Europe Market Open: Trump doesn't think tariff rollback is necessary; European equity futures uneventful

Update: 2025-11-17

Description

- US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be done by Thanksgiving, according to Fox News.

- US President Trump said he does not think more tariff rollbacks will be necessary; he said top US officials spoke with their Chinese counterparts on Friday and that he is speaking to China about soybeans, according to Reuters.

- Apple (AAPL) has intensified succession planning for CEO Tim Cook and is preparing for him to step down as soon as next year, according to the FT.

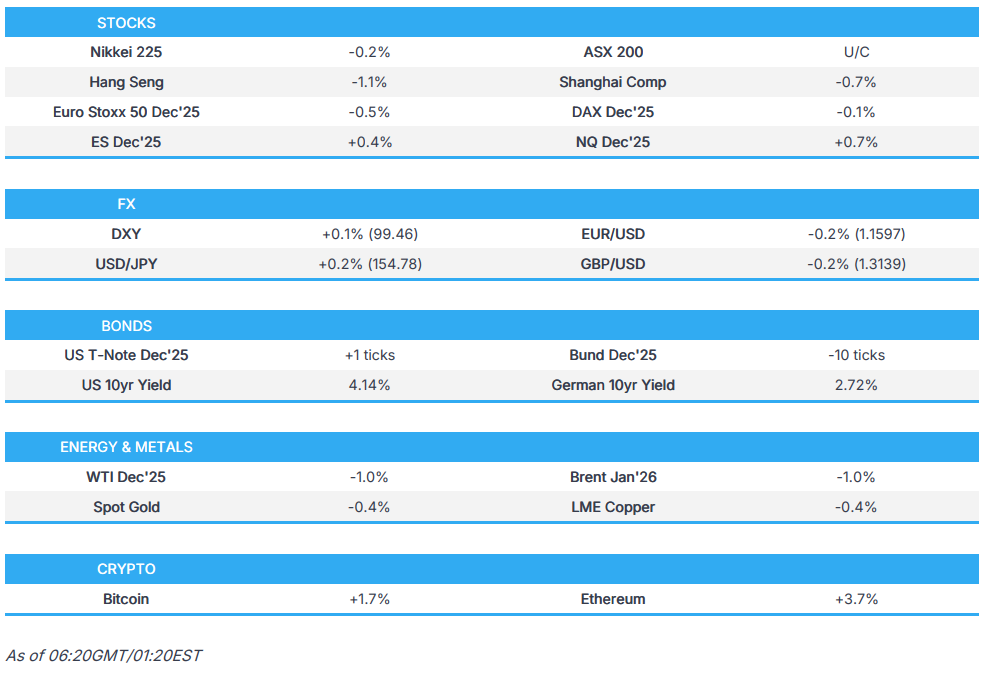

- APAC stocks traded mostly lower after the mixed lead from Wall Street; European equity futures are indicative of an uneventful open with Euro Stoxx 50 future U/C after cash closed -0.9% on Friday.

- Bitcoin briefly erased all 2025 gains, falling to near USD 93k as crypto markets suffered over the weekend.

- Looking ahead, highlights include US NY Fed Manufacturing, Canadian CPI. Speakers include Fed’s Williams, Jefferson, Kashkari, Waller; ECB’s Lane, Villeroy, de Guindos, Cipollone; BoE’s Mann; BoC’s Kozicki

- Click for the Newsquawk Week Ahead.

</figure>

</figure>US TRADE

EQUITIES

- US stocks were pressured, downside attributed to further AI valuation concerns. However, US indices managed to pare the majority of its losses with SPX and NDX closing flat, while RUT outperformed, but DJI and RSP (S&P 500 Equal Weight ETF) lagged. Sectors were predominantly lower, with outperformance seen in Energy, Tech and Real Estate.

- SPX -0.05% at 6,734, NDX +0.06% at 25,008, DJI -0.65% at 47,147, RUT +0.22% at 2,388.

- Click here for a detailed summary.

US DATA UPDATE

- The US BLS announced that September employment data (NFP) will be released on November 20th, 2025, with September real earnings due on November 21st.

- The US Census Bureau said it will release the August International Trade report on November 19th, while August construction spending will be released on November 17th and August manufacturers’ orders on November 18th

- The BEA will also release August US International Trade in Goods and Services on November 19th.

NOTABLE US HEADLINES

- Fed’s Logan (2026 voter) said she supported the September rate cut but would have preferred to hold steady in October; she added that for the December meeting it would be hard to support another cut and she would need to see convincing evidence of inflation coming down or the labour market worsening, while noting it is not appropriate to deliver more pre-emptive insurance to the labour market via a rate cut, according to Reuters.

- Fed’s Bostic (2027 voter) said that on both mandates, the economy is not moving in the direction of targets, adding that he wants information to guide the appropriate policy and hopes a lot of data will come in ahead of the December meeting; he noted he was able to get behind the two most recent cuts.

- Fed Governor Miran (dove) said the data supports rate cuts and should make the Fed more dovish, not less; he again argued that shelter inflation points to weakening price changes, noted that wage gains have moderated, and said it is a mistake to let the job market get softer. He emphasised that monetary policy should be forward-looking and that it would be very appropriate to cut interest rates in December, according to Reuters.

- Fed's Williams (Voter) convened a meeting with banks over a key lending facility, according to the FT.

- Trump administration officials, including Health Secretary Robert F. Kennedy Jr., discussed scaling back the role of FDA Commissioner Marty Makary; RFK Jr. also considered installing a new leader to manage the agency day to day, according to the WSJ.

- US President Trump posted that House Republicans should vote to release the Epstein files, via Truth Social.

NOTABLE US EQUITY HEADLINES

- Apple (AAPL) has intensified succession planning for CEO Tim Cook and is preparing for him to step down as soon as next year, with John Ternus, Apple’s Senior Vice President of Hardware Engineering, widely seen as his most likely successor, according to the FT.

- Google (GOOGL) is to invest USD 40bln in new data centres in Texas, according to Reuters.

TRADE/TARIFFS

- US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be done by Thanksgiving, according to Fox News. Treasury Secretary Bessent said he is confident China will honour the agreement after the upcoming meeting between Presidents Trump and Xi, and emphasised that Washington has “many levers” if Beijing does not comply.

- US President Trump said he does not think more tariff rollbacks will be necessary; he said top US officials spoke with their Chinese counterparts on Friday and that he is speaking to China about soybeans, according to Reuters.

- US Treasury Secretary Bessent said US President Trump’s proposal to send USD 2,000 “dividend” payments from tariffs to US citizens would require congressional approval, according to Reuters.

- The White House released a framework agreed between the US and Switzerland, noting that under the President’s leadership billions of dollars of investment by major Swiss companies such as Roche (ROG SW), Novartis (NOVN SW), ABB (ABBN SW) and Stadler (SRAIL SW) have already been announced, with more on the way; Swiss and Liechtenstein companies will invest at least USD 200bln into the US, including USD 67bln in 2026. The trading partners will pay a cumulative reciprocal tariff rate of no higher than 15%, matching the European Union’s treatment. Switzerland and Liechtenstein intend to remove a range of tariffs across agricultural and industrial sectors — including various fresh and dried nuts, fish and seafood, certain fruits, chemicals and spirits such as whiskey and rum — while Switzerland will also establish tariff-rate quotas for American poultry, beef and bison; both countries also plan to address non-tariff barriers that have long prevented US goods from entering their markets.

- USTR Greer said the US is very close to securing trade deals with other Western countries, according to Reuters.

- The White House is modifying the scope of reciprocal tariffs with respect to certain agricultural products and said the change will be effective for goods entered for consumption, or withdrawn from a warehouse for consumption, on or after 00:01 ET on 13th November 2025, according to Reuters.

- Tesla (TSLA) is now reportedly requiring its suppliers to exclude China-made components in the manufacturing of its cars in the US, a fresh example of the fallout from Washington–Beijing tensions, according to the WSJ.

- Brazil’s Vice President Alckmin said Brazil will continue working to reduce US tariffs further; he noted that progress has been made but there is still a long way to go, expressed optimism about further progress, and said the US government has taken a step in the right direction to reduce costs for its consumers, according to Reuters.

- USTR Greer has warned the EU that trade remains a “flashpoint” with Washington, according to the FT.

APAC TRADE

EQUITIES

- APAC stocks traded mostly lower after the mixed lead from Wall Street, with sentiment in the region subdued as US President Trump over the weekend said he does not think further tariff rollbacks will be necessary. The Nikkei 225 saw modest losses on either side of 50k, while South Korea’s KOSPI (+1.5%) stood out as a clear outperformer amid strong gains in chip names after reports that Samsung is raising chip prices, whilst China's tourist warning to Japan was seen as a positive for South Korea. Focus remains on the tech sector this week in the run-up to NVIDIA earnings midweek.

- ASX 200 was subdued with sectors mixed. Telecoms, Healthcare, and Consumer Discretionary lagged, while IT and Energy outperformed.

- Nikkei 225 was choppy and briefly slipped under 50k following Japan’s GDP contraction — the first in six quarters, albeit shallower than feared. Rising tensions between Japan and China added pressure, with Japanese travel-related names hit after Beijing warned citizens against travelling to and studying in Japan.

- KOSPI was the outperformer, driven by gains in Samsung Electronics and SK Hynix after reports that Samsung raised server memory chip contract prices by up to 60% in November due to shortages - the former also plans to add a new chip production line as demand rises. Broader gains were also supported by China’s warning against travel to Japan.

- Hang Seng and Shanghai Comp both traded with modest losses, broadly in line with regional moves (ex-South Korea). Over the weekend, US Treasury Secretary Bessent said the

Comments

In Channel