I FIND MYSELF UNCONTROLLABLE BULLISH ON JAPAN

Description

Economists really don’t like thinking about politics. If forced to choose between an economic reason and a political reason for something to happen, they will always choose the economic reason. I used to be exclusively “economic” in my thinking, but around 2021 I realised that politics was a far bigger driver. I have tried various different political ideas to make sense of the world, and give a framework for investing with various degrees of success. When I started to think about politics rather than economics, I started to wonder if Japan’s lost decades were driven by a political choice rather than an economic choice. That is in the 1980s trade fiction with the US was rising, and Japan remembering how conflict with the US turned out last time, “decided” to enter a period of weakness. I liked this theory for many reasons, as it would explain the very different tendencies in Yen and JGBs we saw from the rest of the world. While everyone else moved with the economic cycle, Japan chose to lean the other way. Its a nice theory - but for it to have any meaning, it would need to explain why the Yen is no longer strong, and why 30 year JGB yield keep rising.

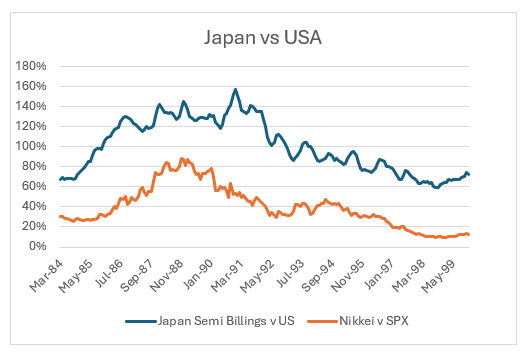

As we have seen with the AI boom the ability to create and access to cutting edge semiconductor is the key to modern economic dominance. Back in the 1980s Japanese dominance saw them capture fifty percent of global market share. Using semiconductor billing data, we can see that Japanese semiconductor dominance coincided with Nikkei dominance.

What went wrong for Japan? Under American pressure they agreed in 1986 to increase imports of US semiconductors, and to keep prices high in the US. This was good for profitability in the short run, but threatened market share in the long run. With the collapse of Soviet Union in 1989, investing into other parts of Asia became far more possible - which saw the rise of various Asian Tigers. Japanese investment was instrumental in the rise of Asian semiconductor industry. Korea and Taiwan, both former colonies of Japan, have become dominant chip players.

In other words two political changes led to the decline of Japanese semiconductor industry and the rise of Asian semiconductor manufacturers. One was the rising trade tensions with the US and the second was the opening up of Asia after the collapse of the Soviet Union. Japan had become expensive, and geopolitics and economics encouraged Japanese corporates to invest overseas. First in the Asian tigers and then in China. When your most successful corporates choose not to invest locally, then is there any surprise you suffer economic decline? But using a similar analysis, political changes are now favouring Japan again. China is now perceived as the bigger threat to the US and Taiwan