SOMETHING WICKED THIS WAY COMES - UPDATE

Description

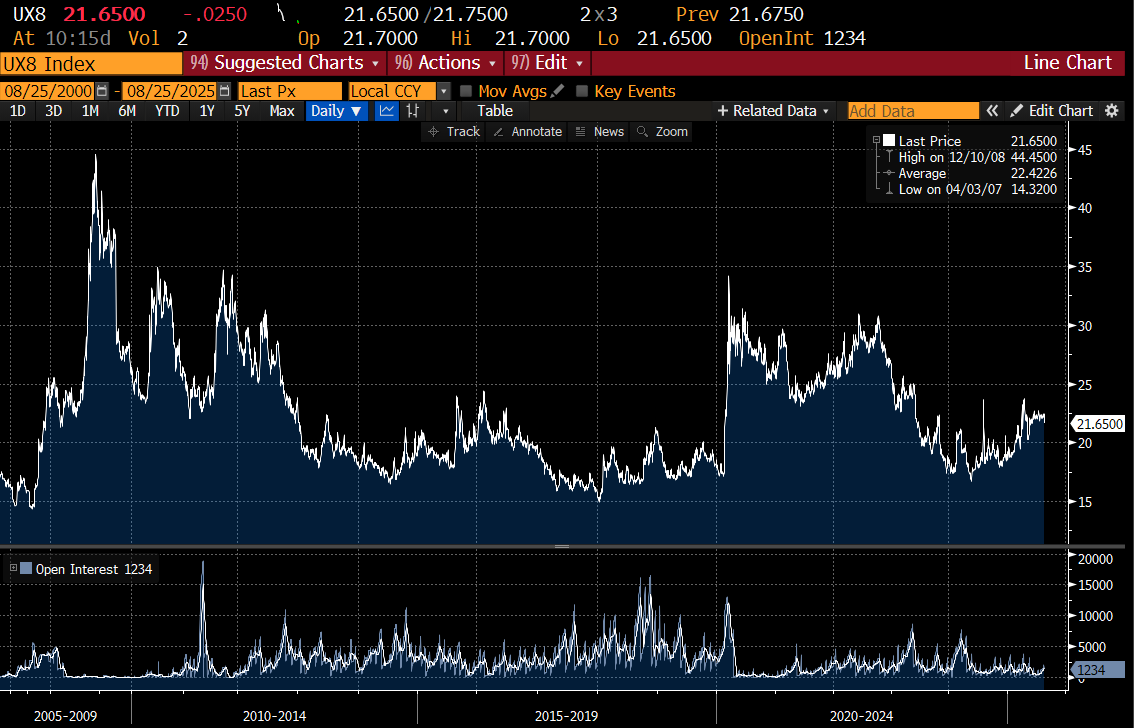

In my last post, I had guessed that something was brewing in markets. What I suspected was a sell off in long term bond yields. I still think that is going to happen, but what the market got was capitulation from Jerome Powell to President Trump. With this capitulation, there are no longer any independent financial institutions left in the US - or to put in another way, fiscal and monetary policy is now fully politicised. The market reacted in a predictable way - gold rallied, US dollar weakened and the likelihood of a recession was cut. One of my favourite indicators is 8mth generic VIX. When it is rising, recession risk is rising, and when it is falling the opposite is true. During the GFC, the Eurocrisis, China Deval concerns and Covid, it moved higher as investors hedge, and then falls as recession risk fades. It fell 3% on Friday, and looks to have turned lower.

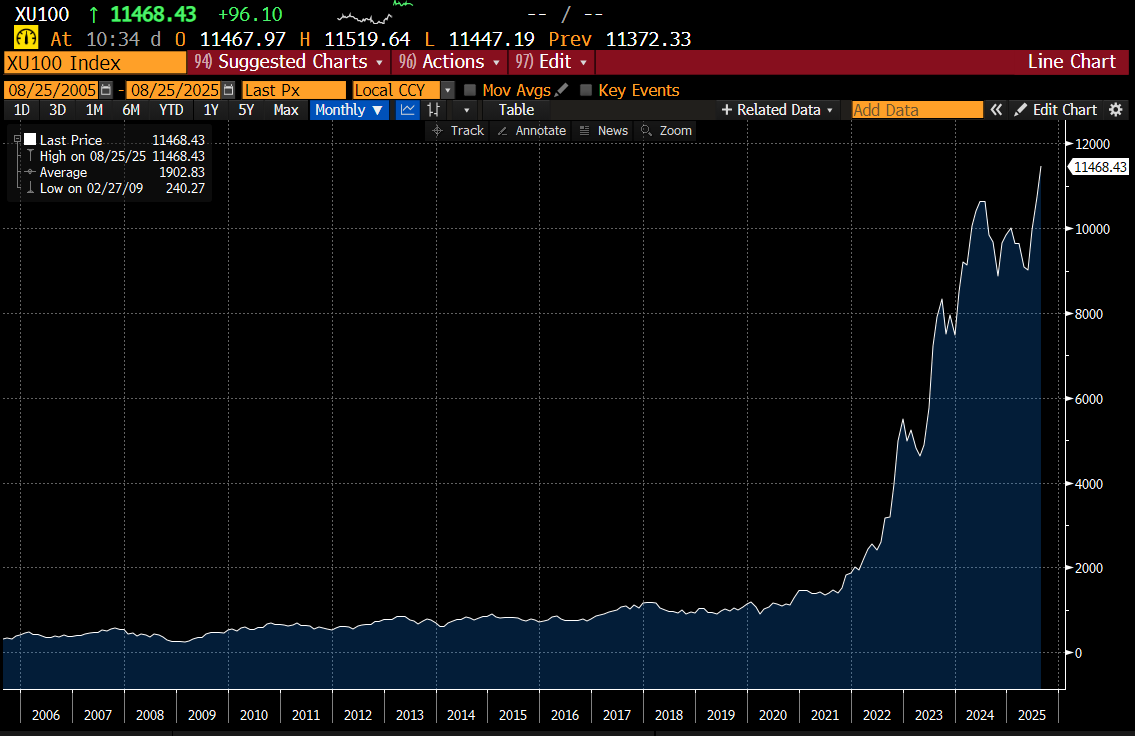

In a pro-labour world, weak assets prices are not really a problem. In fact they help reduce income inequality, and reset property markets. I see pro-labour tendencies in the UK and in Mexico. And for a while, I thought Trump 2.0 was a pro-labour politician. The “Liberation Day Tariffs” seemed very pro-labour at the time. But in practice, Trump is not really a pro-Labour politician, he is just a pro-Trump politician. In this respect, he most closely resembles Erdogan in Turkey, and to a lesser extent Putin in Russia. As it happens, I have been around for the investment journey with both these leaders. It starts off with some useful pro-market reform. And then is followed up by taking on unpopular vested interests (the army in Turkey, oligarchs in Russia), but while both were seen as improving democracy to start with, in the end it was to concentrate more power in the Presidency. After awhile, fiscal and monetary policy gets compromised, and corruption flourishes. This is all beginning to happen in the US. As is my way, I made money on the way up and the way down in Russia and Turkey - but principally from shorting the currency. Shorting locally listed stocks in Turkey is a not rational.

But being bearish on bonds in Turkey does work. 1mth interest rates have gone 10% ten years ago to 35% today.

From a simplistic point of view, the GLD/TLT trade should keep working. This looks ready to move much higher in my view.