Europe Market Open: US appeals court deem Trump tariffs as illegal, European bourses look to open higher

Update: 2025-09-01

Description

- US Appeals Court upheld a ruling that most Trump tariffs were illegal but kept them in place as the case proceeds.

- US was reported on Friday to revoke authorisations for Intel (INTC), SK Hynix (000660 KS) and Samsung (005930 KS) to receive American chipmaking equipment in China unless they obtain licenses, according to the Federal Register.

- US judge did not rule on the dismissal of Fed Governor Cook on Friday and asked both parties to submit subsequent court documents on Tuesday.

- APAC stocks traded mixed with sentiment mostly subdued; European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed with losses of 0.8% on Friday.

- Looking ahead, highlights include EZ & UK Manufacturing PMI (Final), EU Unemployment Rate (Jul), New Zealand Terms of Trade (Q2), and Speakers include ECB’s Schnabel, Cipollone & Lagarde.

- Holiday: US Labour Day, Canadian Labour Day: The desk will run until 18:00 BST/13:00 EDT on Monday 1st September, upon which the desk will close and then re-open at 22:00 BST/17:00 EDT the same day due to US market closures.

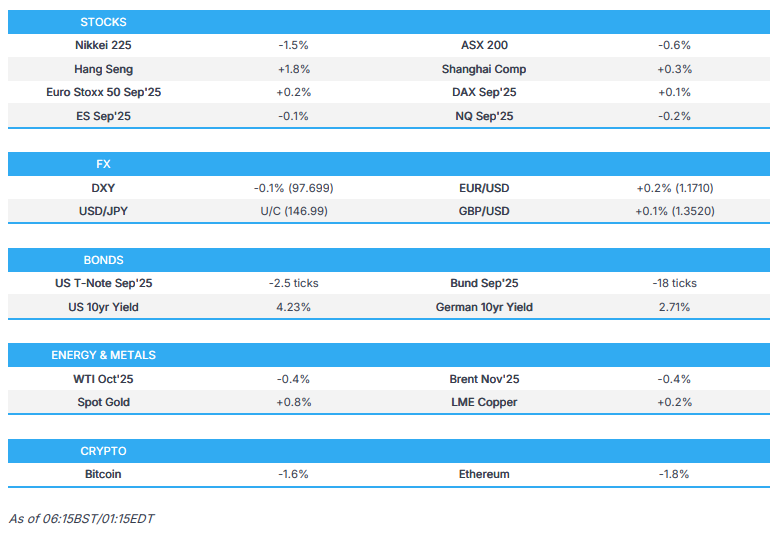

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks closed lower on Friday with underperformance in the Nasdaq, although sectors were mixed, with Tech and Consumer Discretionary posting the largest losses, while Consumer Staples and Health Care outperformed. The focus on Friday was US data, which saw in-line PCE, albeit the supercore print saw three months of consecutive gains, raising concerns about sticky inflation in the face of tariffs. However, it had little influence on Fed expectations with participants eyeing the August jobs report next Friday.

- Furthermore, Chicago PMI data was softer than all analyst expectations and the trade deficit widened due to a jump in imports, while the Final UoM consumer sentiment report for August was revised down due to a drop in expectations, and inflation expectations were also revised lower.

- SPX -0.64% at 6,460, NDX -1.22% at 23,415, DJI -0.20% at 45,545, RUT -0.50% at 2,366.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Appeals Court voted 7-4 on ruling that President Trump exceeded authority by imposing global tariffs using IEEPA emergency law, although the court let tariffs stay in place while the case proceeds, while the ruling applies to ‘Liberation Day’ tariffs, reciprocal tariffs and the extra India tariff but not to the de minimis exemption cancellation.

- US President Trump commented that all tariffs are still in effect and that if these tariffs ever went away, it would be a total disaster for the country and would make the US financially weak.

- US Attorney General Bondi said they will appeal the tariff ruling, while it was separately reported that USTR Greer said they will continue to work on trade negotiations following the tariff ruling.

- US was reported on Friday to revoke authorisations for Intel (INTC), SK Hynix (000660 KS) and Samsung (005930 KS) to receive American chipmaking equipment in China unless they obtain licenses, according to the Federal Register.

- China’s Commerce Ministry said senior Chinese trade negotiator Li Chenggang visited the US and held meetings with US officials from August 27th to 29th, while Li stated that China and the US should manage differences and expand cooperation through equal dialogue and consultation. Furthermore, Li and US officials exchanged views on China-US economic and trade relations, as well as the implementation of the prior consensus.

NOTABLE HEADLINES

- Fed's Daly (2027 voter) said on Friday that policy will be recalibrated soon to better match the economy and noted that both goals are in tension at the moment, with tariffs pushing inflation higher and the labour market showing signs of slowing. Furthermore, she reiterated that she thinks the tariff-related price increases will be a one-off and it will take time before they know that for certain, but added they can't wait for perfect certainty without risking harm to the labour market, via LinkedIn.

- US judge did not rule on the dismissal of Fed Governor Cook on Friday and asked both parties to submit subsequent court documents on Tuesday.

- US President Trump posted on Truth that "Prices are “WAY DOWN” in the USA, with virtually no inflation. With the exception of ridiculous, corrupt politician approved “Windmills,” which are killing every State and Country that uses them, Energy prices are falling,“big time.” Gasoline is at many year lows. All of this despite magnificent Tariffs, which are bringing in Trillions of Dollars from Countries that took total advantage of us, for decades, and are making America STRONG and RESPECTED AGAIN!!!"

- US bipartisan proposal would ban stock trading by lawmakers with a bipartisan bill set to be unveiled in the upcoming week, which would give lawmakers and their family members a period of 180 days to sell off individual stocks, while lawmakers that don’t comply would face fines equal to 10% of the value of the investment, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks traded mixed with sentiment mostly subdued amid tariff and trade-related uncertainty after a US Appeals Court upheld a ruling that most Trump tariffs were illegal but kept them in place as the case proceeds. Participants also digested a slew of data, including mixed Chinese PMIs, while tech was pressured following underperformance in the sector on Wall St last Friday and with the US revoking waivers for Intel, Samsung and SK Hynix to use US tech in their Chinese operations.

- ASX 200 declined with underperformance in tech and consumer discretionary offset the strength in gold miners and resilience in defensives.

- Nikkei 225 underperformed and briefly slipped back below the 42,000 level, with the declines led by notable losses in tech.

- Hang Seng and Shanghai Comp bucked the trend as the Hong Kong benchmark surged on the back of a double-digit rally in Alibaba shares post-earnings, while the upside in the mainland was capped as participants digested mixed PMI data from China in which the headline official Manufacturing PMI missed forecasts and remained in contraction territory, but Non-Manufacturing PMI accelerated as expected and the RatingDog (formerly Caixin) Manufacturing PMI topped forecast with a surprise expansion.

- US equity futures were rangebound with a holiday-quietened start to the US trading week and ahead of approaching key events, including Friday's NFP report.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed with losses of 0.8% on Friday.

FX

- DXY marginally softened with US participants away on Monday due to the Labor Day holiday and with the overall mood cautious amid trade uncertainty after a US Appeals Court ruled late on Friday that most Trump tariffs are illegal but kept them in place as the ruling paves the way for a further battle in the Supreme Court. Fed-related uncertainty also lingered after a US judge did not rule on the dismissal of Fed Governor Cook on Friday and asked both parties to submit subsequent court documents on Tuesday, while there were recent comments from Fed's Daly that policy will be recalibrated soon to better match the economy and that they can't wait for perfect certainty without risking harm to the labour market.

- EUR/USD edged higher and reclaimed the 1.1700 handle following last Friday's upward momentum and despite comments from ECB's Rehn, who sees the risk of inflation cooling and noted there’s great uncertainty over inflation, which calls for flexibility in reacting to shifts in the economy.

- GBP/USD eked mild gains and remained afloat after recently reclaiming the 1.3500 status, but with the upside capped in the absence of any UK-specific drivers.

- USD/JPY traded indecisively amid the lack of tier-1 releases from Japan and despite the underperformance in Japanese stocks alongside the backdrop of trade uncertainty, as it was recently revealed that Japan's top trade negotiator had postponed his trip to the US last week due to issues regarding rice purchases, with Tokyo said to protest against the US President telling Japanese government agencies what to do.

- Antipodeans remained afloat although price action is contained amid the predominantly cautious risk appetite and mixed Chinese PMI data.

- PBoC set USD/CNY mid-point at 7.1072 vs exp. 7.1281 (Prev. 7.1030).

FIXED INCOME

- 10yr UST futures traded uneventfully with US cash markets shut today owing to the Labor Day holida

Comments

In Channel