Europe Market Open: Trump softens China stance, S&P downgrades France and European futures rebound after Friday's loss

Update: 2025-10-20

Description

- APAC stocks were higher amid tailwinds from recent trade-related rhetoric, including US President Trump's comments on Friday that 100% tariffs are not sustainable and that he will be meeting with Chinese President Xi.

- Nikkei 225 surged to a fresh all-time high above the 49,000 level amid a reignition of the Takaichi trade with the LDP leader on track to become Japan's first female PM following an agreement to form a coalition with Japan's Innovation Party.

- In China, PBoC maintained LPRs as expected, whilst Chinese GDP, Industrial Production and Retail Sales either matched or topped forecasts, and the CPC Central Committee is also holding a four-day closed-door meeting through to Thursday.

- US President Trump said on Friday that they are getting along with China, and it looks like the meeting with China will go forward, while he could move the November 1st deadline up if he wanted. Trump added that they will make a deal that will be good for both countries and thinks they will be in a strong position in trade talks with China.

- Israel’s Channel 12 reported that Israel was attacking Gaza, while the Israeli military said Hamas carried out multiple attacks against Israeli forces beyond the ‘yellow line’, violating the ceasefire; both sides later said they will adhere to the ceasefire once again.

- S&P lowered France to 'A+' from 'AA-'; Outlook Stable, while it cited heightened risks to budgetary consolidation; European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.8% after the cash market finished with losses of 0.8% on Friday.

- Looking ahead, highlights include German Producer Prices (Sep), Canadian Producer Prices (Sep), US Leading Index (Sep), New Zealand Trade (Sep), CCP 4th Plenum (20th-23rd), Speakers including ECB’s Schnabel & RBA’s Jones, Supply from EU & Italy, Earnings from Sandvik, Zions Bancorp & Cleveland Cliffs.

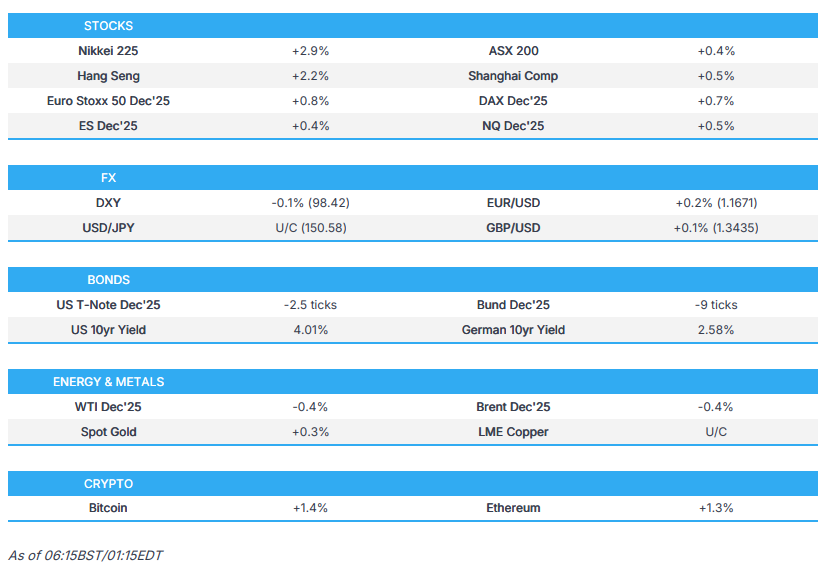

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks were predominantly bid on Friday, in which the SPX, NDX and DJI all posted gains, although the RUT saw further pressure. Nonetheless, the regional banking ETF had pared some of the prior day's losses following woes at ZION and WAL, as bank earnings were strong and helped with the reversal in sentiment, while US commentary on China was also supportive of the risk-on trade, as President Trump responded "no" when asked if he thinks the high tariffs on China will stay, and noted they get along well with China and that he will be meeting Chinese President Xi in two weeks.

- SPX +0.53% at 6,664, NDX +0.65% at 24,818, DJI +0.52% at 46,191, RUT -0.60% at 2,452.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said he wants China to buy soybeans at least in the amount they were buying before, and he believes that China will make a deal on soybeans, while he added that they can lower what China has to pay in tariffs, but China has to do things for them too and they do not want China to play a rare earth game with them.

- US President Trump signed a proclamation on Friday to address the threat to national security from imports of medium and heavy-duty vehicles, parts and buses, while an official had announced that Trump is to impose 25% tariffs on heavy-duty trucks effective November 1st and will impose 10% tariffs on imported buses, as well as provide significant tariff relief for automakers’ US production.

- US President Trump said on Friday that they are getting along with China, and it looks like the meeting with China will go forward, while he could move the November 1st deadline up if he wanted. Trump added that they will make a deal that will be good for both countries and thinks they will be in a strong position in trade talks with China.

- US President Trump’s administration is reportedly quietly watering down some tariffs and has exempted more products from US tariffs in recent weeks, while it offered to exempt hundreds of more goods from farm products when countries strike deals with the US, according to WSJ.

- US Treasury Secretary Bessent and Chinese Vice Premier He Lifeng engaged in candid, in-depth and constructive discussions regarding trade and will meet in person in the week ahead to continue their discussions.

- Dutch Economy Minister Karremans said the Nexperia intervention was needed due to the former CEO’s actions, and he will speak with a Chinese government official about Nexperia within days. Furthermore, he said China and Europe both have an interest in solving problems around Nexperia, and commented that China has the wrong impression that the Netherlands and the US ‘teamed up’ on Nexperia.

- South Korea sees a higher chance of a trade deal with the US by the APEC summit.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said on Friday that he could support a path with another cut if more risks to the jobs market emerge and inflation is contained, while he sees limited space before rate cuts would make policy accommodative. Musalem said the Fed should not be on a preset course and that it is important for the Fed to be cautious right now, as well as noted that it is premature to say what comes with FOMC meetings after October.

- US said on Friday that about 1,400 workers will be furloughed at the Nuclear Weapons Security Agency as of Monday due to the government shutdown.

- NVIDIA (NVIDIA) and TSMC (2330 TT) unveiled the first completed US-made wafers that will eventually become Blackwell chips, and which are said to be the single most important chips now being produced in America, according to Axios.

- Microsoft (MSFT) leaders are reportedly worried that meeting OpenAI's rapidly expanding computing demand could lead to overbuilding servers that might not generate a financial return, according to The Information. It was separately reported on Friday that new analysis of download trends and daily active users provided by Apptopia showed that ChatGPT’s mobile app growth may have hit its peak as estimates indicate that new user growth, measured by percentage changes in new global downloads, slowed after April, according to TechCrunch.

APAC TRADE

EQUITIES

- APAC stocks were higher amid tailwinds from recent trade-related rhetoric including US President Trump's comments on Friday that 100% tariffs are not sustainable and that he will be meeting with Chinese President Xi, while it was also reported that US Treasury Secretary Bessent and Chinese Vice Premier He engaged in candid, in-depth and constructive discussions regarding trade and will meet in person in the week ahead to continue their discussions.

- ASX 200 marginally gained amid strength in tech and industrials, although the index notably lagged behind regional peers amid weakness in the commodity-related sectors.

- Nikkei 225 surged to a fresh all-time high above the 49,000 level amid a reignition of the Takaichi trade with the LDP leader on track to become Japan's first female PM following an agreement to form a coalition with Japan's Innovation Party.

- Hang Seng and Shanghai Comp joined in on the positive mood with the Hong Kong benchmark led higher by strength in tech, and as participants digested the latest Chinese data releases, including GDP, Industrial Production and Retail Sales which either matched or topped forecasts, while the CPC Central Committee is also holding a four-day closed-door meeting through to Thursday to discuss the five-year development plan.

- US equity futures kept afloat following last Friday's positive momentum and amid some tariff-related optimism.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.8% after the cash market finished with losses of 0.8% on Friday.

FX

- DXY traded rangebound with mild losses seen amid the mostly risk-on mood to start the week and following the recent softer tone from US President Trump on China after he noted on Friday that 100% tariffs are unsustainable and that he will be meeting with Chinese President Xi in two weeks. Apart from the trade-related headlines, there were few fresh catalysts from the US, with the Fed on a blackout period and with no end yet in sight regarding the government shutdown.

- EUR/USD bounced off Friday's trough but remained beneath the 1.1700 handle with gains capped as recent comments from ECB officials provided little to spur prices, and after S&P lowered France's sovereign credit rating to 'A+' from 'AA-'.

- GBP/USD eked out marginal gains amid mild strength in cyclical currencies, although the upside was limited after BoE Governor

Comments

In Channel