America have never been so energized to do big things again in our country, and it's great to see.

Doug Lewin

It really is great to see, particularly because – and this is something I think, is not – sometimes is lost on the Inflation Reduction Act and the increase for a Loan Program Office, but also for a lot of other programs. You were on Dave Roberts' great podcast, Volts, talking about nuclear. Anybody interested in nuclear – I know a lot of people are interested in nuclear these days – should be listening to – you should listen to that podcast. What Dave Roberts said, I don't think he said it on that podcast, but he said it somewhere else and I really like it, is that the Inflation Reduction Act is really sort of industrial policy masquerading as climate policy. That the point of the Inflation Reduction Act. Yes, there's a lot in there about clean energy and about decarbonization, but it's also about reshoring manufacturing and actually bringing that back. And that has been one of the huge wins we've seen over the last couple years, right, is the increase in manufacturing. Can you talk about that piece, the competitiveness, actually building a stronger supply chain here, right? We saw after COVID, the weakness of the supply chain and all the problems that caused, and having a lot of sort of critical materials, manufacturing everything from chips, and obviously the CHIPS Act is really important too, to solar panels being manufactured somewhere else makes us vulnerable. The inverse is true. Having it manufactured here makes us stronger. Can you talk about that piece a little bit?

Jigar Shah

Yeah, I mean, I think you've covered a lot of the elements of it. I think, you know, in 2009, there was an attempt to pass climate legislation called Waxman and Markey. That climate legislation was really putting a price on carbon. I think that, you know, because of everyone's experience during COVID. But also I think there was a broader narrative that was started around America wanting to build things in our country. My sense is that it's actually industrial strategy that everyone knew they were voting for industrial strategy. And the climate thing is sort of like a branding exercise.

I mean, I think when you think about all the Senators that voted for that piece of legislation, there's a lot of them in there that are not necessarily climate focused, but are industrial strategy focused. I think, as you suggested on COVID and supply chains, I mean, when you think about what we're trying to do in the United States, where over 75% of everything we've added to the grid every year since roughly 2016 has been clean, right? Has been solar, wind, hydro, geothermal, nuclear. If all of those component parts were imported from China, you could imagine there being less interest from the American public to continue to invest in the energy transition, right?

I mean, you know, I think that, to me, I don't know that you have to, guess too far, to see what the intention of many of the legislature, of the House and Senate members were when they passed this. I think that when you're thinking about something as essential as energy and the energy transition, we want a lot of our batteries to be made here, our critical minerals to come from a diverse set of sources. And I don't think it means that we're not going to do business with China. I think China is still a very large trading partner of the United States. But I think that we're saying in the same way that we managed OPEC. And we didn't want a certain set of countries