HOW FAR CAN EQUITIES OUTPERFORM BONDS?

Description

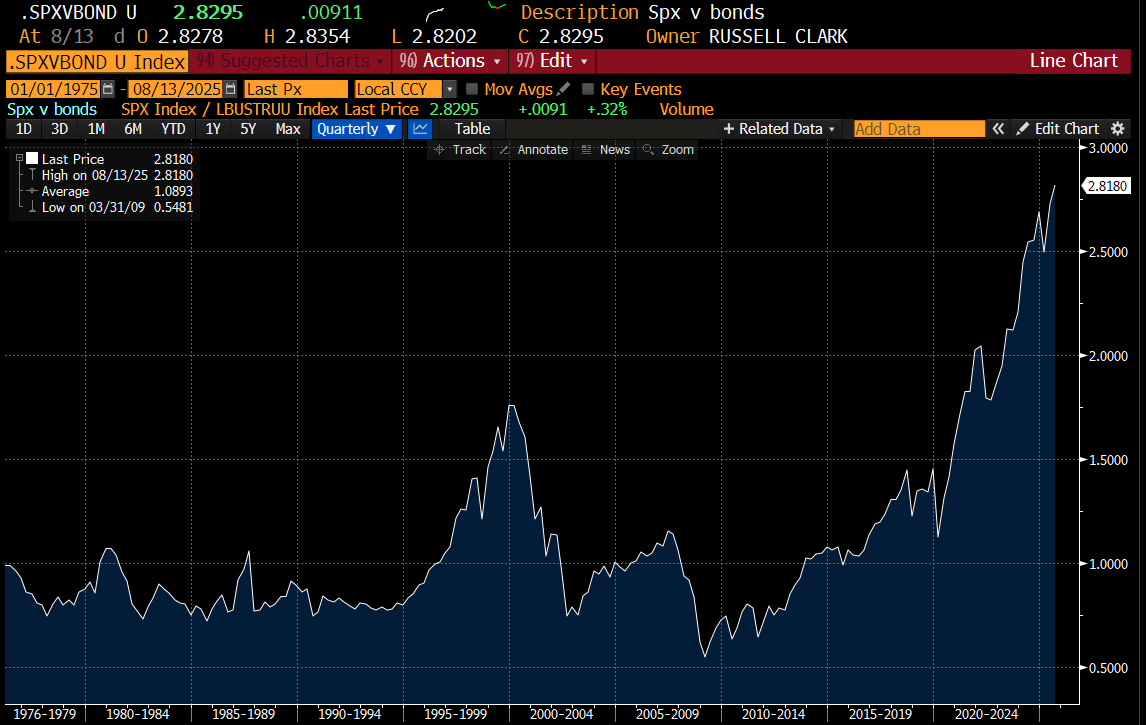

I have tended to be a “mean reversion” type of investor - thinking that boom is followed by bust. This has been the pattern in every market I had ever looked at, until this bull market in the US. I look at the returns of the S&P 500 relative to long term bond returns, it was mean reverting from 1975 to 2020 maybe? But since then, it has been unlike anything we have seen before.

On a shorter time frame, the Freedom Day Tariffs hinted at a breakdown, but we have returned to highs.

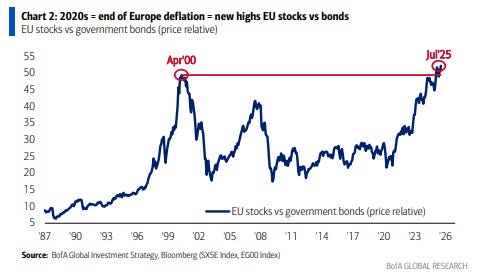

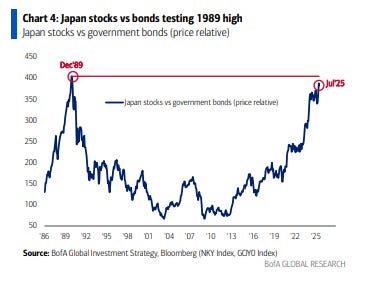

Interestingly BOA Hartnett has pointed out that Japanese and European equities have broken out versus bond returns as well. Even though Europe and Japan lack the tech exposure of the US, they are exhibiting the same relative move in equities versus bonds. Is this a top? Or are we moving to new paradigm?

The Japanese experience is very interesting. Japan went to deflation for nearly 30 years, but has now broken out it. Food prices are surging - but the BOJ is very reluctant to do anything about it.

I always wondered what the S&P 500 versus bonds would have looked like from 1900 to 1975. I assumed in the 1920s, equities outperformed bonds, and then bonds outperformed equities in the 1930s. From 1940