Europe Market Open: Higher market sentiment with European equity futures firmer following positive Nvidia's earnings

Update: 2025-11-20

Description

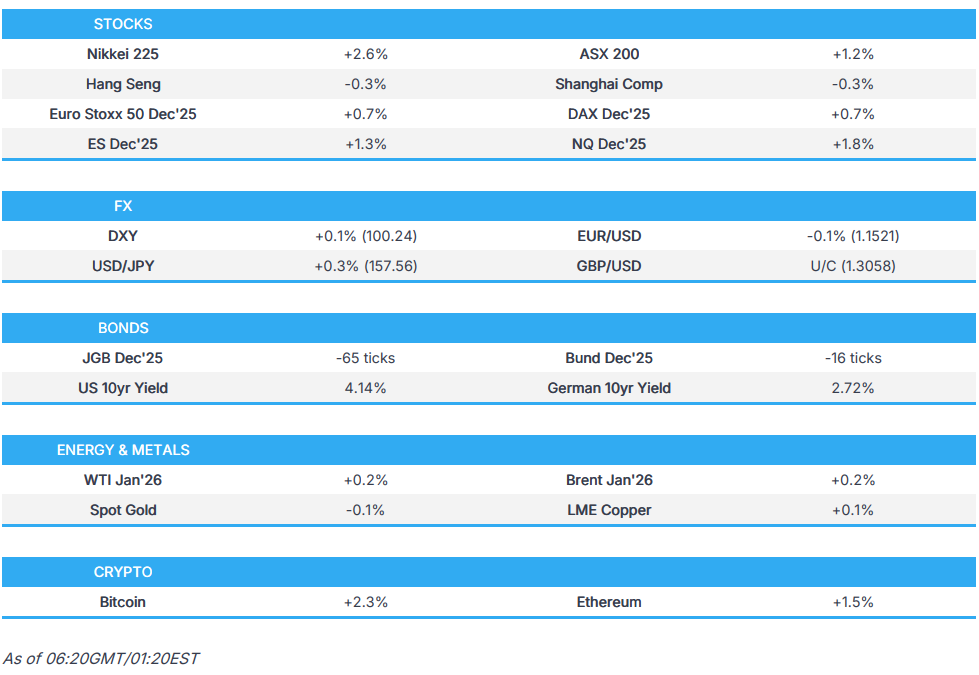

- APAC stocks surged across the board, buoyed by a strong performance in the tech sector following NVIDIA’s solid earnings and guidance, while CEO Huang dismissed concerns of an AI bubble, stating, “We see something different.”

- FOMC Minutes added little new but emphasised divisions on the December decision, with "many" members expecting no change.

- Hawkish Fed repricing was seen as the new BLS data schedule shows that the FOMC won't see the October or November jobs reports before the December 10th meeting.

- China is reportedly mulling new property stimulus measures, including mortgage subsidies, according to Bloomberg sources; Japanese JGB yields continued climbing despite continued verbal intervention.

- Looking ahead, highlights include German Producer Prices (Oct), EZ Consumer Confidence Flash (Nov), US NFP (Sep), US Jobless Claims (w/e 15 Nov), New Zealand Trade Balance (Oct), Australian Flash PMIs (Nov), Japanese Nationwide CPI (Oct), SARB Policy Announcement, Fed’s Cook, Barr, Hammack, Paulson, Miran, Goolsbee; BoE’s Dhingra, Mann. Supply from Spain, France, US. Earnings from Gap, Walmart; ThyssenKrupp; Investec, Halma.

- Click for the Newsquawk Week Ahead.

</figure>

</figure>US TRADE

EQUITIES

- US stocks were choppy, but ultimately settled in the green as participants awaited NVIDIA earnings.

- SPX +0.38% at 6,642, NDX +0.56% at 24,641, DJI +0.10% at 46,139, RUT -0.04% at 2,348

- Click here for a detailed summary.

NVIDIA

Earnings Release

- NVIDIA Corp (NVDA) Q3 2026 (USD): Adj. EPS 1.30 (exp. 1.24), Revenue 57.00bln (exp. 54.41bln), Q4 Revenue view 63.7-66.3bln (exp. 62.2bln). Data centre revenue 51.2bln (exp. 48.3bln). Gaming revenue 4.3bln (exp. 4.4bln). Gross margin 73.4% (exp. 73.5%, prev. guided 73-74%).

- Commentary: "Blackwell sales are off the charts, and cloud GPUs are sold out".

- Guidance: Q4 Revenue view 63.7-66.3bln (exp. 62.2bln). GAAP and non-GAAP gross margins are expected to be 74.8% and 75.0%, respectively, plus or minus 50bps. GAAP and non-GAAP operating expenses are expected to be approximately USD 6.7bln and USD 5.0bln, respectively. GAAP and non-GAAP other income and expense are expected to be an income of approximately USD 500mln, excluding gains and losses from non-marketable and publicly-held equity securities.

Earnings Call Highlights:

- CEO on AI bubble: CEO Huang says there has been a lot of talk about an AI bubble but "we see something different."

- CFO on China: Will continue to cooperate on China. Sizeable purchase orders for H20 AI chip never materialised in the quarter due to geopolitical issues and the increasingly competitive market in China. Not expecting data-center-compute revenue from China in Q4.

- CEO Comments: NVIDIA has done a really good job in terms of planning and supply chains. NVIDIA will continue to do stock buybacks. More successful this year vs last year.

- CFO Comments: Still in early innings. Reiterates visibility into USD 500bn Blackwell and Rubin revenue. Cloud services are sold out. Demand continues to exceed expectations.

Overnight trade: Shares +5.6%

Note: CEO Huang's full interview on Fox Business to be released on Thursday at 15:00 EST/ 20:00 GMT.

FOMC MINUTES

- FOMC minutes revealed a divided committee on the appropriate pace of easing, with many favouring a 25bp cut, several preferring to hold rates, and one advocating a more forceful 50bp reduction. Supporters of a cut pointed to rising downside risks in employment and limited signs of renewed inflation pressures, while those opposed emphasized stalled progress toward the 2% target and insufficient confidence that inflation is on a sustainable path. Despite broad agreement that policy is moving gradually toward neutral, views diverged on how restrictive current settings remained.

- Most participants judged that further cuts are appropriate, but several did not see a December cut as likely, while some thought it could be appropriate if the economy evolves as expected. Concerns about inflation remained persistent, particularly in core non-housing services, expected tariff pass-through, and the risk that prolonged inflation overshoots could lift expectations. However, some noted that inflation excluding tariffs was close to target, and productivity gains or a softer labour market could help curb price pressures. Labour market conditions were seen as softening gradually, with structural factors such as AI-driven investment at play, and activity was moderate with strength concentrated in higher-income households.

- Most members supported concluding the balance-sheet runoff by December 1st and favoured a larger Treasury bill share for flexibility. Several members warned that elevated asset valuations, especially in AI-related equities, left markets vulnerable to corrections. The minutes also touched on asset prices, highlighting the possibility of a disorderly fall in stock prices, especially if AI-related prospects are reassessed abruptly.

- The release, while it largely added little new, did have a hawkish skew and continued to highlight the division in the Committee ahead of the December confab. After the minutes, money market pricing saw further rate cut bets pared, with just 6bps of easing priced, implying a 24% probability of a rate cut in December versus 7bps before the minutes.

DELAYED DATA UPDATE

- The US November jobs report has been rescheduled for December 16th at 08:30 EST/13:30 GMT, with the October NFP to be released alongside November but without an unemployment rate. The BLS said the October 2025 Employment Situation Report has been cancelled, noting the Establishment Survey (NFP) data will be published with November’s release on December 16th, while Household Survey data (unemployment rate) could not be collected, via BLS.

NOTABLE HEADLINES

- US President Trump reiterated his criticisms of Fed Chair Powell, saying rates are too high, according to Reuters.

- US President Trump is reportedly considering an executive order to pre-empt state AI laws, according to Reuters, citing a draft.

- US President Trump is considering signing an executive order as soon as Friday, according to The Verge.

- US President Trump posted that he signed the bill approving the release of the Epstein files, according to Truth Social.

- US President Trump is set to meet New York City Mayor Mamdani on Friday at the Oval Office, according to Truth Social.

Other North American News

- BoC Deputy Governor Vincent said Canada’s weak productivity problem has become more urgent and is a systemic issue requiring a coordinated, economy-wide approach; he said the country is stuck in a vicious cycle where weak productivity makes it harder to meet challenges, shocks to the economy have become more frequent, and Canada is too vulnerable to their impacts. He added that when assessing inflation, the Bank places particular importance on the relationship between rising labour costs and productivity, according to Reuters.

TRADE/TARIFFS

- Key White House officials are pressing lawmakers on Capitol Hill to keep AI chip export restrictions to China out of the annual defense policy bill, according to four sources familiar with the matter, via Axios.

- US lawmakers are reportedly considering a new bill to codify China AI chip export curbs, according to Bloomberg sources; the White House has reportedly asked Congress to reject the bill curbing NVIDIA (NVDA) exports.

- US Commerce Department plans to approve export of 70,000 advanced AI chips to UAE and Saudi Arabia, according to WSJ sources; Export deal includes approval for NVIDIA's (NVDA) GB300 or equivalent chips.

- China’s October rare earth magnet exports to the US rose 56.1% from September, according to customs data.

APAC TRADE

EQUITIES

- APAC stocks surged across the board, buoyed by a strong performance in the tech sector following NVIDIA’s solid earnings and guidance, while CEO Huang dismissed concerns of an AI bubble, stating, “We see something different.”

- ASX 200 held near highs, supported by strength in tech and gold sectors.

- Nikkei 225 surged at the open and reclaimed 50,000+ levels as NVIDIA boosted tech stocks, though it pulled back from highs amid ongoing US-China tensions and fiscal concerns and as JGB yields continued climbing.

- Hang Seng and Shanghai Comp both opened firmer but lagged peers, with China struggling to cap

Comments

In Channel