It's Going to Happen First in Texas with Nat Bullard (Part 2)

Description

This is part 2 of my conversation with Nat Bullard. Check out Part 1 here:

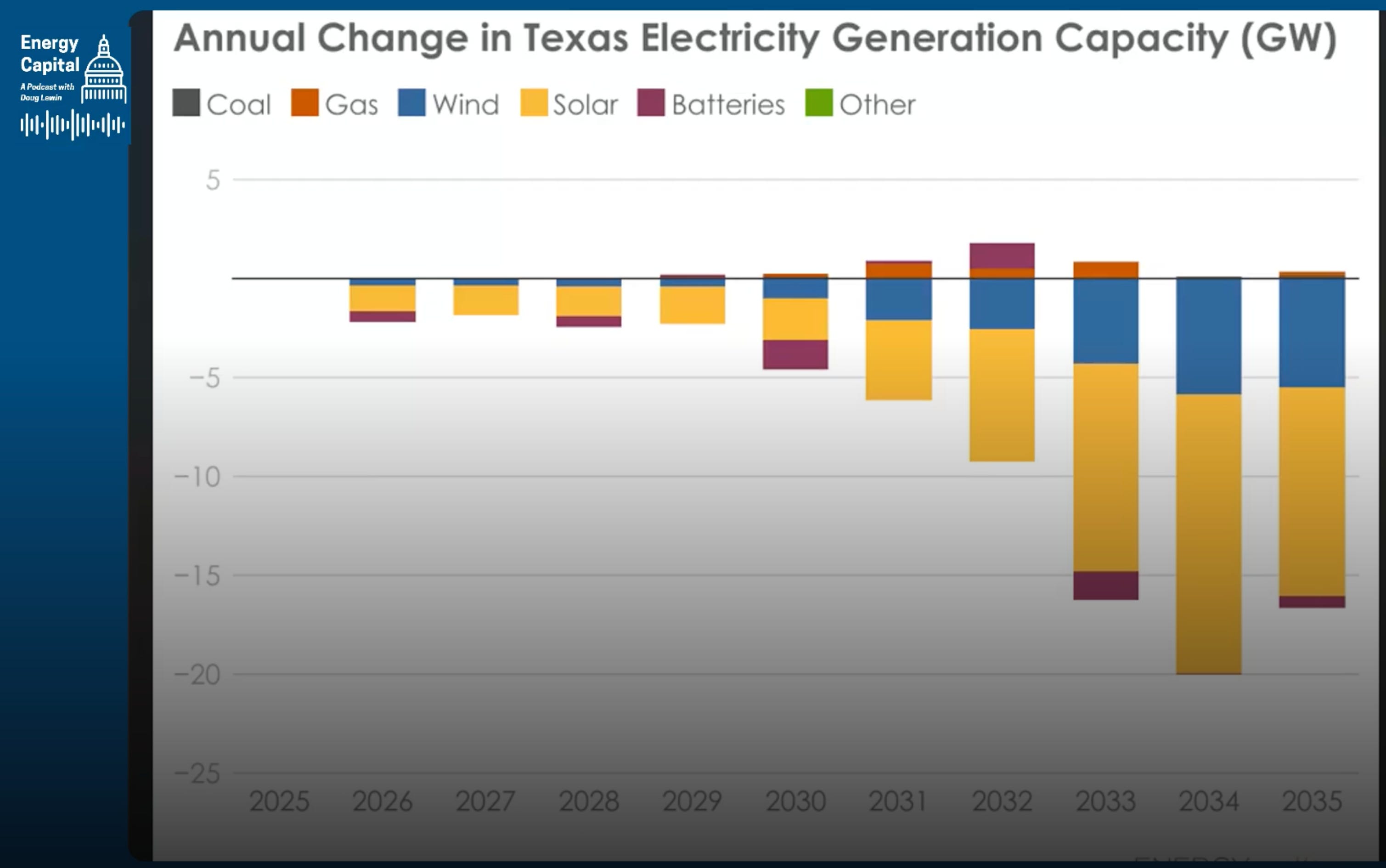

We talk a lot about the grid of the future. The truth is, that future is already showing up in Texas.

Batteries are being built at record pace, data centers are chasing cheap and reliable power, and Texans are adding gigawatts worth of backup systems in homes, schools, and factories.

I sat down with energy analyst Nat Bullard to ask a simple question: if we look at what is actually being built — not the rhetorical arguments happening online, but what is actually happening around the world — where are energy systems headed?

We started with a comparison of batteries and gas peakers. Batteries respond in milliseconds, don’t rely on fuel deliveries during a freeze, and can make money all day providing grid services between scarcity events. Increasingly, duration is less of an issue as prices fall.

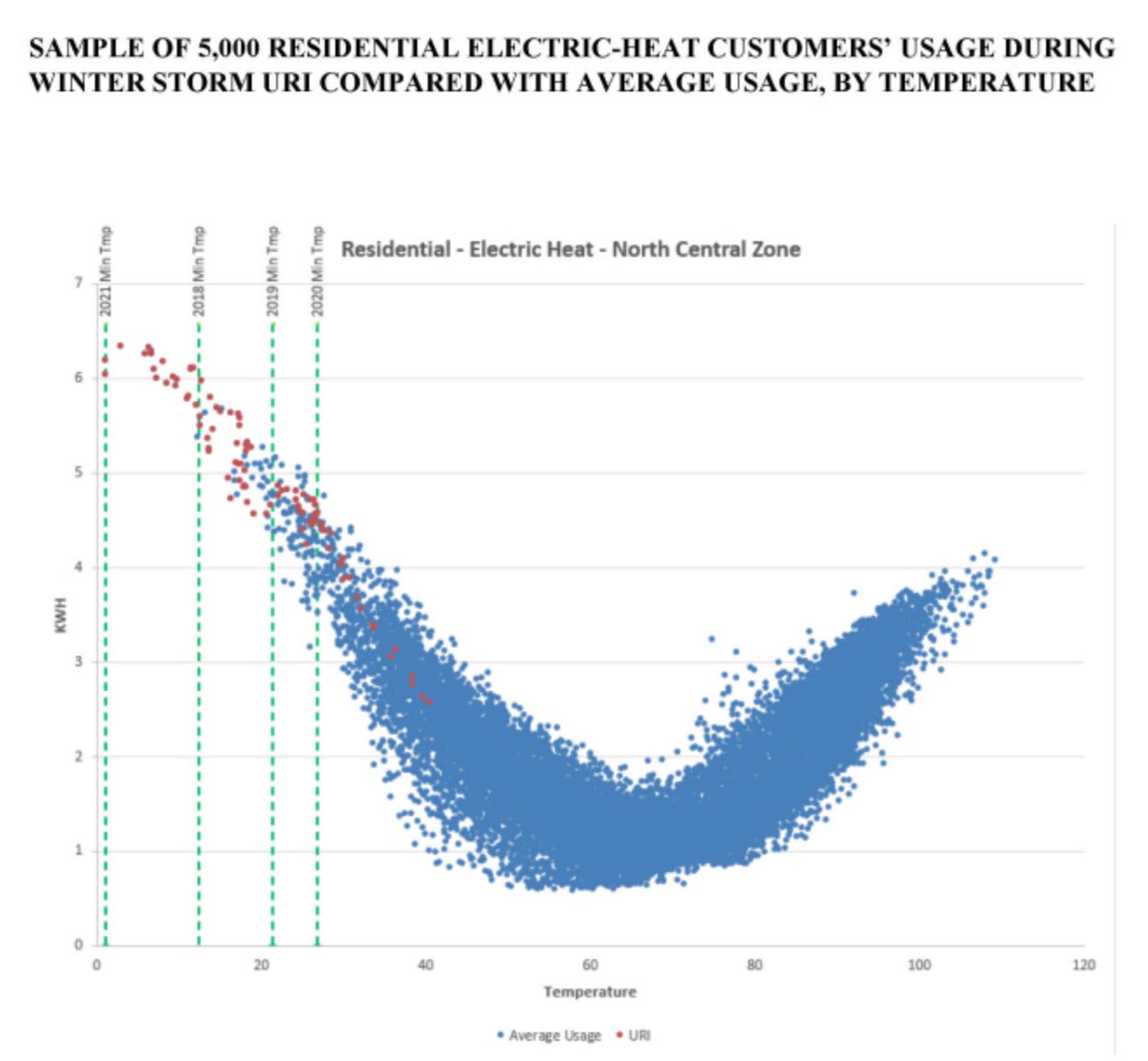

As Nat reminded us, during Winter Storm Uri it was “largely things in the thermal fleet” that failed. Winterizing batteries is likely much less onerous and complicated than winterizing gas plants.

Behind-the-meter systems are also booming. One- to ten-megawatt batteries can turn schools or factories into mini-resilience hubs. If Texas keeps adding storage at this pace, we could end up with the equivalent of dozens of peaker plants—only more responsive and decentralized.

Nat concluded with a description of his family as a mix of, a ground source heat heat pump, a mini split, and a Franklin stove. A small hybrid system built to ride out different conditions.

That is a good picture of where ERCOT is headed: a mix of gas and batteries, large wires and local resources, data centers and smart devices. The question is whether we design structures to speed up that hybrid grid on purpose or stumble along and end up there eventually anyway. The first path costs a lot less.

The more we learn from what’s actually happening — the focus of Nat’s excellent annual decarbonization presentation — the more cost effective our decisions will be for Texas.

Timestamps:

* 00:00 – Introduction

* 01:30 – Price and attributes of batteries compared to gas peakers

* 03:45 – The optimal generation stack; a portfolio approach

* 07:00 – “Ruthlessly practical” developers

* 09:00 – Distributed batteries and community resilience

* 12:00 – Australia’s rapid installation of distributed storage

* 15:00 – Texas Energy Fund’s viability

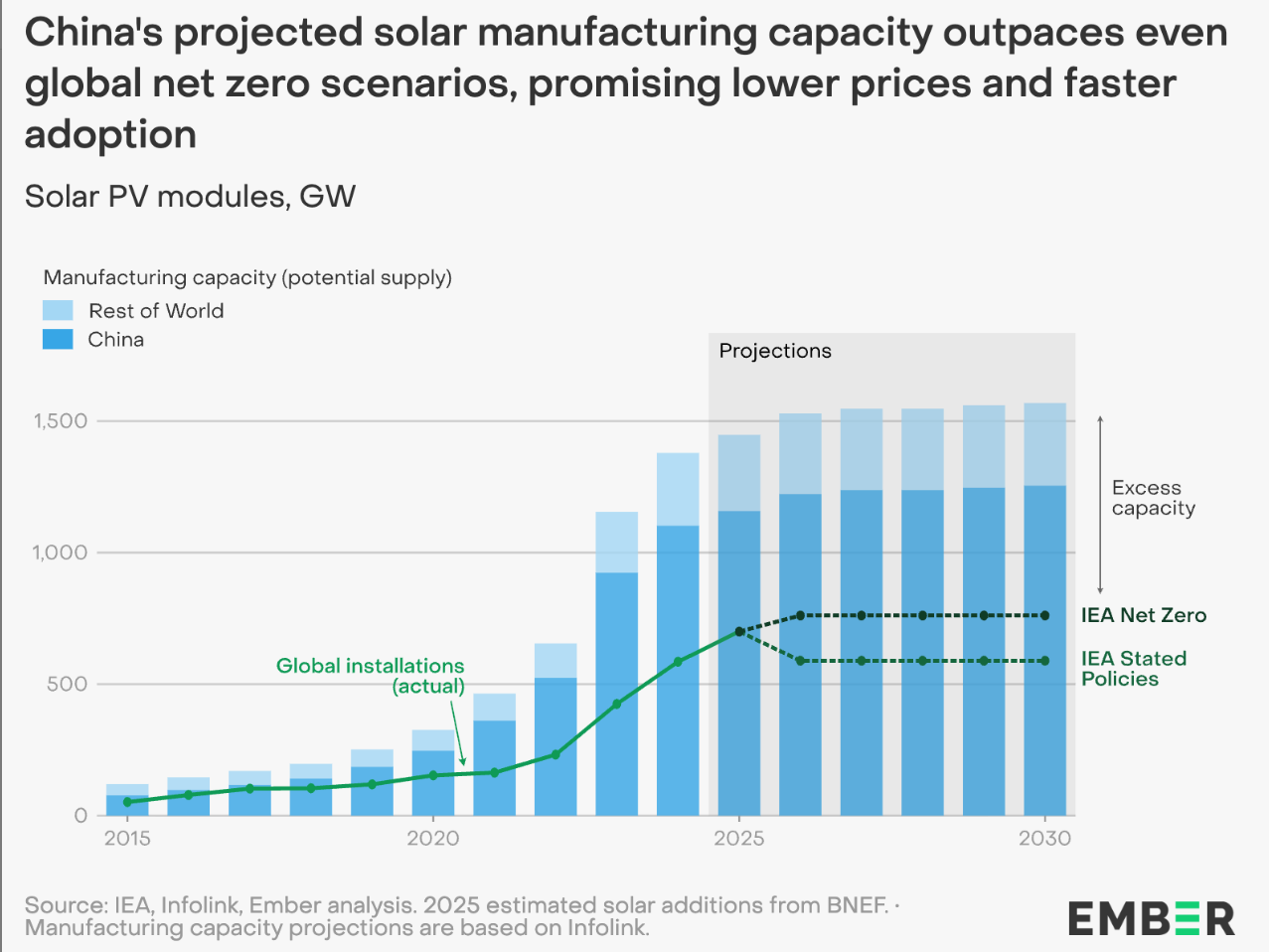

* 16:30 – Global solar scale and trends

* 21:00 – Electrifying countries without electricity

* 23:00 – The absurdity of arguments against distributed energy

* 25:00 – Automated flexible demand; using buildings as thermal batteries

* 30:00 – Winter problems in ERCOT

* 31:30 – Primary energy is a deeply flawed metric

* 35:00 – Looking ahead to Nat’s 2026 Decarbonization slideshow

Resources:

Guest & Company

* Halcyon - Company Website + LinkedIn

* Nat Bullard’s Famous 200-Slide Presentation

* Nat’s NY Climate Week Presentation (From Disparity to Data)

Referenced in this Episode:

* Energy Capital Podcast with Bill McKibben

* The Energy Capital Podcast with Zach Dell

* The Energy Capital Podcast with Bret Biggart:

* The more recent podcast with Zach Dell et al.

Studies & Policy Documents

* GridStrategies Report on Data Center Demand

* International Energy Agency Solar Projections

Doug’s Platforms

* YouTube

Transcript:

Doug Lewin (00:06 .422)

Welcome to the Energy Capital podcast. I’m your host, Doug Lewin, and welcome to part two of my conversation with Nat Bullard. Nat, as you heard last week, is the co-founder of Halcyon. He is also the one who puts together a fantastic energy transition and decarbonization presentation that comes out every January, which we talked about in this podcast. All around, one of the great experts on all things energy transition and decarbonization. I learned a ton from talking to Nat. I couldn’t let him go after the usual 45 to 50 minutes. We ended up going long, so we split it into two parts. This is part two.

As usual, please go to douglewin.com and subscribe. Please become a paid subscriber if you are not already. This is a free episode, but it is not free to produce, and your support is extremely important to us. And you’ll get all kinds of benefits: access to the entire archives, grid roundups, reading and podcast picks, special episodes of the Energy Capital podcast that are paid only, like those with John Arnold and Dan Barcelo from T1, Rudy Garza from CPS Energy, et cetera. And please leave us a five-star review wherever you listen to your podcasts. Please enjoy part two with Nat Bullard. Thanks for listening.

So that kind of leads me to where I wanted to go next. You obviously do a whole lot of tracking of batteries. We’ve been talking about electric vehicles a lot. Obviously batteries first started their performance improvement and cost declines because of their use in computers and phones. But now we’re seeing them go into cars on a mass scale and now onto the grid in a really mass scale. I mean, how do you think about that as far as the price comparisons for batteries, particularly gas peakers? Combined cycle, I would almost put in a little bit of a different category because you’re talking more about something that’s going to have a much higher utilization. These days, I think there weren’t a lot being built. There were very few being built, particularly in Texas, but I think just about anywhere with data centers, I think we’ll see some more built.

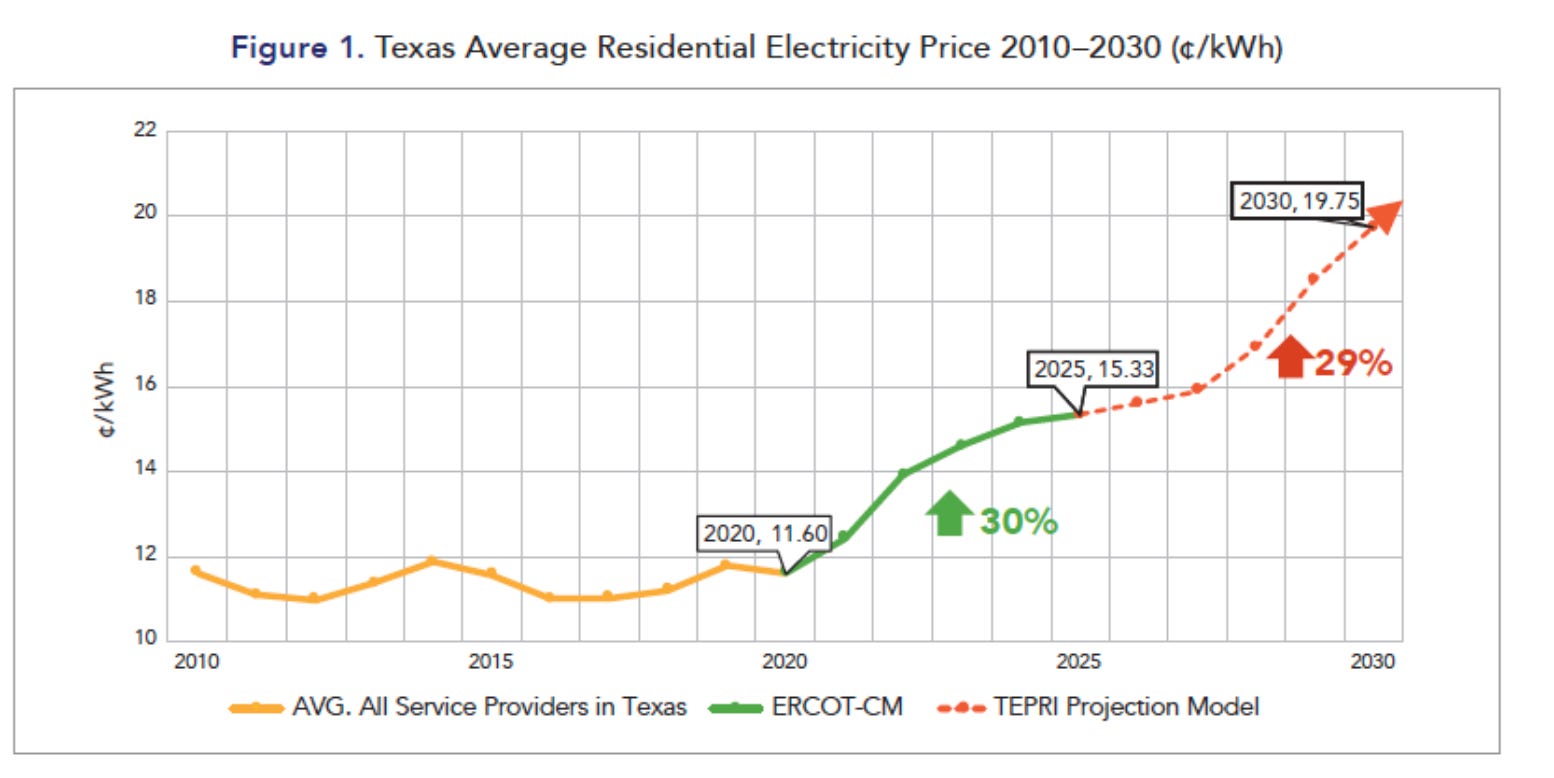

But still in Texas, for instance, in the Texas Energy Fund—this is obviously the subsidy program the Texas legislature put in place a couple of years ago, $7.2 billion in subsidies for gas plants—something like 80% of the projects that applied and were chosen, I think it actually is closer to 85%, were peaker plants. And that’s because we do have an energy-only market. Like you said, in a market, people respond to incentives. The incentives are for short bursts of very high prices. And when you start to stack the peakers up against batteries, and of course the old thing was, you can only go an hour or two, an hour or two is enough for 90, 95% of the high prices in the market. And for the rest, now we’re starting to get to where batteries are going to four or five, six, even longer hour durations. So how do you think about both the price comparison and then the attributes? How do you think differently about the attributes of a peaker versus a battery? Are they really doing the same thing?

Nat Bullard (03:13 .294)

What’s so funny—we had this four-hour standard, more or less. And what’s fascinating about that to me is that is largely an artifact of regulation, not of anything technical. In California back in the day, all you would get paid for was four hours worth of storage. So guess what? Everybody optimizes around this artificially binding constraint that I think we’re starting to see people move past. Again, energy-only market—if there was any place that is going to be ready to do more, or for that matter, to do less, it would be Texas. And also to combine things. When I talk to the biggest of the developers, what their view is, is to meet, let’s say a 500-megawatt load for a data center, the quickest path, the critical path is probably going to be mostly renewable electrons. And within that almost entirely, probably solar, a bunch of batteries. And then you have a combustion turbine to serve the rest of the purpose, but it comes in kind of after the purpose served, obviously, by the generation, but also by the storage.

And that kind of stack is the one that seems to be moving the quickest, probably at the lowest cost, and probably the best fit for anybody who’s out there operating. It’s also the one in the future that, if you want to think about future-proofing it, you’re not talking about having to rip out 600 megawatts of solar and 3,000 megawatt-hours of batteries or whatever you might be doing. You’re talking about keeping those, improving them with software, with new hardware, and then altering the final step at the end. If you were to make this a zero-carbon or zero-net-emissions in the long run, maybe the combustion turbine is running on hydrogen. Maybe you’re doing some kind of durable binding, verified carbon removal to cover the cost of the emissions that are there.

So I guess my way of