IS THE ASIAN SAVINGS GLUT OVER?

Description

One of the effects of a pro-labour world would be that governments would come under pressure to lift real wages - which means avoiding currency devaluation. In Japan, this has meant falling foreign exchange reserves.

The overriding investing theme for me is “pro-labour” politics and the rising cost of capital. The lodestar for this theme has been the inflection of JGB yields higher.

Rising yields has meant for me an inflection in the relative performance of Japanese banks. This has also happened.

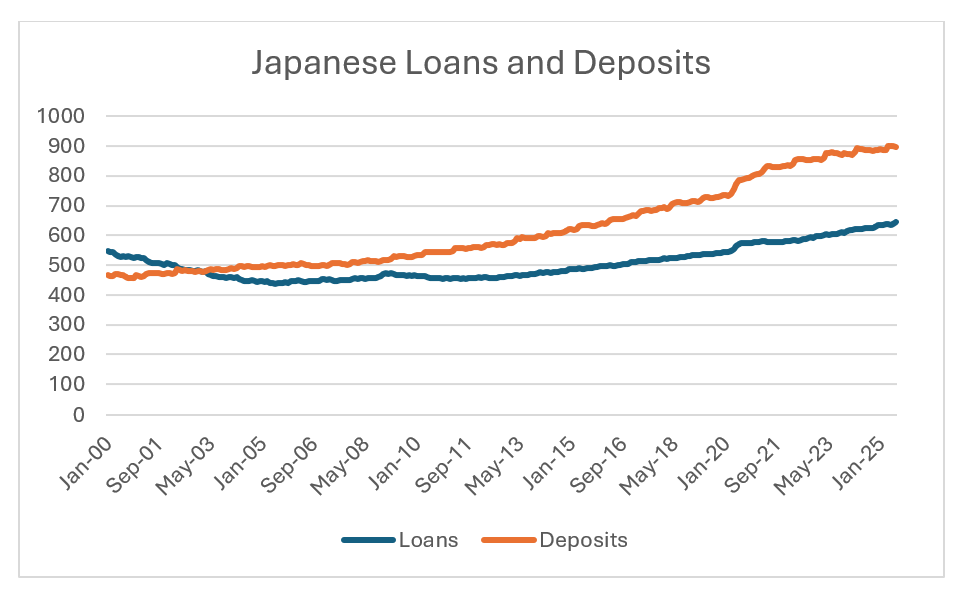

One thing about a pro-labour inflationary world that I have been also looking for is reluctance by households to hold deposits, and increasing demand for loans. If this happens, then there should be less liquidity in the banking system, and government bond yields have to rise. There are some signs of this. After years of deposit growth being faster than loan growth, we are starting to see an inflection in Japan.

If we take deposits less loans, we can see the (possible) inflection more clearly.