WHAT TO DO ABOUT YEN?

Description

Someone asked me about Yen the other day. It was a good question. The old widowmaker trade was shorting JGBs. Short JGBs was a very popular if unsuccessful trade from 1994 to 2016 or so. As Japanese bond yield were so low, hedge fund used to love shorting JGBs and going long higher yielding bonds like US treasuries or Aussie bonds. The problem was that every crisis would see hedge funds gross get cut, and they would all buy back the shorts at the same time, and yields went lower and lower.

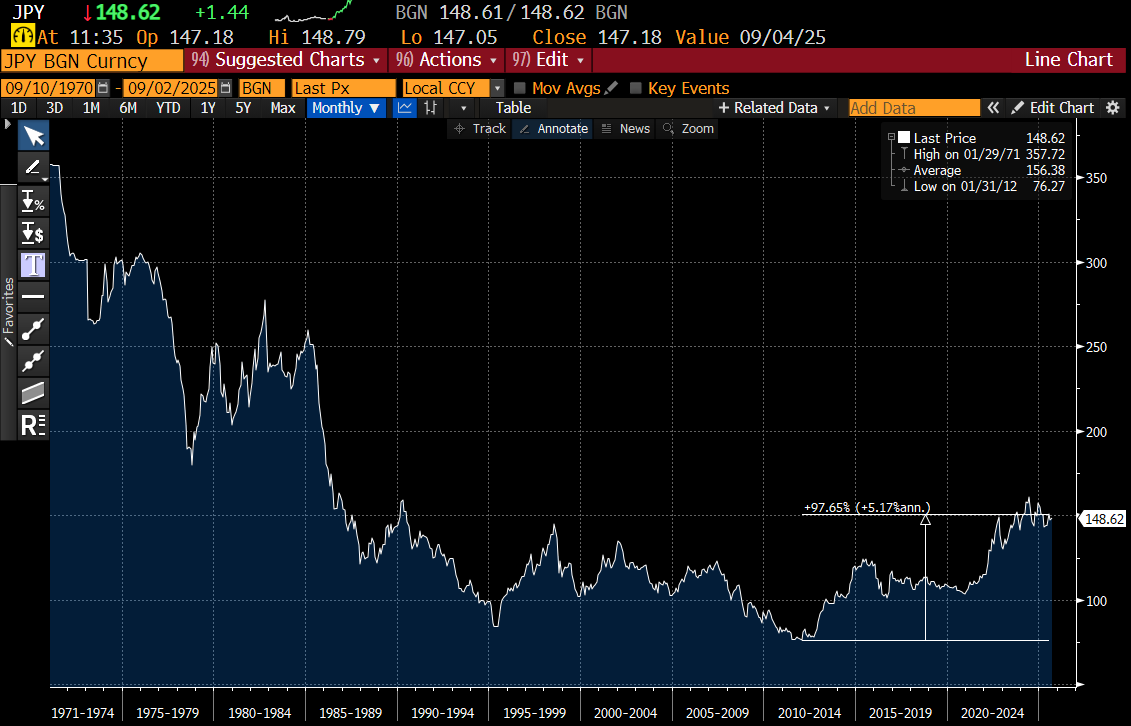

As well as selling JGBs, hedge funds also used to love shorting Yen - even though the Yen was generally a strong currency until 2011 or so. Since then, the Yen has lost half is value against the US dollar. In this graph, up mean weaker Yen.

Despite its weakening bias, markets have gotten very long Yen in 2025. CFTC data use to be very useful for working out when to go LONG Yen - such as 2008 or 2015 or late 2024, when the market was extremely short Yen. But as you can see, even with some reduction of late, the market is the longest it has been on Yen since data started. This suggests short Yen is the better trade.

The long Yen position is not due to high interest rates. 2 year yields are among the lowest in the world.