Europe Market Open: Sentiment boosted amidst US gov't shutdown end looms; European equity futures higher after Friday losses

Update: 2025-11-10

Description

- APAC stocks traded higher amid the improving US-China trade environment and with hopes of ending the US government shutdown as several Democrats supported Republicans to pass a measure through the procedural vote in a rare Senate session on Sunday.

- US Senate voted 60 vs 40 to advance the government funding bill through the procedural hurdle, moving it closer towards passage, after 8 Democrats supported the measure in a rare Sunday session.

- Chinese inflation data over the weekend which printed above forecasts, although factory gate prices remained in deflation.

- NVIDIA (NVDA) CEO said they have very strong demand in Blackwell chips and asked TSMC (2330 TT) for more wafers to meet strong AI demand.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 1.4% after the cash market closed with losses of 0.8% on Friday.

- Looking ahead, highlights include Norwegian CPI (Oct), EZ Sentix (Nov), Chinese M2 & New Yuan Loans (Oct), Speech from BoE’s Lombardelli, Supply from the UK, Earnings from Hannover Re, CoreWeave & Barrick Mining.

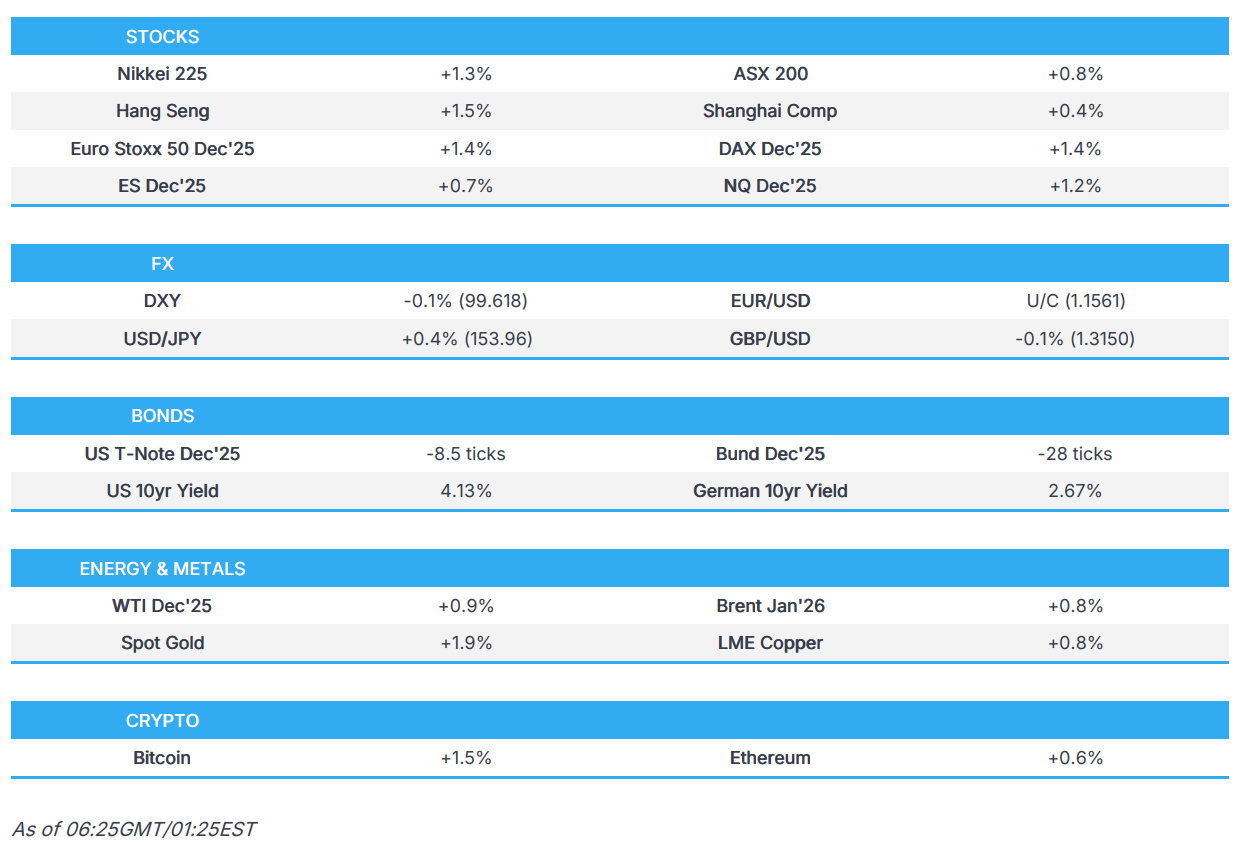

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks were choppy on Friday with an initial risk-off tone amid ongoing concerns over AI valuations and following more weak data with the UoM Survey painting a bleak picture of consumer sentiment amid the government shutdown.

- Stocks then hit lows just after Europe left for the day before the downside gradually started to pare, with a lift seen in late trade on the Democrats offering a compromise by proposing a one-year extension of Obamacare subsidies to end the government shutdown. However, Republicans swiftly rejected this, although stocks stayed near highs into the closing bell.

- SPX +0.06% at 6,725, NDX -0.28% at 25,060, DJI +0.16% at 46,987, RUT +0.54% at 2,432.

- Click here for a detailed summary.

TARIFFS/TRADE

- USTR announced the suspension of action in the Section 301 investigation of China's targeting of maritime logistics and shipbuilding sectors for dominance, with the action to be suspended for one year as of 00:01 EST on November 10th, while the USTR said the US will negotiate with China pursuant to Section 301 regarding the issues raised in the investigation.

- FBI Director Patel visited China last week to talk about fentanyl and law enforcement, according to sources cited by Reuters.

- China’s Commerce Ministry said it suspended the 2024 ban on approving exports to the US of dual-use items related to gallium, germanium, antimony, and superhard materials until 27th November 2026.

- China halted special port fees for US vessels for one year and removed sanctions on US-linked units of Hanwha Ocean (042660 KS) for a year.

- China’s Commerce Ministry said China has taken measures to exempt the export of Nexperia chips compliant with civilian use from export controls, and it welcomes the European side to continue to urge the Dutch side to correct ‘wrongful’ practices. Mofcom also said that China hopes the Netherlands will promote the early resolution of the Nexperia semiconductor issue, and that China agreed to a request from the Dutch Economics Ministry to send officials to China for talks.

- EU Trade Commissioner Sefcovic said they welcome confirmation given by China’s MOFCOM on further simplification of export procedures for Nexperia chips to EU and global clients.

- India and Australia held further talks on boosting trade and economic ties, while they reaffirmed a desire for an “early conclusion” of a Comprehensive Economic Cooperation Agreement, according to Bloomberg citing a statement by the Indian government after India’s Commerce Minister Goyal met Australian Trade Minister Farrell.

NOTABLE HEADLINES

- US Senate voted 60 vs 40 to advance the government funding bill through the procedural hurdle, moving it closer towards passage, after 8 Democrats supported the measure in a rare Sunday session.

- US Treasury Secretary Bessent said the impact of the government shutdown on the economy is getting worse and worse, while he also stated that they are making substantial progress on inflation and expect prices to come down over the coming months. Bessent also commented that President Trump’s suggestion that Americans may receive a tariff “dividend” of at least USD 2,000 could come via the tax cuts passed in his signature economic policy bill earlier this year.

- White House Economic Adviser Hassett said US GDP could be negative in Q4 if the government shutdown drags on.

- US Supreme Court allowed the Trump administration to withhold billions in funding for food aid for now. It was separately reported that the Trump admin ordered US states to stop paying full food aid benefits to low-income American families and said that they are "unauthorised".

- Fed survey on Friday noted that policy uncertainty, including trade policy, central bank independence and availability of economic data, was the most frequently cited risk to US financial stability, while AI was added as a top stability concern, and respondents also cited geopolitical risks, inflation, monetary tightening, and higher long-term rates as top salient risks.

- Fed’s Williams (voter) said the gap between rich and poor risks a US downturn and suggested that poorer Americans’ mounting problems could be a factor in whether the central bank cuts rates in December, while he sees a balancing act for the December rate meeting, according to FT.

- Fed’s Miran (voter) said on Friday that widespread use of stablecoins could argue for lower Fed rates and would likely lower the neutral rate, while it could increase the risk of hitting the zero lower bound.

- US President Trump called for Senate Republicans to send government money given to health insurance companies and send it directly to the people.

- Boeing (BA) spokesperson said they recommended to the three operators of the MD-11 freighter that they suspend flight operations, while UPS (UPS) and FedEx (FDX) spokespersons said they made the decision to immediately ground their MD-11 fleets following the Louisville crash.

- NVIDIA (NVDA) CEO said they have very strong demand in Blackwell chips and asked TSMC (2330 TT) for more wafers to meet strong AI demand, while he stated that business is growing strongly and there will be a shortage of different things, as well as noted said Samsung (005930 KS), SK Hynix (000660 KS), and Micron (MU) have scaled up capacity.

APAC TRADE

EQUITIES

- APAC stocks traded higher amid the improving US-China trade environment and with hopes of ending the US government shutdown as several Democrats supported Republicans to pass a measure through the procedural vote in a rare Senate session on Sunday.

- ASX 200 gained with the upside led by the mining and tech sectors, while financials also showed resilience despite ANZ positing a decline in fiscal 2025 cash profit.

- Nikkei 225 rallied amid a weaker currency and as participants digested earnings, while it was also reported that Japan's GPIF posted July-September quarterly investment return of JPY 14.45tln.

- Hang Seng and Shanghai Comp ultimately conformed to the upbeat mood amid the improving US-China trade environment, as both the US and China relaxed trade restrictions on each other, while there was also inflation data over the weekend which printed above forecasts, although factory gate prices remained in deflation.

- US equity futures steadily gained amid hopes of ending the US government shutdown.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 1.4% after the cash market closed with losses of 0.8% on Friday.

FX

- DXY was rangebound with a mixed performance against its major counterparts as participants reflected on the positive US-China trade-related headlines and amid hopes to end the US government shutdown with 8 Democrats voting to support the Republican spending measure to advance through the procedural hurdle.

- EUR/USD was indecisive around the 1.1550 level with little catalysts from the bloc, while ECB’s Sleijpen cautioned against hurriedly approving joint European bonds, which he said would ultimately result in higher debt.

- GBP/USD marginally pulled back from last week's peak but with price action confined to within tight parameters near the 1.3150 level amid a lack of pertinent drivers.

- USD/JPY advanced at the open as optimism related to the US-China trade and US government reopening hopes, sp

Comments

In Channel