ARE TREASURIES A BUY?

Description

It is pretty safe to assume that the Federal Reserve will be run by a dovish Chairman in the foreseeable future who will be looking to cut interest rates. Does that make long bonds a buy? If I look at the trend on the US 10 year yield, we have not had a break out in yields since 2023.

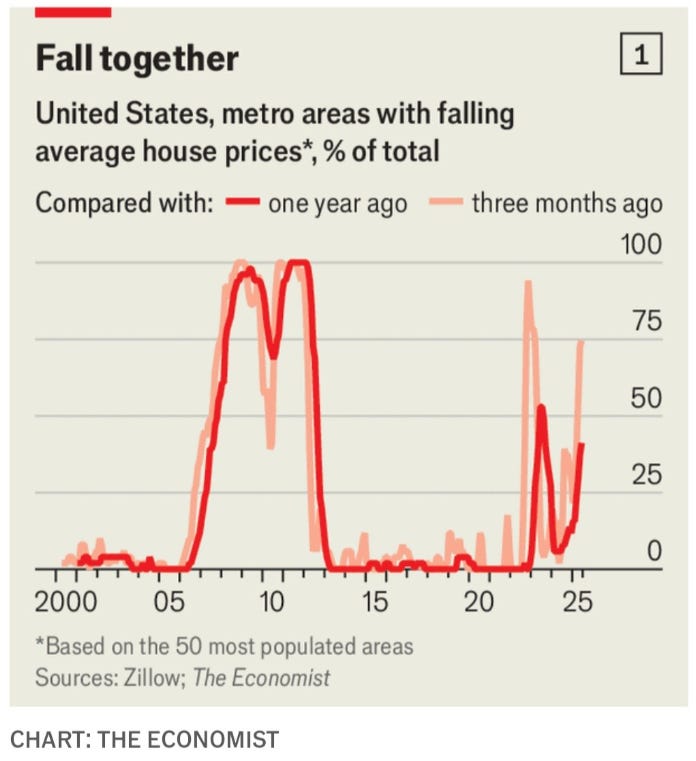

Certainly for most of my investment career, if we started to see signs of a weakening US housing market, I would be a buyer of bonds.

And we are currently living through the longest period of equity outperformance versus bonds. The implication would be to favour bonds over equities is you thought this would change.

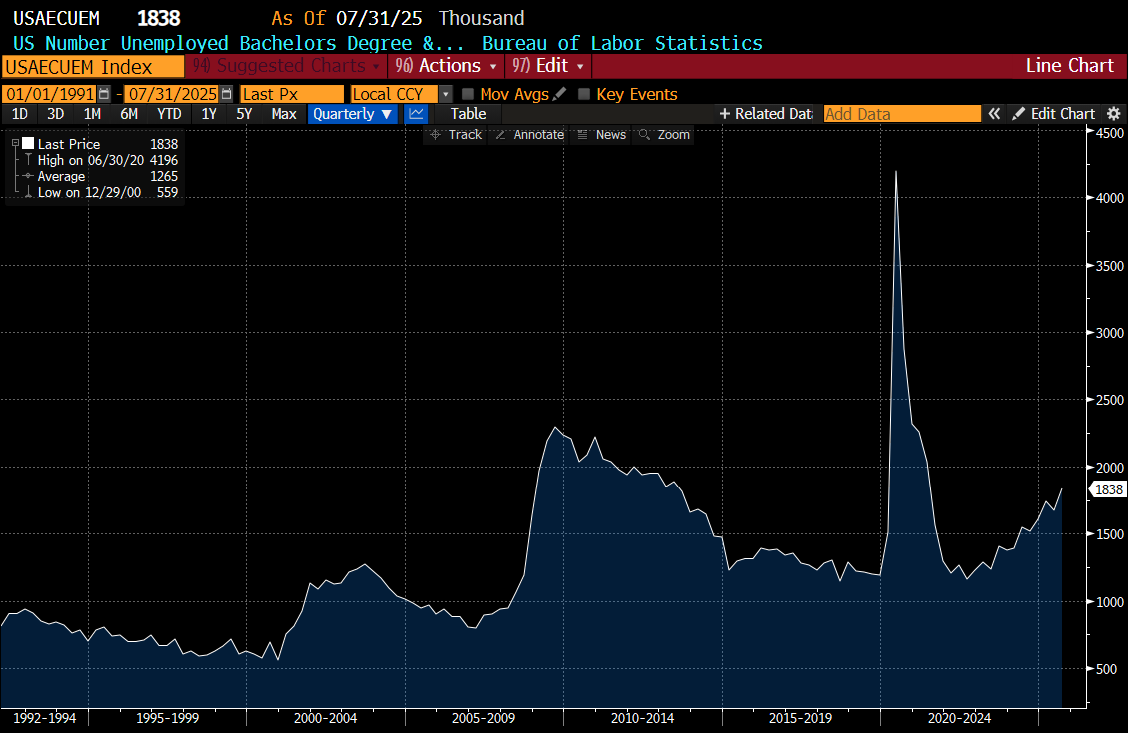

The final cherry on top would be the rising unemployment rate of university graduates. This has been a bond buying signal historically.

There was a time in my career when the above four charts would be enough for me to go all in on treasuries. But we live in new and uncertain times. For most of my investing career, JGB yields gave you a good tell on where US yields were going to go. Why do JGBs offer a tell? I could be that Japanese corporates tend to be more manufacturing heavy, or Japanese inve