Texas Businesses To Pay 54% More for Power

Description

This podcast is on YouTube with Graphs

Congress’ new budget bill is an energy earthquake. It could wipe out tens of gigawatts of energy production, just as we’re experiencing load growth unlike anything since the 1960’s. It will drive power bills higher for families and factories, and give China the upper hand in the race for 21st century economic supremacy.

To understand in more detail the impacts of the federal budget bill, this week on the Energy Capital Podcast, I talked with Dan O’Brien, senior modeling analyst at Energy Innovation. His team modeled what this bill really means for Texas and the numbers should stop us in our tracks.

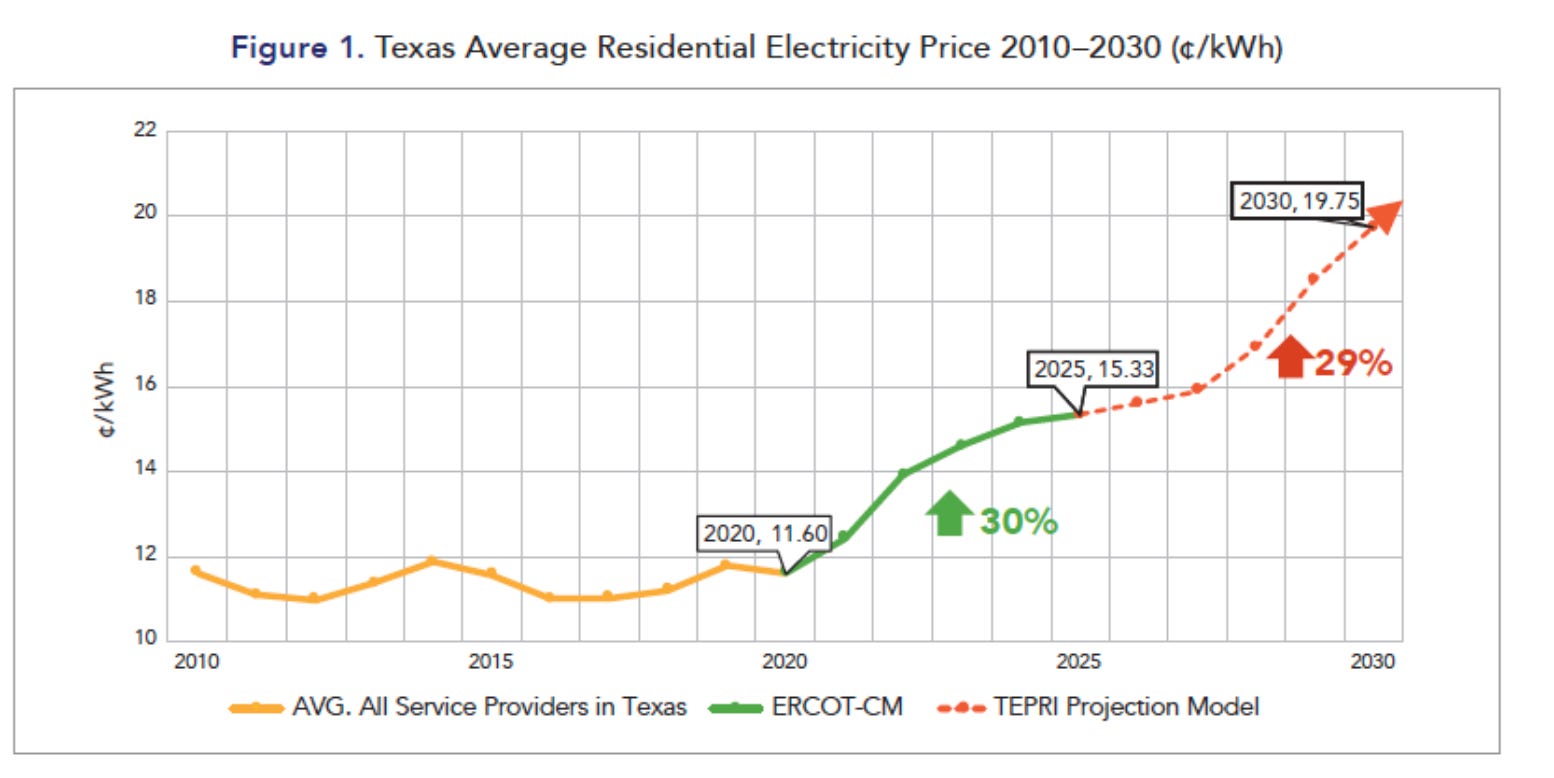

If you’ve been reading this newsletter, you know I’ve warned about this moment for months. Now, the data is here. It’s worse than we thought. We were on a path to energy abundance and we’re about to get energy scarcity including increased risk of blackouts and much higher electric bills.

From Ramp to Cliff: What This Bill Actually Does

Here’s what Congress passed:

* Ends clean energy tax credits abruptly. No glide path, no transition, just a cliff.

* Imposes impossible project timelines that most developers can’t meet.

I’ve written before about how this creates scarcity, not abundance (Energy Scarcity). We’re pulling the cheapest, fastest-growing resources off the table while demand is surging. That’s a recipe for higher prices and weaker reliability.

And make no mistake: this isn’t happening in a vacuum. It’s happening right when Texas has proven that solar and storage are great for reliability and affordability.

The Modeling: 77 GW Gone

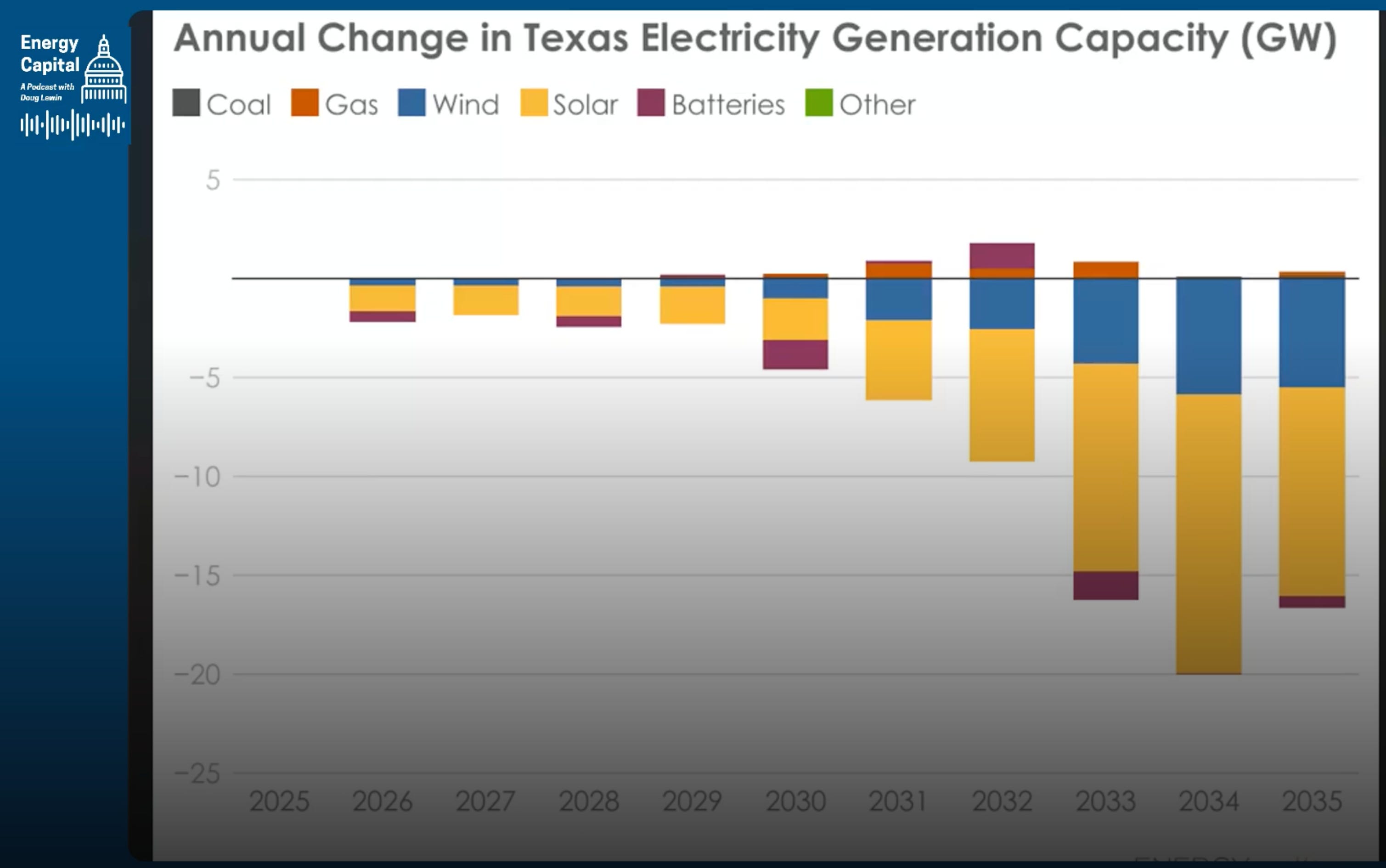

Dan’s modeling tells the story:

* 77 gigawatts of lost clean energy in Texas, including over 50 gigawatts of solar and over 20 gigawatts of wind)

* Only 2 gigawatts of additional gas

* Household power bills up $400–$500 a year

* Industrial energy costs up 50%

* Tens of billions in lost rural tax revenue

Put that in perspective: ERCOT’s entire summer peak is about 85 gigawatts. This bill wipes out nearly that much future clean power before it’s even built.

These numbers aren’t isolated. Princeton’s REPEAT Project and Columbia’s Climate Knowledge Initiative show the same trend: abruptly ending credits doesn’t save money. It costs money—because you’re replacing cheap renewables with expensive alternatives, or worse, with nothing at all.

Demand Is Exploding, So Why Are We Pulling Back?

At the same time, Texas demand is skyrocketing. From 2021 to 2025, Texas has experience 6% year-over-year growth, the fastest since the 1960s. AI data centers, crypto, and industrial electrification are all plugging in at once.

And here’s the kicker: the resources meeting that demand surge aren’t gas or coal. They’re wind, solar, and batteries. They’re 92% of what’s been added since 2021. In the first half of 2025, wind and solar made up 40% of ERCOT’s generation mix. Batteries are breaking records almost monthly, keeping the grid balanced during extreme heat and sudden shifts.

ERCOT calculated summer energy emergency risk dropped from 16% to under 1% in one year, because of solar and storage. We have the data. We have the results. So why are we sabotaging it?

The Human Side: Jobs and Rural Texas

The energy sector is one of the largest drivers of job growth in Texas. These are real people—60,000 Texans working in wind, solar, and storage, including 6,000 veterans. It’s rural school districts balancing their budgets with wind and solar tax base and farmers and ranchers keeping their land in their families for another generation.

It’s welders, electricians, and manufacturers in counties that haven’t seen this level of investment in decades.

Global Stakes: China’s Electrostate Moment

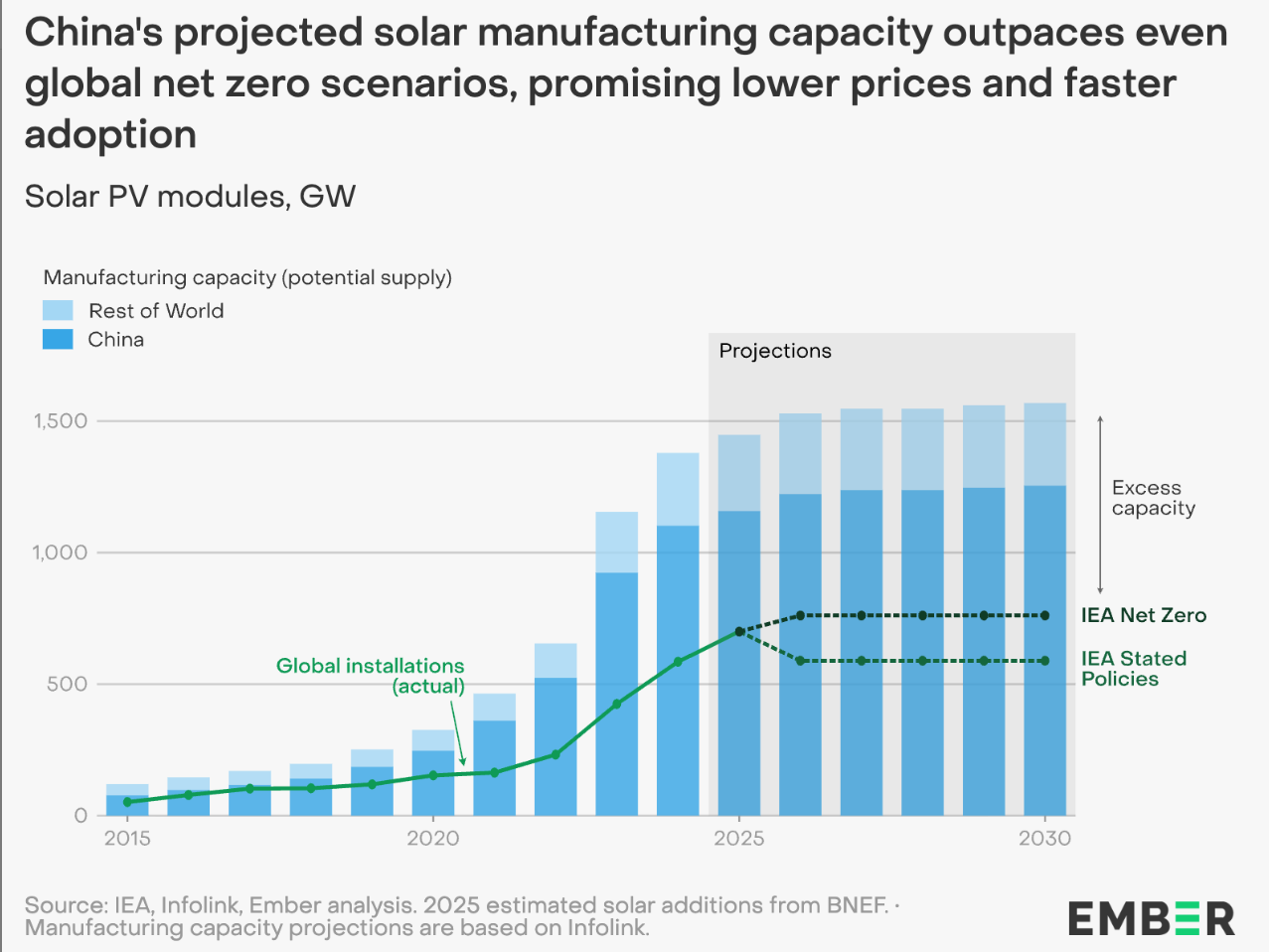

Zoom out. While we’re cutting our legs out from under us, China is sprinting ahead. Last year, they added 400 GW of clean energy, several Texases worth of power. Last month, they put in 90 gigawatts of solar. The Financial Times calls them the first “electrostate.”

The U.S.? We added 60 GW in 2024. And now we’re debating LNG power plants that don’t exist. As I wrote in Energy Submission: this isn’t energy dominance. It’s energy surrender.

If we abandon clean energy leadership now, we’re not just risking higher bills—we’re giving away the 21st century.

There’s Still Time: Ramp, Don’t Cliff

I’m not arguing for permanent subsidies. We should phase them out, but smartly, with predictability. A ramp-down avoids price shocks, keeps manufacturing momentum, and protects rural tax bases while we scale what’s next.

We’ve already proven the formula: reliability up, prices down, emissions falling. It’s not theoretical. It’s working. And throwing it away overnight isn’t policy, it’s ideology.

The Bottom Line

The Texas grid is stronger than it’s ever been, because of solar and storage. That’s not my opinion; that’s ERCOT’s own data. Reliability is improving, costs are falling, and we’re finally catching up to the energy future the rest of the world is racing toward.

This bill reverses that progress. It’s a choice between abundance and scarcity, between leadership and surrender. And the clock is ticking.

Timestamps

* 00:00 – Introduction

* 02:00 – What is the federal budget bill and why is it important?

* 04:30 – Impact on Texas power

* 07:00 – Why is there only a tiny increase in new gas capacity

* 10:00 – Modeling Assumptions and Safe Harbor Provisions

* 12:30 – Demand forecasts and modeling variables

* 14:00 – Residential energy cost increases: $480/year

* 16:00 – Why that could be worse if Treasury’s guidance is restrictive

* 19:00 – Why are power prices high if renewables are lowering costs?

* 21:00 – 54% increase in power costs for large commercial & industrial customers

* 25:00 – Job losses from the federal bill

* 29:00 – Rural community impacts and manufacturing losses

* 30:00 – Policymakers could revisit this policy as the impacts take hold

* 32:00 – Phasing out credits would protect consumers and end them permanently

Resources

Energy Innovation - Linkedin

* Daniel (Dan) O’Brien - LinkedIn

* Updated: Economic Impacts of the U.S. “One Big Beautiful Bill Act” Energy Provisions — Energy Innovation

* Impacts of the One Big Beautiful Bill on Texas Energy Costs, Jobs & Emissions (PDF) — Energy Innovation

* Texas Reliability Entity 2024 Reliability Performance & Regional Risk Assessment — Texas RE

Related: Writing

* TRE: Solar and Storage Help Reliability; Texas Grid Roundup #68 - Doug Lewin

* Clean Energy Development Slows Without Tax Credits — Texas Tribune

* Boom Fades for U.S. Clean Energy as Trump Guts Subsidies — Reuters

* What the ‘Big Beautiful Bill’ Would Mean for Renewable Energy — Governing Magazine

Transcript

Doug Lewin (00:05 .922):

Welcome to the Energy Capital Podcast. I'm your host, Doug Lewin. My guest this week is Dan O'Brien, senior modeling analyst at Energy Innovation. Dan has spent a lot of time working on a model to show the impacts of the federal budget bill that passed the Senate on July 3rd, signed by the president on July 4th. This episode