BRUMBY UPDATE

Update: 2025-08-03

Description

July was a volatile month. The core trade of GLD/TLT broke higher during July, to then pull back in the last week to finish near lows.

The other core trade of gold versus S&P 500 had a late month breakdown to approach the 200MDA.

The Dollar Index also saw a late month rally.

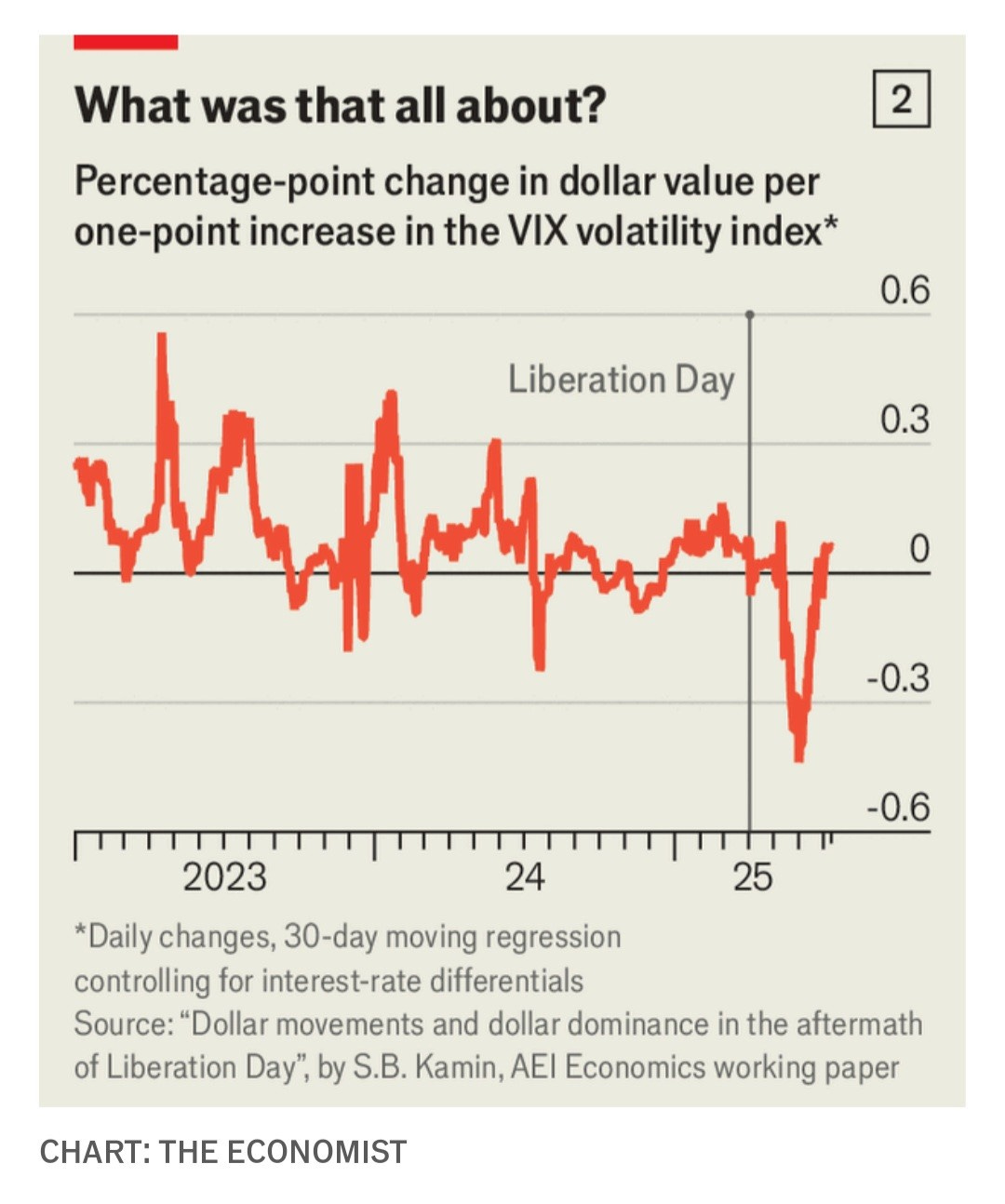

With so many core themes reversing in the final week of July, we ended up having a down month. However I did take of the advantage of the strength of the dollar to add to dollar weakness trades. As much as the late month trend reversals disturb me, I can not forget the “correlation break” we saw earlier this year, when treasuries and dollar sold off as equities weakened. The Economist provides a useful graph.

Comments

In Channel