WHAT IF THE TRUMP ATTACK ON THE FED IS HAWKISH?

Description

I had viewed the political machinations around the Federal Reserve as a transparent attempt of the Trump administration to control interest rates and push them lower. The market has agreed, with 2 year Treasury yields touching 3 year lows.

The pressure on the Fed has also led the price of gold to surge, as investors question the safe haven nature of the US dollar.

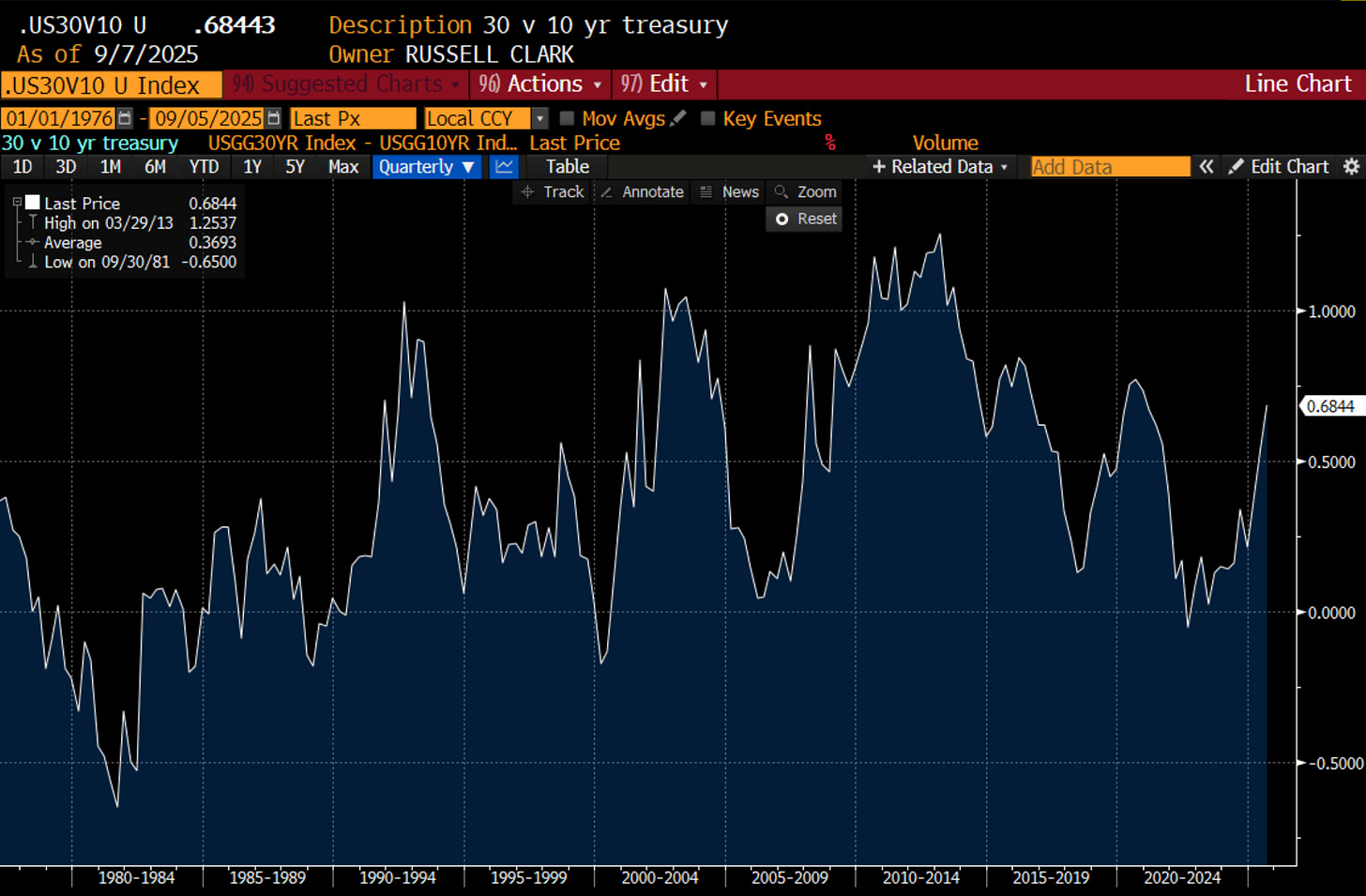

My preferred inflation measure, the 30 year yield to the 10 year yield, has also surged to new highs. That is market seeing yields lower in the short term, but needing to be higher in the long term.

So far so simple. The Trump administration puts a friendly team in at the Federal Reserve, the dollar tanks, the stock market surges and everyone is happy. And that would be fine by me. But I just read an interview of Scott Bessent in The International Economy, and he had the following criticisms of the Fed policy in recent years.

And then this:

It is particularly noticeable that since Covid, (and really from 2016 onwards) the spread on corporate debt to treasuries has become low and stayed low (COVID aside).