IS AI A BUBBLE?

Description

Old men and women are always obsessed with the past. When I first started working in finance in 2000, the oldies in my office would go on about the 1970s. There was a lady working in the cash management department who had started with the company in 1960s as a secretary, and kept telling me about 1974 crash. She said it was like a light switch was turned off. The managing partners came in and basically looked at the office and said everyone sitting to the left of the central aisle is fired and that was it. At the time, I thought, well that was 25 years ago when people thought flares were a good idea, nothing to do with me. Of course, within 6 months, the dot com bubble burst, and once again half the office was fired.

So here we are 25 years later, and an oldie is talking about a bubble bursting 25 years ago, and if you are in your 20s, you are probably thinking why is he talking about 2000, you guys were going to Blockbuster and thought Nokias were cool. I would calm yourself now, as this particular oldie is not going to talk about AI being a bubble - but I am going to look into other oldies claims that we could be a AI bubble. The FT Alphaville is conjuring up comparisons to the telecommunications bust that was part of the dot com bust.

Most of the note is based of Morgan Stanley research - a tech bullish broker. First of all they forecast USD 2.9 trillion of capex from 2025 to 2028 - which is a very big number in a very short period of time.

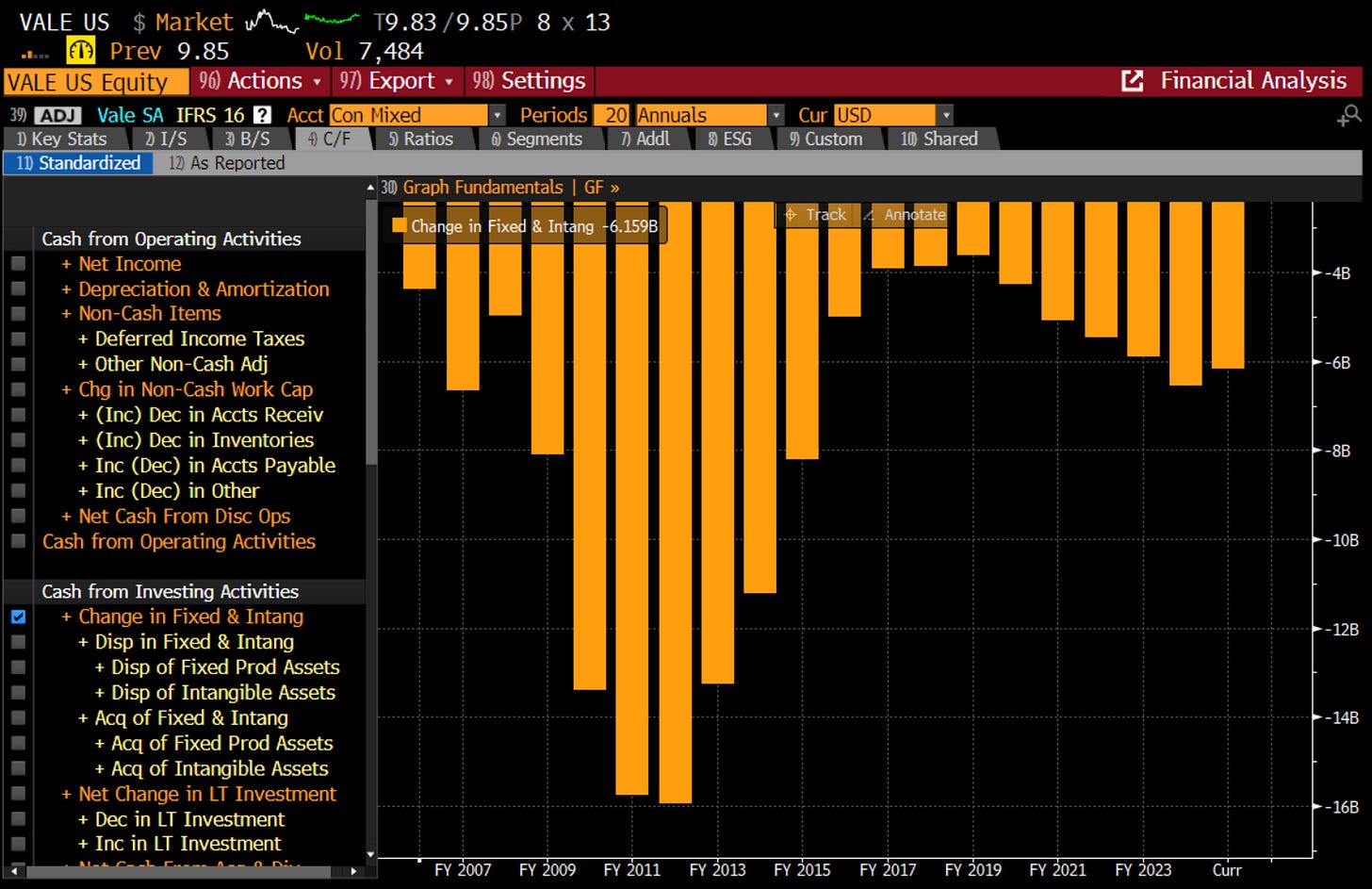

A big increase in capex IS a bearish signal. One of my best short were iron ore miners, who massively increased capex in from 2007 to 2011. Vale in Brazil was a poster child for this excess. The peak in capex then led to a 90% fall in the share price.

As both the FT and MS acknowledge, the hyperscalers have the cashflow to fund their investments, so they spend their times looking at the other USD1.4 trillion of investment that is coming from private markets. In my view, if the hyperscalers are spending, then the other markets will deliver the cash as well, so there is no need to think too much about credit markets.

For me, excess capex is a necessary, but not sufficient condition for thinking about a “bubble” (lets take bubble to mean excess investment that leads to collapsing prices and write-downs). Back in the dot com bubble era, there were two separate type of company that got into trouble at the same time. The first were a whole bunch of internet stocks that listed, but had no real path to profitability. If you were to talk about a bubble, this was it. Companies like Web Van or Boo.Com. Once the market turned on them, there was no way back. The modern day equivalent of these would be some SPAC companies and “shitcoins”. Generally speaking, these highly speculative companies got destroyed in the 2022 sell off. And we saw a corresponding sell off in Nvid